What Is MACRA?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a law that reformed the Medicare payment system. MACRA repealed the Sustainable Growth Rate (SGR) formula used to update the Medicare Physician Fee Schedule (MPFS) and thereby determine physician reimbursement. The SGR was replaced with a “value-based” payment system that incorporates quality measurement into payments with the goal of creating an equitable payment system for physicians. MACRA also reauthorized the Children’s Health Insurance Program (CHIP).

The Permanent Doc Fix

On April 16, 2015, President Obama signed into law the Medicare Access and CHIP Reauthorization Act of 2015 — the largest change to the American healthcare system since the Affordable Care Act of 2010. Overwhelmingly endorsed by Democrats and Republicans in an uncommon moment of bipartisanship in Congress, MACRA ended the way Medicare Part B providers were disadvantageously reimbursed through the SGR.

MACRA is known as the Permanent Doc Fix because it revised the flawed 1997 Balanced Budget Act, which resulted in exorbitant reimbursement reductions that incited physicians to threaten to leave the Medicare program.

From 2002 to the enactment of MACRA in 2015, Congress voted 17 times to delay the implementation of the SGR to prevent SGR-calculated cuts from taking place. If not for the enactment of MACRA, the Medicare program — as well as persons who rely on it to receive medical care — would have been at risk.

By law, MACRA required the Centers for Medicare & Medicaid Services (CMS) to establish value-based healthcare business models that link an ever-increasing portion of physician payments to service-value rather than service-volume. These incentive-based business models, collectively referred to as the Quality Payment Program (QPP), provide two participation tracks for eligible clinicians — the Merit-based Incentive Payment System (MIPS) and Alternative Payment Models (APMs) — both of which involve levels of financial rewards and risks.

Unlike previous quality initiatives, participation in the QPP does not require providers to enroll. Eligible clinicians need only choose which track they prefer — MIPS or Advanced APMs — based on their practice size, specialty, location, and patient population.

MACRA Healthcare Reform At-a-Glance

Ended the Sustainable Growth Rate methodology from the determination of annual conversion factors in the formula for payment for physicians' services

Introduced a new methodology focused on alternative payment models to reward clinicians for value over volume

Invoked sunset of legacy programs—Physician Quality Reporting System (PQRS), Value-Based Payment Modifier (Value Modifier), and Medicare EHR Incentive Program (known also as Meaningful Use or MU)—now streamlined in the new Merit Based Incentive Payments System (MIPS)

Allotted bonus payments for participation in eligible Advanced Alternative Payment Models (APMs)

MIPS Eligibility

The MIPS track of the QPP pertains only to providers of professional services paid under Medicare Part B. CMS defines MIPS eligible clinicians—identified by their unique billing Tax Identification Number (TIN) and 10-digit National Provider Identifier (NPI) combination — as clinicians of the following types who meet or exceed the low-volume threshold:

Certified Registered Nurse Anesthetists

Clinical Nurse Specialists

Doctors of Chiropractic

Doctors of Dental Medicine

Doctors of Dental Surgery

Doctors of Medicine

Doctors of Optometry

Doctors of Osteopathy

Doctors of Podiatric Medicine

Nurse Practitioners

Physician Assistants

Clinical Psychologists

Physical Therapists

Occupational Therapists

Qualified Speech-Language Pathologists

Qualified Audiologists

Registered Dietitian or Nutrition Professionals

Clinical Social Workers

Certified Nurse Midwives

For the 2023 performance year, the three criteria of the low-volume threshold that establish MIPS eligibility of approved clinician types are those who:

Bill Medicare for $90,000 or more in Medicare Part B allowed charges;

Provide care for 200 or more Medicare Part B beneficiaries; and

Provide 200 or more Medicare Part B covered professional services under the MPFS.

Groups or virtual groups with one or more MIPS eligible clinicians are also eligible. Additionally, clinicians who meet or exceed one or two of the low-volume threshold criteria can opt in to participate in MIPS.

MIPS eligibility is determined from two consecutive 12-month look-back periods. In keeping with the fiscal year, the two determination periods for 2023 are Oct. 1, 2021, to Sept. 30, 2022, and Oct. 1, 2022, to Sept. 30, 2023. Eligibility, however, is based solely on the first 12-month period.

Check Your MIPS Eligibility

If you’re unsure about your MIPS eligibility status, you can enter your NPI number in CMS’ QPP Participation Status tool, which will tell you, by performance year, whether you’re eligible to participate in the MIPS program track.

MIPS Exclusions and Exceptions

An eligible clinician may be excluded from MIPS payment adjustments if the clinician is:

A new Medicare-enrolled MIPS eligible clinician who has not, under any billing number or tax identifier, previously submitted a claim to Medicare as an individual or as part of a group

A Qualifying APM Participant (QP) or Partial QP in an Advanced APM

In addition to exclusions from MIPS, CMS provides exceptions designed to meet the needs of small practices, practices located in rural areas, non-patient facing individual MIPS eligible clinicians or groups, and individual MIPS eligible clinicians and groups that participate in a MIPS APM or a patient-centered medical home.

