What Is Risk Adjustment?

Risk adjustment is a methodology that equates the health status of a person to a number, called a risk score, to predict healthcare costs. The “risk” to a health plan insuring members with expected high healthcare use is “adjusted” by also insuring members with anticipated lower healthcare costs.

While most medical coders are familiar with the fee-for-service (FFS) payment methodology in which insurers pay providers based on the procedures or services performed for a patient, risk adjustment is instead how insurance companies participating in specific programs get payment for managing the healthcare needs of members based on their diagnoses.

Risk adjustment is critical to ensuring adequate compensation to health insurance plans, so they maintain coverage and access to care for beneficiaries likely to incur higher than average costs. Because risk adjustment programs are developed and managed by government agencies created to serve all eligible members of the public, a health insurance company cannot discriminate or purposely insure only a certain demographic of members with a limited range of expected healthcare costs. The case mix of both healthy and sicker patients, and the cost-sharing of expenses spread across all members, is designed to provide access to quality healthcare regardless of health status and history.

Providers have an important role to play in risk adjustment, too. An engaged partnership between the provider and the health plan is vital to bringing valuable benefits to enrollees. For instance, insurers may use premiums and risk adjustment payments to offer their members enrollment in exercise programs, case or disease management, transportation to medical appointments, and other services. The health plan uses diagnosis codes that providers submit on claims to identify what types of programs are needed, and more specifically who needs them.

Hierarchical Condition Categories (HCCs) Coding Model

Understanding Hierarchical Condition Categories is a good place to start when learning about risk adjustment, particularly from a coding perspective.

A Hierarchical Condition Categories (HCCs) list is a list of diagnoses that have been assigned a value for risk adjustment. The Department of Health and Human Services (HHS) updates the list yearly and publishes it in a spreadsheet format. Each risk adjustment payment model uses its own variation of this general HCC list.

To establish an HCC list, all conditions that are coded in ICD-10-CM are organized into diagnosis groups of body systems or disease processes. These groups are then subdivided into condition categories based on similar cost patterns. The final HCC list includes only the diagnoses that are likely to impact long-term healthcare costs related to clinical and/or prescription drug management particular to the demographics of the specific risk adjustment payment model. This list of HCCs is referred to as a crosswalk because it shows which HCCs cross to which diagnosis codes.

How do coders use an HCC coding model? HCC crosswalks are fairly easy to use, and medical coders who work with HCC coding models and risk adjustment may access the information in different ways. For instance, a coder may determine the ICD-10-CM code for the encounter from the medical record and, if using the HCC spreadsheet, look for that code on the crosswalk. If the coder uses coding software, many companies will offer an HCC add-on. If the condition is HCC-relevant, the condition category is listed with the ICD-10-CM code. If the condition is not HCC-relevant, the ICD-10-CM code will not be on the crosswalk (and will not be flagged in the coding software as having an HCC value.) This doesn’t mean the coder shouldn’t report that code on a claim; it merely means there is no anticipated long-term cost involved with that diagnosis, so it has not been assigned a risk value.

HCCs are called hierarchical because certain conditions within a related category (family) may have a notable severity difference; the highest severity in the family will trump, or take precedence over, less severe conditions within that family. Diabetes is a good example to explain hierarchy. Figure 1 and the examples below use HCCs from the Centers for Medicare & Medicaid Services (CMS)-HCC Risk Adjustment Model version 28. Note that CMS assigns each HCC a number, such as CMS-HCC 36.

Figure 1. Example of CMS-HCCs Based on Severity

A patient may see multiple providers throughout the year with each submitting a claim for services. Not all providers will document details of a condition identically, which may result in the hierarchical system coming into play. Only the HCC value of the most severe condition in the hierarchy would be used for risk score calculation for that member. Calculation occurs once the state or federal government agency overseeing the program receives all diagnoses for each member for that calendar year.

