What is medical billing?

Medical billing is the process of generating healthcare claims to submit to insurance companies for the purpose of obtaining payment for medical services rendered by providers and provider organizations. After translating a healthcare service into a billing claim, the medical biller follows the claim to ensure the organization receives reimbursement for the work the provider performed. A knowledgeable medical biller can optimize revenue performance for the physician practice or healthcare organization.

Get TrainedIs medical coding the same as medical billing?

Medical coding and billing are distinct but related processes. Both are integral to the business of healthcare, as both are involved in reporting diagnoses, procedures, and supplies to commercial and federal payers, such as Aetna and Medicare.

Medical coders and billers both work with clinical staff and must know medical terminology, anatomy, and pathophysiology to understand physician notes and operative reports. Medical coders sometimes participate in the billing process and may code for billing companies. In small physician practices, it’s not uncommon for the same person to serve as medical coder and medical biller. And while billing and coding are not the same, these two functions are equally important segments of the healthcare revenue cycle.

What medical coders do

Every time a patient sees a clinician for medical treatment or evaluation, a medical chart is kept. Medical coders review the medical chart and extract billable information that they then translate into standardized codes.

Procedure codes — CPT®, HCPCS Level II, or ICD-10-PCS — tell the payer what service the healthcare provider performed. Diagnosis codes, reported using the ICD-10-CM code set, tell the payer why the patient received the services.

Related article: What does a medical coder do?

Here’s where medical coding and medical billing meet — in the standardized codes that medical billers now use to create insurance claims and bills for patients.

But the medical billing cycle begins prior to medical coding and does not end until the physician or healthcare organization receives all allowable reimbursement for the medical care given.

What medical billers do

Medical billers navigate between patients, healthcare providers, and insurance companies (also known as payers) to arrange for reimbursement of healthcare services. Billers first collect necessary information. This includes patient demographics, medical history, insurance coverage, and what services or procedures the patient received.

Gathering this information requires billers to review patients’ medical charts and insurance plans to verify coverage of services. They then generate medical claims, check for accuracy, and submit claims to payers. Once payers approve the claims, the claims are returned to billers with the amount payers agreed to pay.

At this point, or before patients see the doctor, billers prepare the patient’s bill. This involves deducting the amount covered by insurance from the cost of the procedure or service, factoring in copays and deductibles, and adding outstanding patient balances. Invoices are sent to patients when required and payments are posted and reconciled. But much more happens before, after, and between in the medical biller’s workday.

The medical billing process

While the medical billing cycle comprises numerous steps that can take anywhere from a few days to several months, accurate billing and timely follow-up are No. 1 priorities. Most states require insurance companies to pay claims within 30 or 45 days. Conversely, payers impose claim filing deadlines that, when missed, nullify coverage. The late claim is denied without option to appeal, and the organization forfeits reimbursement.

Errors occurring at any stage in the billing cycle can prove costly in terms of revenue and administrative workload, which underscores the value of medical billers able to command their role in the billing process. The financial health of physician practices and provider organizations, such as hospitals, health systems, and surgery centers depends on the effectiveness of front-end and back-end billing staff.

Front-end vs back-end medical billing

The medical billing process can be broken down into stages, what’s known as front-end and back-end. Front-end billing takes place pre-service — or before the patient sees the doctor. This stage involves the front-office staff and includes all the patient-facing activities on which accurate billing depends.

Back-end billing occurs after the provider sees the patient. Once the medical coder completes their responsibilities and the billing staff have access to the medical codes that represent the patient encounter, the billing process resumes in the back office, which simply means that back-end activities are not patient-facing.

Back-end billing staff attend to the many tasks focused on claims management and reimbursement. These tasks are as crucial to revenue cycle management as front-end billing activities where simple errors commonly inflate claim denial rates. But the level of complexity increases in back-end billing. Certified professional billers are needed at all stages of the billing process but claim preparation and post-adjudication activities demonstrate the education and expertise required of this profession.

Front-end medical billing

Front-end medical billing staff should be well versed in their organization’s payer mix. Familiarity with the various payers and health plans accepted by the organization prepares billers to verify insurance eligibility, as well as remaining aware of filing deadlines and which payers require preauthorization of services.

Pre-registration and registration

Processing an insurance claim begins when a patient contacts the provider’s office to schedule an appointment or registers at the hospital. Staff typically obtain the patient’s demographic and insurance information, or the patient completes a registration form after arriving at the place of service.

When the billing staff maintain standard operating procedures for patient registration, they’re better equipped to avoid data capture errors. Accurate patient data is paramount when determining the patient's eligibility and benefits, in addition to obtaining prior authorization.

Insurance eligibility verification

To receive payment for services, front-office staff must confirm that the services are covered by the patient’s health plan. This step, which can be conducted by phone or by an insurer’s electronic eligibility verification tool, verifies eligibility effective dates, patient coinsurance, copay, deductible, and plan benefits as they pertain to specialty and place of service.

Obtaining necessary preauthorization is also important. Insurers often require preauthorization as a contingency of payment, particularly for medical services conducted outside the primary care setting.