Due to a variety of natural disasters, including Hurricanes Fiona and Ian, severe storms, and wildfires in specific states, MIPS eligible clinicians in Federal Emergency Management Agency (FEMA)-designated disaster areas, who are not participating in MIPS as a group, virtual group, or APM entity, will be automatically identified and receive a neutral payment adjustment for the 2022 performance year/2024 payment year. All four MIPS performance categories for these clinicians will be automatically weighted at 0 percent for the performance year. Clinicians who submit data on two or more categories will be scored as usual.

If extreme and uncontrollable circumstances — such as a practice closure, severe financial distress, or vendor issue — render an eligible clinician unable to submit MIPS data, the clinician can apply for reweighting of any or all MIPS performance categories. Significant hardship exception applications must be submitted by Dec. 31 of the performance year.

MIPS Performance Categories

MIPS tracks data in four performance categories: Quality, Cost, Improvement Activities, and Promoting Interoperability. Each category is weighted and contributes to a MIPS eligible clinician’s or group’s final score.

MIPS Year 7 performance categories and weights in the final score are:

2023 MIPS CATEGORIES

Cost | Quality | Improvement Activities | Promoting Interoperability |

|---|---|---|---|

30% | 30% | 15% | 25% |

MIPS Cost Performance Category

The Cost category assesses eligible clinicians and groups on the resources used to treat attributed Medicare beneficiaries. For the 2023 performance year, Cost performance accounts for 30 percent of a MIPS final score. Unlike other MIPS categories that require data submission, cost performance is measured via Medicare Part B claims data.

MIPS participants are awarded points based on their cost performance against measure benchmarks. In 2023, the Cost performance category measures include:

Total per Capita Cost measure

Medicare Spending per Beneficiary Clinician (MSPB-C) measure

Episode-based measures

MIPS Quality Performance Category

Quality is worth 30 percent of an eligible clinician’s or group’s MIPS final score in the 2023 performance year. MIPS participants can choose from hundreds of quality measures and must submit a full year of data on six quality measures for compliance in this category. Each measure is worth up to 10 points, with the number of points earned based on data completeness compared to national benchmarks.

Achieving the highest score in the Quality performance category (60 points) requires MIPS eligible clinicians to report at least one outcome measure or high-priority measure. A high-priority measure is a MIPS quality measure listed in the categories for outcome, appropriate use, patient safety, efficiency, patient experience, care coordination, or opioid-related measures.

For the 2023 performance period, CMS moves away from using historical benchmarks for scoring administrative claims measures and will use performance period data. New measures will have a 7-point scoring floor for the first performance period and a 5-point scoring floor in the second performance period.

MIPS Improvement Activities Performance Category

The MIPS Improvement Activities category identifies measures for improving clinical practice or care delivery that potentially result in improved patient outcomes. Improvement activities focus on care coordination, patient engagement, and patient safety.

The Improvement Activities category is worth 15 percent of the MIPS final score. To earn full credit, a clinician or group must complete activities equal to a maximum 50 points or successfully participate in a patient-centered medical home or medical home payment model, or in a similar specialty practice and a MIPS APM.

MIPS Promoting Interoperability Performance Category

Promoting Interoperability, formerly called Advancing Care Information, requires the meaningful use of certified electronic health record technology (CEHRT), promoting the secure exchange of health information. The foremost intention driving this category is to create a patient-driven healthcare system where patients have the information needed to become active healthcare consumers.

Promoting Interoperability is worth 25 percent of the MIPS final score for most providers. In some cases, a provider may qualify for an exception from this MIPS category. If granted an exception in performance year 2023, the Promoting Interoperability category will be reweighted to 0 percent, and the Quality performance category will be increased by 25 percent to 55 percent.

Note: The following providers will have automatic reweighting for the 2023 performance period:

Clinical social workers;

Physical therapists;

Occupational therapists;

Qualified speech-language pathologists;

Qualified audiologists;

Clinical psychologists; and

Registered dieticians or nutrition professionals.

Small practices will also continue to qualify for automatic reweighting in performance year 2023. There is no need to submit a Promoting Interoperability Hardship Exception application.