For instance, suppose a member is enrolled in a Medicare risk adjustment program. If a Medicare claim was submitted in March for diabetes with no complication (CMS-HCC 38) and another claim was submitted in August for the same member for diabetes with the chronic complication of chronic kidney disease (CMS-HCC 37), only the risk value of the more severe CMS-HCC would be used in the HCC risk score calculation for that member. As Figure 1 shows, CMS-HCC 37 is more severe than CMS-HCC 38.

Another important aspect of HCCs is that risk adjustment payment models are additive. That means values of each HCC are added together to establish the overall risk score of a member (unless a diagnosis is trumped by a more severe diagnosis in the hierarchy family, as explained above). Also keep in mind that no matter how many different ICD-10-CM codes map to the same HCC, the value for that category is added only once to a member’s risk score.

As an example, in the Medicare risk adjustment model, both diabetes with no complications and diabetes with hyperglycemia cross (or map) to HCC 38. The risk value of HCC 38 is added only once for an individual member’s risk score calculation. But if the member also had a diagnosis from outside that diabetes family, such as stroke (HCC 249), the risk value for HCC 249 would be added to the value for HCC 38 in the risk score calculation.

While the information about hierarchies is interesting to risk adjustment coders, responsibility for calculating a risk score falls on the state or federal government agency overseeing the risk adjustment program. Health plan actuarial departments also may use this information to help predict the next year’s healthcare expenditures.

Risk Score/Risk Adjustment Factor (RAF)

A risk score is the numeric value an enrollee in a risk adjustment program is assigned each calendar year based on demographics and diagnoses (HCCs). The risk score of an enrollee resets every January 1 and is officially calculated by the state or government entity overseeing the risk adjustment program the member is enrolled in. Another term for risk score is risk adjustment factor (RAF), sometimes referred to as RAF score.

What Causes a Risk Score to Increase or Decrease?

For the program to capture the risk score of a patient accurately, a provider must submit all conditions affecting the patient’s health status at least once per calendar year on one or more claims. If a chronic condition is not recaptured from a previous year, the patient’s risk score will decrease for the current year. Likewise, if additional conditions are reported, the patient’s risk score will increase from what it was in the previous year. Because risk scores reset every January 1, the person’s base risk score for that year reflects only the demographic factors. The final risk score takes diagnoses into account. To maintain predictability in the healthcare costs of its enrollees, a risk adjustment health plan relies on accurate and consistent submission of all conditions each year.

Demographic Factors

Demographic factors used in addition to diagnoses for risk score calculation include:

Age

Sex

Socioeconomic status

Disability status

Medicaid eligibility

Institutional status

Risk adjustment programs get demographic information from the enrollment application. Whether applying for Medicare, Medicaid, or commercial insurance, there is an application process. The programs use a person’s Social Security number, permanent address, and medical and financial questionnaires to establish enrollment.

Socioeconomic status as a demographic factor in risk score calculation is a distinct concept from the ICD-10-CM categories concerning social determinants of health that may affect the wellness of a patient. In recent years, social determinants of health (SDOH) have gained the attention of the World Health Organization (WHO). WHO defines SDOH as circumstances in which a person is born, grows, lives, works, and ages. In the ICD-10-CM code set, categories Z55-Z65 Persons with potential health hazards related to socioeconomic and psychosocial circumstances capture conditions such as problems with education and literacy; employment or unemployment; problems with housing; and upbringing issues such as not living with a parent or living with a parent who pressures too much. These codes do not map to an HCC or directly affect a risk score, but health plans may use them to determine additional benefits to certain members.

Diagnoses/Health Status

In addition to demographic factors, the patient’s health status is used for risk score calculation. The purpose of capturing diagnoses in an HCC model is to offer an accurate assessment of the patient’s health status, and correct reporting of diagnosis codes is essential to this process. Not every one of the more than 74,000 diagnosis codes available in the ICD-10-CM code set maps to an HCC to be used in HCC risk score calculation; only conditions that are costly to manage from a medical or prescription drug treatment perspective are likely to be found in the risk adjustment model’s HCC crosswalk.