Point of service collections

Having determined benefit information during eligibility verification, staff is informed of the patient’s financial responsibility. This allows the biller to collect the copay, deductible, coinsurance, or full balance due while the patient is at the front desk, either during check-in or checkout.

Point of service collections are key to medical billing, in that they reduce the expense of patient balance follow-up and help to avoid bad debt and write-offs.

Encounter form generation

An encounter form, also called a superbill or fee ticket, is a form generated for each patient encounter. Printed with patient demographics added, the form consists of a list of common services (including their medical codes), as well as an area for clinicians to note diagnoses.

Front-end staff generate the encounter form, which will be used to communicate information about the number and type of services provided to the patient. At the end of the patient encounter, the provider will tick the appropriate boxes and sign the form to attest that the ticked services were performed and may be billed. If the provider uses an EHR and practice management system, the encounter form will likely be electronic.

Checkout

At this stage in the billing cycle, front-end staff make a follow-up appointment when required and ensure that the physician completed the encounter form. Checkout also provides a second opportunity for point of service collections.

After the patient checks out, medical coders obtain the medical records and convert the billable information into medical codes.

Back-end medical billing

Medical billers regularly communicate with physicians to clarify diagnoses or to obtain more information about a patient encounter. The medical biller must know how to read the medical record and be familiar with CPT®, HCPCS Level II, and ICD-10 codes.

Charge entry

The encounter form relays to the charge entry staff what services and procedures were performed and why they were performed. The charge entry staff then enter these charges into the practice management system, along with payments made by the patient at the time of service.

If staff notice an encounter form lacking a diagnosis (which is required by payers to justify performing a medical service), the charge entry staff must ask the provider for more information.

Charge entry responsibilities also involves charge capture reviews to confirm that all charges and receipts were added when reconciling patient charges. This review is usually done at the end of day by balancing total charges and payments from encounter forms with a printed system report of the day’s charge entry.

Claim generation

After the charges and payments are entered, it’s time to create the claim. This may involve compiling charges, revenue codes, CPT®, HCPCS Level II, and ICD-10 codes.

Pulling information from the superbill, either manually or electronically, allows medical billers to prepare the claim. The superbill, if you recall, is the encounter form detailing the patient’s demographic information, as well as the services provided to the patient and the diagnosis that verifies those services.

This itemized form also includes the date of service and essential provider information, such as the provider’s name, location, signature, and National Provider Identifier (NPI). It may also include provider notes and comments to justify medically necessary care. In some cases, it may include an admission date and information for billing provider and referring provider.

Once pulled, this information is translated into a claim and sent to third-party payers for reimbursement.

Claim scrubbing

During claim preparation, billers scrub claims to ensure all procedure, diagnosis, and modifier codes are present and accurate. Claim scrubbing also involves ensuring that required patient, provider, and visit information is complete. To accomplish this stage in the billing cycle, medical billers typically run claims through claim scrubbing software, which identifies and corrects errors.

Some physician practices and provider organizations send claims to clearinghouses instead of, or in addition to, scrubbing their claims. A clearinghouse is a third-party company that reviews, edits, and formats medical claims (or returns them to billers for needed corrections) before sending them to insurance payers.

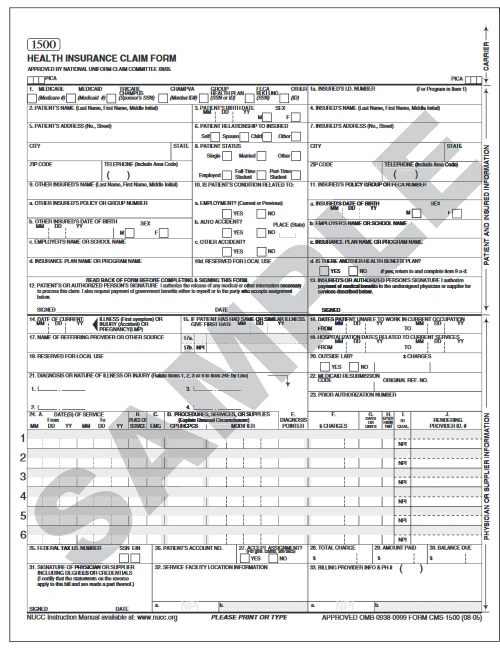

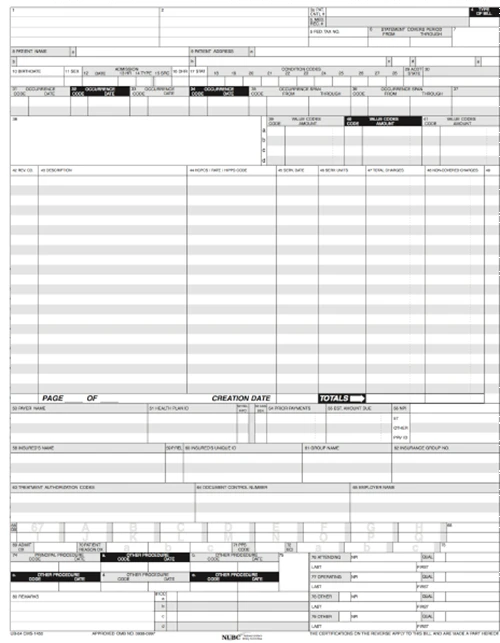

Claims forms

Medical billers primarily use one of two claim forms to obtain payment from insurers — the CMS-1500 claim form and the UB-04 claim form — both of which were created by the Centers of Medicare & Medicaid Services.