MIPS Final Score

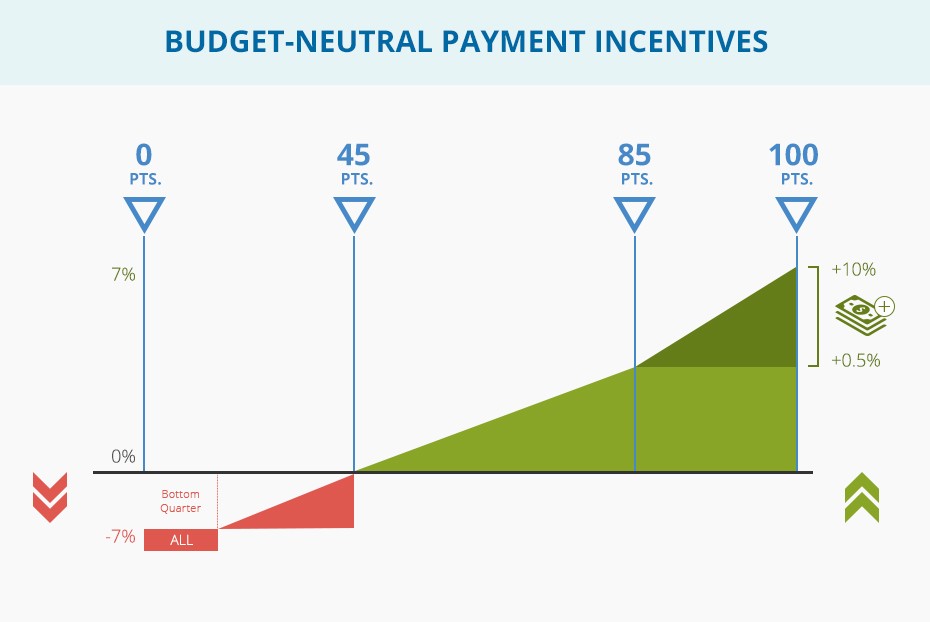

MIPS scores assess an eligible clinician’s overall performance in the four MIPS categories compared to the CMS performance threshold score. Eligible clinicians will receive a score in each performance category, which is then weighted accordingly and totaled in their final score. The final MIPS score, which ranges from 0-100 points, will determine the payment adjustment an eligible clinician receives.

The performance threshold defines the score required to earn a neutral to positive payment adjustment for a given year.

Scores below the performance threshold result in a negative payment adjustment.

Scores at the performance threshold result in a neutral payment adjustment.

Scores above the performance threshold result in a positive payment adjustment.

The 2023 MIPS performance threshold remains at 75 points. This is the minimum final score needed to avoid a downward payment adjustment to Medicare Part B claims in 2025.

MIPS PERFORMANCE THRESHOLD SCORES

2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

3 points earned by submitting a single Quality measure or attesting to performing one improvement activity for 90 days | 15 points achieved in multiple pathways | 30 points achieved in multiple pathways | 45 points achieved in multiple pathways | 60 points achieved in multiple pathways | 75 points achieved in multiple pathways | 75 points achieved in multiple pathways |

MIPS Bonus Points

The 2022 performance year was the last year for an additional performance threshold and/or additional MIPS adjustment for exceptional performance. There will be no option to gain bonus points for the 2023 performance year/2025 payment year.

MIPS Performance/Payment Timeline

Based on a provider’s MIPS performance score, a payment adjustment is applied to the Medicare payment of every Part B item and service billed by the provider. The payment adjustment is received in the payment year, two years after the performance year.

TWO-YEAR PERFORMANCE-PAYMENT GAP

2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|

Year 1

| Year 2

| Year 3

| Year 4

| Year 5

| Year 6

| Year 7

|

Year 1

| Year 2

| Year 3

| Year 4

| Year 5

|

MIPS Rewards

CMS estimates that MIPS eligible clinicians who choose not to participate in MIPS lose an average 8.2 percent in Part B reimbursement. That amounts to a hefty sum when you consider an 8.2 percent loss on every Part B item and service billed by a provider. A potential annual Medicare reimbursement of $100,000, for example, becomes $82,000 — minus $18,000 in much-needed revenue. So, here’s the $18,000 question:

What Does MACRA Mean for Physicians?

MACRA rewards physicians for shifting to value over volume through the MIPS track of the QPP and can greatly enhance a clinician’s profit margin through better Medicare reimbursement.

But a clinician’s MIPS score has broader implications that translate into more far-reaching and long-term rewards. It’s vitally important, therefore, for the MIPS clinician and staff — from medical coders and billers to clinical documentation specialists, auditors, and practice managers — to educate themselves every year on updates to the Quality Payment Program final rule.

Understandably, MIPS performance depends on knowledge of ever-evolving MIPS reporting requirements. Without current and reliable MACRA proficiency, a physician’s far-reaching and long-term rewards can fast become far-reaching and long-term penalties. Here’s why.

MIPS Is Competition

MIPS points are scored on a peer-percentile benchmark scale, which essentially means that MIPS clinicians compete against each other, and the winners who score big profit on two fronts — revenue and reputation.

Because MACRA is budget neutral, the law requires MIPS financial penalties to fund MIPS financial rewards. Low-performing MIPS clinicians who earn negative reimbursement adjustments, in other words, pay for the positive incentives their high-performing peers receive.