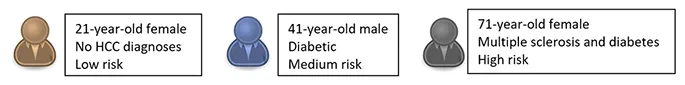

The sicker the patient, the higher the healthcare cost expenditures are predicted to be, and therefore the higher that patient’s risk factor will be, as shown in Figure 2.

Figure 2. Patient Risk Based on Demographics (Such as Age) and Health Status (HCC Diagnoses)

Just as not every diagnosis affects a person’s risk score, not every person has a risk score. Only people enrolled in a risk adjustment insurance plan are assigned risk scores. Some diagnosis codes applicable in one risk adjustment payment model may not be applicable in another.

Risk Adjustment Payment Models

Risk adjustment payment models reflect how an insurance company gets paid for covering the healthcare needs of the members they insure. Within most payment models, there are smaller programs. Most notable are diagnosis-related programs focused on medical costs to manage the clinical treatment of a condition and prescription-related programs that reimburse the health plan for covering medication needed to treat conditions that are on the crosswalk for that risk adjustment model. Below are some specifics for the most popular risk adjustment payment models.

Commercial Risk Adjustment

Commercial risk adjustment was created by the Patient Protection and Affordable Care Act (ACA) of 2010 and implemented in 2014. This type of payment model serves individuals and small groups who purchase insurance through the online insurance exchange called the Health Insurance Marketplace.

The health insurance companies listed in the Marketplace have agreed with the federal and state governments to offer these insurance plans at a competitive premium to the enrollee. There is a timeframe each year for enrolling on the Marketplace, but there are exceptions that allow members to enroll at other times, such as losing other coverage, a change in marital status, having a baby, or qualifying for Medicaid.

The commercial risk adjustment payment model is designed to be a “risk stabilization program” in that a plan collects premiums from its enrolled members, but funds are distributed from plans with low-risk enrollees to plans with high-risk enrollees. According to the National Health Council, CMS applies a formula to compare each plan’s average risk score to the average across all plans. Typically, if a plan’s risk score is higher than the average risk score for all plans in their state, the plan gets additional money called a transfer payment. If the plan’s risk score is lower than the average, the plan pays a fee.

In other words, a health plan in a commercial risk payment model receives money from enrollees by way of the premiums paid during the year. The fees and transfer payments resulting from the risk score comparison then occur between the plans in the program. State and local government funds are not involved in commercial risk adjustment. The risk stabilization process (paying a fee or receiving a payment from other plans in the commercial risk adjustment model) occurs after the risk adjustment validation audit. In the commercial risk adjustment model, this audit usually occurs within six months following year’s end.

The Department of Health and Human Services (HHS) administers and regulates commercial risk adjustment and has two programs: HHS-HCC for diagnosis-related risk and Prescription Drug Categories (RXC) for prescription-related risk. Enrollees in commercial risk adjustment are identified by age (adult, child, infant). They are also classified by the level of plan purchased. The five classifications are given a metal level (platinum, gold, silver, or bronze) or called catastrophic. The level of plan determines the percentage of healthcare costs a member pays, with platinum being the least out-of-pocket expense after premiums and catastrophic being the highest. The plan level also affects the risk value of a diagnosis mapping to an HHS-HCC.

Table 1 shows an excerpt from the April 27, 2023, Federal Register for 2024. Notice that one HCC in the adult model can have various values depending on the level of plan in which the member is enrolled.