The CMS-1500 claim form is used to report professional services performed by providers and Ambulatory Surgical Centers. The CMS-1450, more commonly known as the UB-04 claim form, is used to report services and procedures performed at inpatient facilities, such as hospitals.

Image: CMS-1500 medical claim form

Commercial payers may use custom claim forms based on their requirements for reimbursement. Many private payers, though, have transitioned to the CMS forms.

Image: UB-04 medical claim form

Although it is important for the medical biller to understand the form fields, most field completion is programmed into the practice management system (or clearinghouse software).

Claim submission

Provider organizations can submit claims directly to payers, which is usually done electronically using software that meets electronic filing requirements, as established by HIPAA claim standards. Most physician practices, though, opt to submit medical claims through a clearinghouse.

Clearinghouses offer an array of services, one of which is to review claims for compliance with payer policies and federal regulations. The clearinghouse will return claims needing corrections to the biller, and then send the corrected claims to the payer.

When the claim makes it past the clearinghouse to the payer, the data file is processed, converted to a claim form for the claims analyzer or claims adjudicator to review. The clearinghouse report should show when a claim has been received by the payer. It may contain notes from the payer, such as a patient ineligible for date of service.

Claim tracking

The medical biller’s job isn’t over when the claim is submitted. Billers must check claim statuses daily. Clearinghouses, when used, typically offer dashboards that give billers convenient access to status updates for submitted claims.

Once a claim makes it to the payer, adjudication begins. Adjudication refers the review process and resulting determination of if and how much a payer will pay the provider. This determination is based on the information the biller provided and whether the claim is valid and should be paid.

Following adjudication, payers generate two types of statements:

Electronic Remittance Advice (ERA), sent to providers

Explanation of Benefits (EOB), sent to patients

ERA statements sent to the provider organization detail what services were paid, if additional information is still needed, or why a claim was denied.

Payment posting

On the day physician practices or hospitals receive their ERAs and accompanying checks or direct deposits, payments must be posted. This includes zero-dollar remittances, as these often include denial codes and other important details.

The back-end billing staff need to match payments to the respective patient accounts, reconciling payments against their claim and confirming that data from the ERA (or EOB) match payments. At the end of the day, medical billers need to balance direct deposits received and posted.

Patient payments

As soon as remittance advice is posted, patient statements should be sent for all outstanding balances. The sooner the statement is received by the patient, the sooner it will be paid. Patient statements should detail the date of service, services performed, insurance reimbursement received, payments collected at the time of service, and reason the patient balance is due.

Once these final payments are made by patients, commonly arriving by mail, they should be posted and balanced. With many patient cases, this completes the billing process and closes the patient account.

Denial management

Denials or reimbursement problems should be worked as soon as they are received from insurers. When a payer denies a claim, the remittance advice provides billing staff with a denial code(s) and a brief explanation as to why the claim was denied. The denied claim should be reviewed by the billing staff to determine whether additional information is needed, if errors need to be corrected, or if the denial should be appealed.

When appealing claim denials, medical billers often team up with medical coders, depending on the root cause of the denial. The billing staff will then prepare the appeal letter and refile the claims.

A/R collections

The final phase of medical billing is patient collections. Delinquent accounts happen, and medical billers will follow-up with patients who fail to pay their patient financial responsibility after a set period.

In addition to regular communications through statements and availability to answer questions, patient follow-up can involve offering conveniences to accelerate collections and lessen bad debt. These conveniences might include payment plans and online payment methods.

Once payment is collected, medical billers submit the revenue to accounts receivable (A/R) management, where payments are tracked and posted.

Credit balances

Credit balances — receiving money for medical services in excess of charges — poses a significant risk to provider organizations. While many events could lead to a credit balance, the medical billing staff must identify overpayments and promptly refund them to appropriate parties. Failure to do so could result in litigation and civil monetary fines.

Interested in a medical billing career?

Increasing reimbursement pressures within the healthcare industry have increased the need among provider organizations to hire highly trained, highly skilled medical billers. Professionals with an understanding of medical insurance, reimbursement methodologies, and the claims process are in high demand.

If you’re exploring the idea of becoming a certified professional biller, AAPC, the largest medical coding and billing training and certification association in the world, provides flexible training options. Prepare for your CPB certification and career in medical billing today!

Got questions? Contact an AAPC Career Counselor for a free consultation to learn more about medical billing and coding. You can reach us online, via email, or by calling 800-626-2633.

Last Reviewed on March 04, 2022

Presented by

Get certified as a professional biller with the CPB credential.

Learn medical billing, coding, insurance processes, and regulatory guidelines.

Set yourself up for success. Get the prerequisite training you need.

Medical coding and billing takes time and practice to learn. And getting up to speed on the terminology and knowledge required can be like learning a whole new language.