In the first two years of MACRA, CMS made it relatively easy for MIPS clinicians to avoid penalties. A corollary to this accommodation meant high-performing clinicians received lower than expected incentive payments. In subsequent years, CMS increased the program difficulty and raised reporting requirements. For 2020, this translated into bigger financial gains or losses at stake for MIPS participants.

Still, CMS caps the maximum upward adjustments it awards at three times the maximum negative adjustment, which limits the moneys available for financial rewards. The implications of this raise the bar for high performers. While each point a clinician scores above the performance threshold results in higher incentives, exactly how much one clinician’s score will earn depends on the performance of every clinician.

The only way to ensure you receive the maximum available incentive payment is to recognize the competition factor and ambitiously invest in your MIPS performance. Again, this will require onboarding your team and making sure all staff are fluent in MACRA Year 7, equipped with working knowledge of current MIPS requirements.

MIPS Means PR

MIPS financial rewards extend beyond Part B incentive payments. You could say, in fact, that Part B incentive payments are just the tip of the iceberg in terms of potential revenue gains associated with MIPS performance.

MIPS scores become clinician marketing — free advertising for exceptional performers, as well as potential liability for underperformers.

By law, MACRA requires CMS to publish MIPS final scores and performance category scores on every MIPS participant within 12 months of the performance year through CMS’ online portal, Physician Compare.

In its efforts for optimal transparency — as consumers spend more out-of-pocket for their healthcare — CMS has taken public reporting a step further by making Physician Compare data sets available to third-party physician rating websites. This means your MIPS score will affect patient attraction among all commercial payer populations, as well as Medicare beneficiaries.

What's more, to ensure MIPS performance measures clearly delineate peer-to-peer comparisons, the MACRA Final Rule instituted a 5-star rating system in 2018 to help healthcare consumers accurately interpret the MIPS 100-point performance scale.

As with any business, revenue and reputation go hand in hand. Research demonstrates that online physician reviews drive patient healthcare decisions — that more consumers rely on physician reviews than any other U.S. service or product, according to Harvard Business School. Its analysis of Yelp reviews, for instance, show a 5-9 percent revenue increase linked to each star on a 5-star scale — meaning that a 5-star rating can potentially boost a clinician’s annual revenue by 36 percent.

Voluntarily opting into MIPS, for those whose participation is not mandatory, deserves serious consideration, as the program automatically serves as the frontline initiative of practice marketing and pays in big dividends.

But the risks to underperforming in MIPS are equally substantial, which underscores the need for eligible clinicians to provide their staff with expert MACRA education each year to avert damage to their reputations and ensure they reap the rewards they deserve.

Understand that MIPS scores are irrevocable, a permanent part of public record. Furthermore, CMS ties MIPS scores to the practitioner so that scores follow the practitioner from one practice to another. If, for example, a clinician performs poorly in 2023 and joins a group in 2024, the new group will inherit the clinician’s 2023 performance via his or her 2025 payment adjustment.

MIPS scores, therefore, give clinicians a tremendous advantage or, possibly, a handicap. Performances will not only impact patient attraction and retention but also physician recruiting, contracting, and compensation plans.

MIPS Reporting Requirements

In most cases, eligible clinicians will be scored in all four categories, and a MIPS composite, or final score, will determine their Medicare payment adjustments.

MIPS participants can choose to report as a group or individually. If clinicians collectively submit their MIPS data as a group, each eligible clinician in the group will receive the same payment adjustment based on the group’s final score. Groups are defined by a single TIN, while individuals are defined at the TIN/NPI level.

Highlights to Year 7 MIPS reporting requirement updates include:

MIPS APM participants can report the APM Performance Pathway (APP) as an individual, a group, or an APM entity. The CMS Web Interface continues to be a reporting option for Shared Savings Program ACOs reporting via the APP in performance years 2023 and 2024.

The APP is composed of a fixed set of measures for each MIPS performance category. The APP quality measure set for an individual, group, or APM entity consists of:

The CAHPS for MIPS Survey measure;

2 administrative claims measures; and

3 eCQMs/MIPS CQM quality measures.

The APP quality measure set for Shared Savings Program ACOs consists of:

CAHPS for MIPS Survey measure;

10 CMS Web Interface measures; and

2 administrative claims measures.

Meeting MIPS reporting requirements:

Set your reporting goals for the performance period.

Determine which improvement activities you’re already doing and consider implementing other activities to boost your MIPS final score.

Review the Quality measures and select those that apply to the provider’s patient mix. The more measures you report on, the higher your chances of an increased score.

Ensure your coder is a CPC® or an AAPC specialty-certified coder. Accurate coding to the highest level of specificity is essential to clinicians receiving proper credit in MIPS.

Review performance feedback reports to identify your most costly patient population conditions and diagnoses. Identify targeted care delivery plans for these conditions.

If you haven’t adopted CEHRT, explore the cost and opportunity.