Table 1. Commercial HCC Values Vary Depending on the Enrollee’s Plan Level

HCC or RXC No. | Factor | Platinum | Gold | Silver | Bronze | Catastrophic |

|---|---|---|---|---|---|---|

HCC001 | HIV/AIDS | 0.610 | 0.495 | 0.426 | 0.382 | 0.380 |

HCC002 | Septicemia, Sepsis, Systemic Inflammatory Response Syndrome/ Shock | 9.632 | 9.382 | 9.265 | 9.203 | 9.202 |

HCC003 | Central Nervous System Infections, Except Viral Meningitis | 8.965 | 8.831 | 8.747 | 8.678 | 8.675 |

HCC004 | Viral or Unspecified Meningitis | 8.914 | 8.769 | 8.675 | 8.592 | 8.589 |

HCC006 | Opportunistic Infections | 8.576 | 8.501 | 8.427 | 8.333 | 8.329 |

HCC008 | Metastatic Cancer | 24.525 | 24.081 | 23.916 | 23.899 | 23.899 |

HCC009 | Lung, Brain, and Other Severe Cancers, Including Pediatric Acute Lymphoid Leukemia | 13.190 | 12.873 | 12.733 | 12.672 | 12.670 |

Commercial risk adjustment is a concurrent payment model in that current year diagnoses are used to predict current year healthcare costs. Therefore, information for risk adjustment relies solely on the medical record data submitted for reimbursement in the year it occurred.

The External Data Gathering Environment (EDGE) is a data collection service that insurers must use to submit enrollee information as well as medical and pharmaceutical claims. An EDGE server runs HHS-developed software designed to verify submitted data, execute risk adjustment processes, and generate summary reports for submission to HHS.

Medicaid Risk Adjustment

Medicaid Chronic Illness and Disability Payment System (CDPS) is the risk adjustment payment methodology states use for Medicaid beneficiaries who enroll in a Managed Care Organization (MCO). While each state has its own set of eligibility criteria, in general, Medicaid (the federal branch of CMS partnering with states) provides health coverage for qualified low-income families and children, pregnant women, the elderly, and people with disabilities. Medicaid beneficiaries may enroll or disenroll at any time. Applying for Medicaid can be done on the Marketplace exchange.

The Children’s Health Insurance Program (CHIP) is an insurance program that provides low-cost health coverage to children in families that earn too much to qualify for Medicaid but not enough to buy private insurance. Each state offers CHIP coverage, which works closely with the state Medicaid program according to federal requirements. Depending on the eligibility of the enrollee, CHIP may or may not fall under a risk adjustment payment model.

Medicaid risk adjustment identifies the demographics of an enrollee and uses different values of risk score calculation for disabled individuals, adults, and children. The Medicaid risk adjustment model is concurrent in that the current year’s diagnoses affect the current year’s risk score.

Like all risk adjustment models, CDPS uses a crosswalk that assigns certain diagnosis codes to an HCC, which then is computed into a risk score. In the Medicaid risk adjustment payment model, conditions are weighted hierarchically within major condition category groups. For example, within the adult cardiovascular group, you may see information as shown in Table 2.

Table 2. Example of Medicaid Risk Adjustment Cardiovascular Group

CDPS Category | Severity Rank | CDPS Level | CDPS Adult Group | Example Diagnosis | ICD-10-CM Code |

|---|---|---|---|---|---|

Cardiovascular | 7 | Extra low | CAREL | Hypertension | I10 |

Cardiovascular | 4 | Medium | CARM | Hypertensive heart disease with heart failure | I11.0 |

Cardiovascular | 4 | Medium | CARM | Primary pulmonary hypertension | I27.0 |

In Table 2, the CDPS Adult Group shown in the fourth column is based on the category from the first column (cardiovascular) and the level of risk from the third column (extra low to extremely high), forming an abbreviation. For example, CAREL means the diagnosis hypertension falls into the cardiovascular (CAR) category with an extra low (EL) level of risk within the CDPS Adult Group.

This table also helps show hierarchy. Because both hypertensive heart disease with heart failure and primary pulmonary hypertension are in the medium level, the risk value assigned to those diagnoses is added to the patient’s risk score only once even if the patient has both conditions documented. If the patient also has the extra low condition (hypertension) reported, it is not calculated because the medium severity rank 4 trumps hypertension’s extra low severity rank 7. If a member has other diagnoses in a different CDPS Category, this additive, but hierarchical, payment system adds score values for those categories (not shown in this example).

A noticeable difference between the CDPS model and other payment models is the inclusion of less common but costly conditions more prevalent among disabled Medicaid beneficiaries. Another difference is how prescription use affects a person’s risk score. MRx is a pharmacy-based program in the Medicaid risk adjustment payment model that uses National Drug Codes (NDCs) to assess risk. In the CDPS+Rx payment model, both diagnosis codes and NDCs combine to determine the patient’s risk score.

Medicare Risk Adjustment

Medicare risk adjustment is the most widely used risk adjustment model and is connected to Medicare Advantage Organizations.

A Medicare Advantage Organization (MAO, formerly known as Part C) is a health insurance plan contracting with CMS to offer Medicare beneficiaries insurance that incorporates institutional and outpatient services as well as optional prescription benefits.

Typically, a person who is 65 years or older is eligible for Medicare benefits, but disabled persons are also eligible regardless of age. A beneficiary can decide whether to enroll in traditional Medicare Parts A and B or with an MAO. There are various scenarios that will determine when a person can and should enroll.

Risk (RAF) score calculation: Medicare risk adjustment uses the CMS-HCC crosswalk to calculate a member’s annual risk score based on chronic and severe acute conditions that are expected to impact healthcare costs long term. The RxHCC crosswalk is used if the beneficiary is also enrolled in a Part D (prescription drug) plan.

Like in other risk adjustment models, each HCC is a collection of similar diagnoses in one payment group. For example, pulmonary hypertension (I27.20) and chronic diastolic heart failure (I50.32) map to the same HCC even though they are coded differently in ICD-10-CM. No matter how many of a patient’s ICD-10-CM codes map to a CMS-HCC, the risk value (factor) for that category is added only once to a patient’s risk score, as the HCC calculator tool in Figure 3 shows. The two example codes in the top Diagnoses section both map to HCC 226, but the Calculator Results at the bottom adds the HCC risk factor only once.

Figure 3. HCC Calculator Showing Multiple Diagnoses Mapping to a Single HCC

Hierarchy elimination: Another area to consider is that some CMS-HCCs belong to “families” that are subject to hierarchy elimination. If providers report multiple conditions that map to a family in a single calendar year for a patient, only the HCC representing the most severe condition is used for risk score calculation.

The fragment of a CMS-HCC hierarchy list in Table 3 will help demonstrate. If an ICD-10-CM code submitted for a patient during a calendar year maps to an HCC shown in the first column, and diseases were also reported for that patient in any HCC listed in the last column of the same row, then all the HCCs in the last column are dropped, or not used in HCC risk score calculation. Only the HCC in the first column is calculated. For instance, if HCC 17 applies to a patient, then Medicare will not use HCCs 18, 19, 20, 21, 22, and 23 in the risk score calculation.

Table 3. CMS-HCC Hierarchy List Showing Which Disease Groups Drop When Multiple HCCs Apply to a Patient

Remember that the CMS-HCC model is additive. If a provider submits other diagnoses outside of a family at any time in a calendar year, Medicare also uses those diagnoses when calculating the HCC risk score. For instance, note how the Calculator Results section in Figure 4 shows multiple HCC scores added together (for HCCs 17, 37, and 328) and also lists when an HCC is not used for calculation. For instance, the score for HCC 22 is not included because HCC 17 takes precedence, and the score for HCC 38 is not included because HCC 37 takes precedence.

Figure 4. Example of Additive CMS-HCC Model, Adding Multiple HCC Scores Together

CMS performs these calculations and hierarchy groupings. Official risk scores are reported to the MAO, but the health plan may run its own analysis to aid in predicting costs. Risk adjustment coders will rarely need to perform these calculations, but seeing how risk scores are calculated is helpful to fully grasp the need for accurate and complete diagnosis reporting.