Determine if the clinician or group qualifies for an exception or special accommodations in MIPS scoring.

Keep an eye on your projected MIPS final score throughout the performance period.

PERFORMANCE CATEGORY | WEIGHT | REPORTING REQUIREMENTS |

|---|---|---|

Cost | 30% | No reporting requirement; data pulled from administrative claims.

-23 MIPS Episode-Based Cost Measures |

Quality | 30% | Report a full year of data on 6 measures, including 1 outcome or high priority measure, or all measures in a specialty measure set |

Improvement Activities | 15% | Groups of 16+ clinicians: Report on a minimum of 4 medium weighted activities or 2 high-weighted activities for at least a continuous 90-day period

|

Promoting Interoperability | 25% | 1. Use 2015 Edition Certified EHR Technology for more than 90 consecutive days in the performance period

|

2023 MIPS Data Submission

As in previous years, eligible clinicians can submit measures using multiple collection types and be scored on the data submission with the highest number of achievement points.

MIPS Data Submission Tips

Assign a Certified Professional Coder (CPC)® to audit medical documentation to ensure it meets requirements to support quality measures.

Determine if reporting as an individual or group improves your clinicians’ MIPS final score.

Clinicians billing under more than one TIN should report their MIPS data through each group to earn bonuses.

Determine a submission mechanism for MIPS quality data to CMS (i.e., Claims, EHR, QCDR, etc.). Remember, though, that not all measures can be submitted every way, so be sure to read each measure’s specification document carefully.

Contact your professional association about their clinical data registry options.

Retain MIPS data submitted to CMS for six years from the end of the MIPS performance period. This includes documents verifying your annual IT security risk assessment required for Promoting Interoperability performance.

MIPS eligible clinicians or groups billing Part B through a common TIN may choose from the collection types in the table below:

MIPS DATA SUBMISSION OPTIONS

PERFORMANCE CATEGORY | INDIVIDUAL | GROUP |

|---|---|---|

Quality | -Qualified Clinical Data Registry (QCDR) -Qualified Registry -EHR -Claims

| -QCDR -Qualified Registry -EHR -Administrative Claims -CMS Web Interface -CAHPS for MIPS

|

Promoting Interoperability

| -QCDR -Qualified Registry -EHR -Direct Attestation | -QCDR -Qualified Registry -EHR -Direct Attestation -CMS Web Interface |

Improvement Activities | -QCDR -Qualified Registry -EHR -Direct Attestation | -QCDR -Qualified Registry -EHR -CMS Web Interface -Direct Attestation |

Cost | -Administrative Claims | -Administrative Claims |

MACRA FAQs

Find answers to your Medicare Access and Chip Reauthorization Act of 2015 (MACRA) questions and stay up to date on current QPP requirements for 2002. Learn the difference between MIPS and APMS. MACRA FAQs help you with information on eligibility criteria and other key factors for MIPS and APMS.

Find answers to all these questions in the list mentioned below:

What Is a Partial Qualifying Participant (QP)?

A Partial QP is an eligible clinician who participates in an Advanced Alternative Payment Model (APM) but hasn’t met the payment or patient threshold to be considered a Qualifying APM Participant (QP). A Partial QP is ineligible to receive the 5% lump sum bonus. If the Advanced APM is a MIPS APM, and the Partial QP opts to participate in MIPS, the Partial QP will be scored under the APM Scoring Standard.

MIPS eligible clinicians can check their QP status using the QPP Participation Status Tool.

Payment Year | 2021 | 2022 | 2023 and later |

|---|---|---|---|

Partial QP Payment Amount Threshold | |||

Medicare Minimum | 20% | 20% | 20% |

Total | 40% | 40% | 50% |

Partial QP Patient Count Threshold | |||

Medicare Minimum | 10% | 10% | 10% |

Total | 25% | 25% | 35% |

What Are the Requirements for Participation in a Virtual Group?

Clinicians can choose to participate in MIPS as an individual, a group, an APM entity in a MIPS APM, and as a virtual group.

A virtual group is a combination of two or more TINs assigned to one or more solo practitioners or one or more groups consisting of 10 or fewer eligible clinicians that elect to form a virtual group for a performance period for a year.

If a group chooses to join a virtual group, all the clinicians in that group are part of the virtual group. The group’s final score and resulting payment adjustment percentage applies to all clinicians in the virtual group. The virtual group eligibility determination period aligns with the first period of data analysis under the MIPS eligibility determination period. The determination period is Oct. 1, to Sept. 30 the following year(including a 30-day claims run out).

Eligibility

A virtual group election is considered a low-volume threshold opt-in for any prospective member of the virtual group that exceeds at least one, but not all three, of the low-volume threshold criteria. Clinicians can only participate in one virtual group per performance period. There is no limit on the size of a virtual group.