Diagnosis documentation: CMS has strict criteria concerning the medical record documentation used for risk score calculation. Only records signed by approved provider types for services performed in approved locations can be used for diagnosis validation. While any healthcare provider with a National Provider Identifier (NPI) may submit claims for payment of services (FFS), only face-to-face encounters with approved specialty types are acceptable for abstracting diagnosis codes for risk score calculation.

Payment: Medicare risk adjustment is considered a prospective model. The current year’s demographics and diagnoses predict the following year’s payments.

While MAOs receive a per-member per-month (PMPM) capitation payment based on predicted risk scores, final payment from CMS based on actual risk scores could take up to two years. For example, in Table 4, notice the final payment for 2021 dates of service (DOS) will not occur until after the final submission of diagnosis codes in 2023.

Table 4. Comparison of DOS and Payment Adjustment Year in Medicare Risk Adjustment

DOS Period | Submission Date | Payment Adjustment Year |

|---|---|---|

01/01/2021 to 12/31/2021 | 01/31/2023-Final | 2023 |

01/01/2022 to 12/31/2022 | 3/3/2023-Interim | 2023 |

01/01/2022 to 12/31/2022 | 01/31/2024-Final | 2024 |

01/01/2023 to 12/31/2023 | 03/03/2024-Interim | 2024 |

01/01/2023 to 12/31/2023 | 01/31/2025-Final | 2025 |

01/01/2024 to 12/31/2024 | 03/03/2025-Interim | 2025 |

Table 4 is not all-inclusive of submission dates, but it puts into perspective why accurate and complete diagnosis coding is so important at the provider claim level. In other words, if a health plan receives a diagnosis claim in 2023, it can help predict future costs for its members and, when submitted to CMS early, will affect the PMPM payment received in 2024. Just because the plan has until Jan. 31, 2025, to submit 2023 diagnoses to CMS for final payment, that does not mean the plan should have waited until the deadline. Funds received via premiums and risk adjustment payments are used for member benefits and programs. The earlier the plan receives the funds, the earlier it can distribute benefits.

Each year, CMS announces changes that affect the Medicare Advantage program for the following year. Of note, on March 31, 2023, CMS released the Announcement of Calendar Year (CY) 2024 Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies. This announcement (referred to in the MA industry as the “Final Rule”), in part, outlines the changes from the v24 HCC mapping to v28.

Among the most significant changes in v28 is the removal of numerous diseases, such as those that are not specified or are considered unlikely to affect the cost of care of the MA member, as well as the restructure of the hierarchical condition categories themselves.

The net reduction in ICD-10-CM codes that will map to a CMS-HCC in v28 is due to 2,236 codes being removed and 209 codes being added. The additional HCC payment categories reflect the grouping of conditions differently. For example, in v24, neoplasm codes are mapped to five HCCs but in v28, there are seven neoplasm categories.

It is important for MA plans to continue submitting v24-applicable codes to CMS for risk score calculation through 2025 dates of service. This is due to the phase-in approach CMS will use for v28:

2023: 100% v24

2024: 67% v24 + 33% v28

2025: 33% v24 + 67% v28

2026: 100% v28

Other Risk Adjustment Payment Models

In addition to the three major risk adjustment payment models already discussed, there are additional models that serve unique populations.

Programs of All-inclusive Care for the Elderly (PACE)

PACE is a CMS program offered to people at least 55 years old who need nursing home care, but who live in a community with a PACE program to avoid being institutionalized. Following the CMS-HCC crosswalk, a frailty adjustment is added to the member’s demographic risk factor to offset additional healthcare expenditures.

End-Stage Renal Disease (ESRD)

The ESRD risk adjustment model follows the CMS-HCC model but includes additional conditions more likely to occur in a patient who is on dialysis or who has received a transplant. Medicare oversees the ESRD payment model.