Virtual groups are held to the same requirements for each performance category as standard groups, and are responsible for aggregating data for their measures and activities across the virtual group. TINs can inquire about their TIN size prior to making an election during a 3-month time frame, which begins Oct. 1 and ends Dec. 31 of the calendar year prior to the applicable performance period.

Election Process

There is a two-stage election process for virtual groups:

Stage 1 (optional): If you’re a solo practitioner or part of a group with 10 or fewer eligible clinicians:

Make any formal written agreements.

Send in your formal election registration.

Budget your resources for your virtual group.

Stage 2 (required): The virtual group must have a formal agreement between each solo practitioner and group that composes the virtual group prior to submitting an election to CMS. Each virtual group has to name an official representative who is responsible for submitting the virtual group’s election. Elections must be submitted via e-mail to MIPS_VirtualGroups@ cms.hhs.gov by December 31 of the preceding year you intend to operate as a virtual group.

The data submission criteria applicable to groups are also generally applicable to virtual groups, except for data completeness and sampling requirements for the CMS Web Interface and CAHPS for MIPS survey:

Data completeness for virtual groups applies cumulatively across all TINs in a virtual group. There may be a case when a virtual group has one TIN that falls below the 60 percent data completeness threshold, which is an acceptable case as long as the virtual group cumulatively exceeds such threshold.

The CMS Web Interface and CAHPS for MIPS survey sampling requirements pertain to Medicare Part B patients with respect to all TINs in a virtual group, where the sampling methodology will be conducted for each TIN within the virtual group and then cumulatively aggregated across the virtual group. A virtual group would need to meet the beneficiary sampling threshold cumulatively as a virtual group.

What Are Patient-Facing Encounters?

Patient-facing encounters are in-person visits where the MIPS eligible clinician is in the physical presence of the patient. The MIPS eligible clinician then bills these patient-facing services (general office visits, outpatient visits, and procedure codes) under the Medicare Physician Fee Schedule.

What Is the Patient-Facing Encounter Codes List?

Patient-facing encounter codes determine non-patient facing status. The list of patient-facing encounter codes includes evaluation and management (E/M) codes and surgical and procedural codes.

This list is used to determine the non-patient facing status of MIPS eligible clinicians.

An individual who bills 100 or fewer patient-facing encounters (including telehealth)

A group with 75% of the clinicians billing under the group’s TIN meeting the definition of a non-patient facing individual

Who Is Considered a Non-Patient Facing Clinician?

A non-patient facing MIPS eligible clinician is a clinician who meets or exceeds the low-volume threshold but only bills Medicare for 100 or fewer patient-facing services (including telehealth services) under Medicare Part B during one or both of the 12-month segments of the MIPS determination period. Groups and virtual groups also qualify for this special status when more than 75% of the clinicians in the group or virtual group are non-patient facing eligible clinicians. Non-patient facing eligible clinicians are afforded more flexible reporting options under MIPS.

How Long Should I Retain Documentation?

You should keep all documentation to support your MIPS data submission for at least 6 years, as CMS may request to audit your patient medical records. You have 45 days to comply with the request.

Quality—Past precedence with CMS PQRS audits indicates that it is important to retain archived EHR patient-level snapshots of the entire period of data reported upon. In addition, certain 3rd-party data submission entities such as qualified registries and QCDRs are subject to annual CMS audit requirements which may involve the providers and groups they serve.

Improvement Activities—Because this performance category will be reported through attestation, it will be important for clinicians to maintain documentation that justifies their Yes/No statement that an activity was performed during the reporting period, in case of an audit. A group or virtual group may attest to an improvement activity when at least 50%t of MIPS eligible clinicians in the group participate in or perform the activity. At least 50% of the group’s NPIs must perform the same activity for the same continuous 90 days in the performance period.

Cost—No separate auditing requirements apart from the usual auditability of the administrative claims upon which the cost measures are based.

Promoting Interoperability—Pay special attention to retaining documents supporting the annual IT security risk assessment applicable to the reporting period.

Does MIPS Payment Adjustment Apply to Part B Drugs?

MACRA legislation requires MIPS payment adjustments be made to payments for both items and services under Medicare Part B, including Part B drugs.

What Are Quality Data Codes (QDCs)?

Medical coders for small practices, as defined by CMS, can report for the MIPS Quality category when an eligible CPT® or ICD-10 code is used for an encounter. To collect and submit quality data through Medicare Part B claims, coders attach quality data codes (QDCs) to their Medicare Part B claims throughout the performance year.

QDCs are specified CPT® II codes and G codes used for submission of quality data for MIPS. You’ll also need to apply encounter codes, including ICD-10-CM, CPT® Category I, or HCPCS Level II codes to show which patients should be added toward the denominator/numerator of the quality measure.

Medicare Part B claims require certain billing codes appended to denominator-eligible claims to indicate the required quality action or exclusion occurred.

How Have MIPS Performance Categories Changed?

The Advancing Care Information category was renamed to Promoting Interoperability in 2019. As of Year 3, the four MIPS performance categories are Quality, Cost, Promoting Interoperability (PI), and Improvement Activities. Categories weights are subject to change, as seen in the table below:

PERFORMANCE CATEGORY | Year 1 2017 | Year 2 2018 | Year 3 2019 | Year 4 2020 |

|---|---|---|---|---|

Quality | 60% | 50% | 45% | 45% |

Cost | 0% | 10% | 15% | 15% |

Improvement Activities | 15% | 15% | 15% | 15% |

Advancing Care Information | 25% | 25% | ||

Promoting Interoperability | 25% | 25% |

What Milestones Should I Know for the 2020 MIPS Performance Period?

If you’re participating in MIPS in 2020, also referred to as Year 4, the performance period starts January 1, 2020 and ends on December 31, 2020.

MIPS Participation: Key Dates for Year 4

Jan. 1, 2020 | Jan. 2020 | Oct. 3 2020 | Nov./Dec. 2020 | Dec. 31, 2020 | Jan. 2, 2021 — March 31, 2021 | July 2021 | Jan. 1, 2022 — Dec. 31, 2022 |

|---|---|---|---|---|---|---|---|

2020 MIPS performance period begins | Preliminary 2020 MIPS eligibility is available | The last day to begin data collection for a continuous 90-day performance period for the Improvement Activities and/or Promoting Interoperability performance categories | Final 2020 MIPS eligibility is available (for nonAPM participants) | 2020 MIPS performance period ends Deadline for submitting a Promoting Interoperability Hardship Exception Application Deadline for submitting a QPP Extreme and Uncontrollable Circumstance Exception Application (available for all performance categories) | 2020 MIPS performance period data submission window | 2020 MIPS final score and performance feedback available | 2022 Payment adjustments based on 2020 MIPS performance period performance are applied to payments made for Part B covered professional services payable under the Physician Fee Schedule |

Is MIPS Scoring Different for Non-Patient Facing Eligible Providers?

A non-patient facing MIPS eligible provider is one who bills 100 or fewer patient-facing encounters (including Medicare telehealth services) during the non-patient facing determination period.

Groups and virtual groups with more than 75% of NPIs billing under the group’s TIN meet the definition of a non-patient facing individual MIPS eligible provider during the non-patient facing determination period.

The MACRA statute allows for flexibility in the application of measures and activities required by “non-patient facing” providers. Special MIPS scoring adjustments include:

Reweighting the Promoting Interoperability performance category to 0 and

Reallocating the performance category weight of 25% to the Quality performance category

What Is the Difference Between MIPS and APMs (MIPS vs APMs)?

The majority of eligible healthcare professionals opted to begin their QPP participation in the MIPS track. In the first payment year of MIPS (2019), most MIPS eligible clinicians or groups received a 4% upward (or downward) payment adjustment based on their final performance score.

The MIPS payment adjustment is slated to increase gradually until capped in 2022 at 9%. To avoid the MIPS payment adjustment, some providers evaluate the benefits of moving from the MIPS track into advanced APMs. The biggest difference between MIPS and APMs is that APMs participants assume greater financial risks but can potentially receive greater financial rewards, such as a 5% bonus for qualifying participants in an advanced APM.

Merit-based Incentive Payment System (MIPS): Clinicians eligible for the MIPS track must report clinician performance across four categories. The data you report is related to evidence-based and practice-specific data you submit to show you provided high-quality, efficient care supported by technology. You do this by sending in information in the following categories: Quality, Improvement Activities, Promoting Interoperability, and Cost. You can earn a performance-based payment adjustment to your Medicare payment for participation in the MIPS track.

Advanced Alternative Payment Models (also known as Advanced APMs): APMs are approaches to paying for healthcare that incentivize clinicians to provide high-quality and cost-efficient care. APMs let you earn more for taking on some risk related to patients’ outcomes. They can apply to a specific condition, episode of care, or a population. You have the opportunity to earn an incentive payment for participating in an innovative payment model.

What Is the MIPS Budget Neutrality Factor?

MIPS is budget neutral, which means that payment incentives are made on a sliding scale. CMS allocates the money it saves from providers who receive payment reductions to fund incentive rewards to providers based on their performance in the four MIPS categories. The maximum upward adjustments are capped at three times the maximum negative adjustment.

Because the QPP is budget neutral, all incentive payments received in a given payment year depend on the number of providers sharing the $500 million MACRA allocated for this purpose.

What Are the Episode-Based Cost Measures for the 2020 Performance Period?

Episode-based cost measures are based on services provided to a patient during an episode of care.