Dual Eligible Special Needs Plans (D-SNPs)

Dual eligibility is a term used for beneficiaries who meet the age or disability requirement of Medicare but the financial criteria for Medicaid. They may choose to enroll for healthcare coverage with an MAO in a special plan called D-SNP. Risk scores are calculated based on the CMS-HCC crosswalk with a dual-eligibility adjustment to account for the special needs of enrollees in this type of plan.

Risk Adjustment Data Validation (RADV) Audit

A Risk Adjustment Data Validation (RADV) audit is an audit of insurance companies offering risk adjustment plans to members to ensure accuracy of the data submitted.

The Improper Payments Information Act of 2002, as amended by the Improper Payments Elimination and Recovery Act of 2010 (IPIA/IPERA), requires government agencies to identify, report, and reduce erroneous payments in the government’s programs and activities. A RADV audit is the process of verifying that codes submitted and used in risk score calculations are supported by medical record documentation.

CMS has created a checklist to help determine a record’s suitability for a RADV audit, such as confirming the date of service of the face-to-face visit and verifying the medical record is from an acceptable provider type with credentials in the signature. Each date of service is considered a stand-alone medical record.

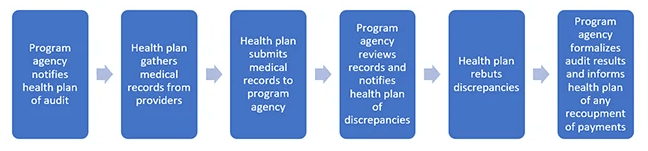

Each risk adjustment model type has its own RADV process, but all have a similar flow, shown in Figure 5.

Figure 5. Sample RADV Flow

Remember that the risk adjustment contract is between the program agency (state or federal government) and the health plan. If payments based on diagnoses are not supported in a RADV, the program agency will recoup overpayments from the health plan, not the provider. Depending on the contract between the health plan and the provider, there may or may not be consequences to the provider based on a RADV audit result.

Below is an overview of how RADV audits work for different programs.

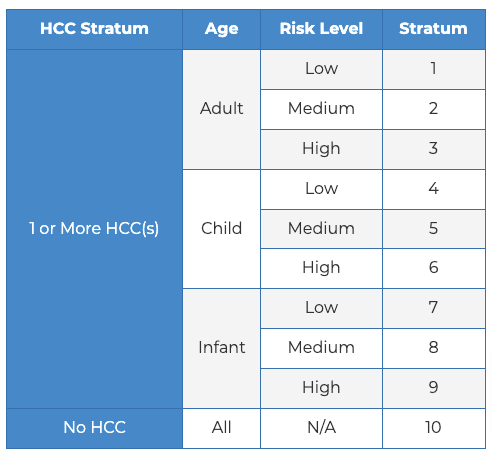

Commercial: The ACA requires states, or HHS on behalf of states, to validate statistically a sample of risk adjustment data each year. Called an HHS-RADV, this type divides the age groups and risk levels into 10 strata so that a true statistically random sample of enrollees is audited.

Table 5. HHS-RADV Divisions by Age and Risk

1 or more HCC Stratum:

Adult Risk Level & Stratum

Low: 1

Medium: 2

High: 3

Child Risk Level & Stratum

Low: 4

Medium: 5

High: 6

Infant Risk level & Stratum

Low: 7

Medium: 8

High: 9

No HCCs

All:

Risk level: N/A. Stratum: 10

HHS-RADV audits typically take place six months after year-end, and all commercial risk adjustment health plans are required to be audited. An insurer may offer as many medical records as it deems fit to satisfy the audit request, but all claims for the dates of service provided must have been originally submitted on the EDGE server.