2020 EPISODE-BASED COST MEASURES

Existing/No Change (8) | New (10) |

|---|---|

1. Elective Outpatient Percutaneous Coronary Intervention (PCI) 2. Intracranial Hemorrhage or Cerebral Infarction 3. Knee Arthroplasty 4. Revascularization for Lower Extremity Chronic Critical Limb Ischemia 5. Routine Cataract Removal with Intraocular Lens (IOL) Implantation 6. Screening/Surveillance Colonoscopy 7. Simple Pneumonia with Hospitalization 8. ST-Elevation Myocardial Infarction (STEMI) with Percutaneous Coronary Intervention (PCI) | Episode-Based Measures: 1. Acute Kidney Injury Requiring New Inpatient Dialysis 2. Elective Primary Hip Arthroplasty 3. Femoral or Inguinal Hernia Repair 4. Hemodialysis Access Creation 5. Inpatient Chronic Obstructive Pulmonary Disease (COPD) Exacerbation 6. Lower Gastrointestinal Hemorrhage (groups only) 7. Lumbar Spine Fusion for Degenerative Disease, 1-3 Levels 8. Lumpectomy Partial Mastectomy, Simple Mastectomy 9. Non-Emergent Coronary Artery Bypass Graft (CABG) 10. Renal or Ureteral Stone Surgical Treatment |

What Is a Hospital-Based Clinician?

The 2017 MACRA Final Rule authorized CMS to use measures from other payment systems (e.g., inpatient hospitals) for the Quality and Cost performance categories for “hospital-based” MIPS eligible providers. MIPS eligible providers included those who furnished 75% or more of covered professional services in an inpatient hospital (POS 21), on-campus outpatient hospital (POS 22), or emergency room setting (POS 23) in the year preceding the performance period.

In 2018, CMS modified the definition to include covered professional services furnished by MIPS eligible providers in an off-campus outpatient hospital (POS 19), such as items and services furnished by emergency physicians, radiologists, and anesthesiologists.

When Will Historical Quality Benchmarks Be Available for the 2022 Performance Period?

The 2022 Quality Benchmarks zip file will be posted on the QPP Resource Library, shortly before the performance period begins on January 1, 2022.

What Is a Topped Out Measure?

A quality measure becomes topped out if meaningful distinctions and improvements in performance can no longer be made. These measures are identified in each final rule. If a measure is identified for 3 consecutive years, it will be eliminated in the fourth year. Topped out measures are capped at 7 points and do not apply to the CMS Web Interface measures.

In the 2020 final rule, CMS identified 2 measures as topped out:

MIPS #1 NQF 0059 Diabetes: Hemoglobin A1c (HbA1c) Poor Control (>9%)

MIPS #236 NQF 0018: Controlling High Blood Pressure

What Is PTAC?

PTAC is an acronym for the Physician-Focused Payment Model Technical Advisory Committee—an independent federal advisory board established by MACRA to review and make recommendations on new Physician-Focused Payment Models (PFPM) that may qualify as Advanced APMs.

Criteria used by the PTAC in evaluating innovative physician-driven payment models include:

Value over volume—incentives to deliver high-quality care

Flexibility for practitioners

Improving quality at no additional cost or at decreased cost. CMS will review PTAC comments and recommendations on proposed PFPMs and post detailed responses to them on the CMS website.

What Is an APM Entity?

An APM Entity is an organization that participates with an Advanced APM or other APM. Clinicians may join an existing APM Entity or create a new APM Entity. Eligible clinicians participating in an APM Entity are identified by a combination of the APM identifier, APM Entity identifier, TIN, and NPI for each participating eligible clinician.

Most APMs Entities allow clinicians to join throughout the year. It is important to understand the existing regulations for the APM the clinician will be joining.

What Are AMP Entity Attribution-Eligible Beneficiaries?

Attribution-eligible beneficiaries are the universe of beneficiaries that could be attributed to the APM Entity. Physicians within the entity are incentivized to see patients more frequently who are attributed to them. Different APMs have different rules on what constitutes a patient as “attributed” to an individual provider.

Attribution-eligible beneficiaries are patients who are:

Not enrolled in HCC MA or a Medicare cost plan

Do not have MSP

Are enrolled in both Medicare Parts A and B

Are at least 18 years of age

Are U.S. residents; and have a minimum of one evaluation and management (E/M) visit or other qualified service under the rules of the APM

But the definition of attribution is complicated because the same beneficiary may be attribution-eligible for multiple eligible clinicians. For example, a patient who sees one physician for one problem and another physician for a different problem could create confusion regarding who the patient officially “belongs” to on the attribution list. Nonetheless, APM Entities have officially accepted the responsibility of cost and quality of care for the patients on their attribution list.

Presented by

MACRA Proficiency Course

Are you up to speed on MACRA 2022 requirements? Get your annual MACRA training from AAPC, the leader in medical coding and healthcare business compliance.

Subscribe to our YouTube channel

This channel features videos about AAPC, the leader in certifications for the business of healthcare. Don't miss out on any updates.