Medicaid: The Social Security Act, Section 1936, created the Medicaid Integrity Program (MIP) and directed CMS to conduct audits of any Medicaid provider, which includes managed care entities. Audit Medicaid Integrity Contractors (Audit MICs) are entities with which CMS has contracted to conduct post-payment audits. The Audit MICs share the results with CMS, who in turn shares the results with the applicable state. The states will pursue collection of any overpayment identified in the audit in accordance with state law.

Medicare: The Code of Federal Regulations (CFR), Title 42, outlines the principal set of rules and regulations regarding public health in the United States. Under this Title, CMS is required to adjust payments and report a payment error rate for MAOs.

CMS conducts two major RADV audits:

Contract-Level: This process selects a stratified sample of enrollees per MAO contract based on low-, medium-, and high-risk classification. Conducted annually, the purpose is to establish an error rate of MAOs and conduct payment recovery for overpayments.

National sample: Sometimes considered a “target sample,” this type of validation audit reviews MAOs who have certain outliers such as a large increase in risk scores from one year to the next.

CMS allows any face-to-face medical record from an approved provider type in an approved place of service to be submitted for a RADV, but CMS limits the number to five records that best capture the HCC needing support. A CMS RADV typically takes place two or three years after the payment year, which realistically could be up to five years after the date of service.

The 21st Century Cures Act of 2016

Over the years, government legislation has addressed healthcare policies for underprivileged demographics with increasing focus on risk adjustment. The 21st Century Cures Act (Cures Act or CCA) is one such law, as it relates to societal health, including additional funding to the National Institutes of Health Innovation Projects, the Food and Drug Administration, HHS, and more.

Risk adjustment coders need to pay attention to how this act and other rule making affect Medicare risk adjustment. For instance, CMS has implemented variables that count conditions in the HCC adjustment model: When enrollees have five or more (up to 10) conditions mapping to a CMS-HCC, an adjustment value will be incrementally added to the risk score. The adjustment is meant to help MAOs with resources to better serve their sicker patients.

Also, as part of the goal to phase out using CMS’ Risk Adjustment Processing System (RAPS), explained more below, the Cures Act paved the way for CMS to begin using the Encounter Data System (EDS; also sometimes referred to as the Encounter Data Processing System or EDPS). In 2021, 75 percent of diagnosis data used for risk score calculation came from EDS, while 25 percent came from RAPS. In 2022 and beyond, EDS has been used entirely as the source of MAO diagnoses. The biggest difference between these systems is the data source.

Sources of Diagnosis Data for Risk Score Calculation

Risk Adjustment Processing System (RAPS): MAOs submit data in five fields of the reporting system: date of service from, date of service to, provider type, diagnosis code, and patient identifier. This data is abstracted from claims submitted by providers, but also includes diagnoses captured during internal or vendor-contracted audits of medical records.

Encounter Data System (EDS): A claim is sent from the provider to the MAO. The standard claims currently used are the CMS-1500 (paper claim) and the American National Standards Institute Accredited Standards Committee (ANSI ASC) X12N 837 version 5010A1 (electronic version). The insurance company forwards the claim to CMS.

With EDS, there is valid concern on the part of the MAOs about using only the diagnosis codes listed in the provider’s outpatient claim to calculate risk scores. Analysis and studies of claims are proving that providers’ claims do not list all applicable diagnoses. For this reason, MAO plans have increased their efforts to improve documentation practices of providers.

Last reviewed on Jan. 29, 2024, by the AAPC Thought Leadership Team

Presented by

Risk Adjustment Services

Maximize your risk adjustment accuracy and meet your revenue goals.

Certified Risk Adjustment Coder (CRC)®

CRCs play a critical role in establishing accurate risk scores for patients, which promotes optimal patient care and ethical payer reimbursement for providers and health plans.

From Contracts to Coding: The Challenges of Risk Adjustment

What does risk adjustment look like from a provider's perspective? In this episode of AAPC's Podcast: The Pulse, we dive into the risk adjustment program and why it appears to be broken.