What Is HCC Coding?

Hierarchical Condition Category (HCC) is a term that describes the grouping of similar diagnoses into one related category (an HCC) to be used in a risk adjustment payment model. Risk adjustment payment models are regulated by the federal government to reimburse participating health insurance plans for the medical care of enrollees.

HCC coding is a process by which a professional coder reviews medical records and abstracts (searches for and identifies) supported diagnosis codes that are clinically significant in a risk adjustment payment model. HCC coders are employed by health plans, provider groups in a collaborative arrangement with health plans, vendors working on behalf of health plans, and companies contracted with the government to conduct audit services.

Each HCC in a payment model has a value called a risk adjustment factor (RAF). The RAF is then used by the Centers for Medicare & Medicaid Services (CMS) for Medicare Advantage or by the Department of Health & Human Services (HHS) for commercial risk adjustment to calculate the payment sent to the health plans responsible for managing an enrollee’s healthcare needs.

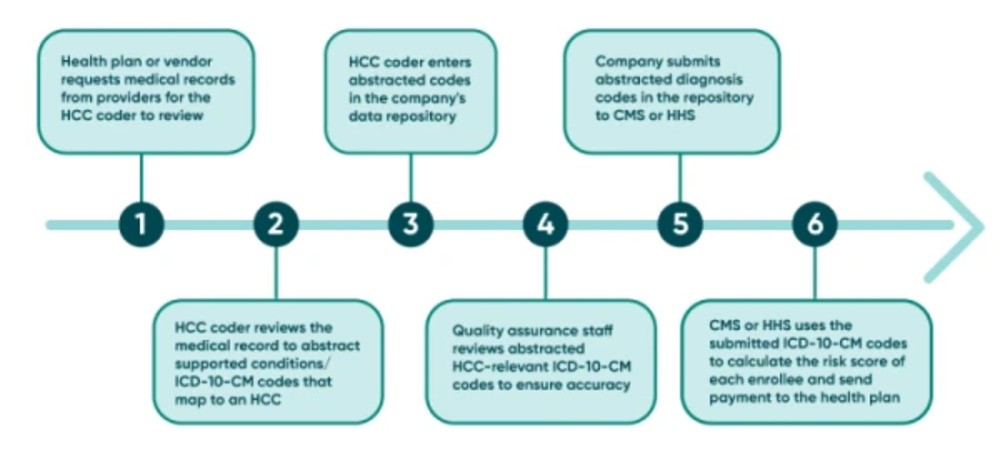

This process diagram shows a general workflow associated with HCC coding on a yearly basis. Each employer, whether a health plan, vendor, or government subcontractor, will train the employee on the specific process of their organization.

Qualifications for an HCC Coder

HCC coding is a medical coding specialty pertaining to risk adjustment. Professional coders who are experts in diagnosis coding, and also understand the regulations surrounding the risk adjustment payment models, are best suited for this specialty.

CMS expects HCC coders to “apply their expertise in documentation and official coding guidelines” as “medical records can be unique in format, legibility, content, organization, etc.” A trained, experienced HCC coder understands the need to be up-to-date on regulatory expectations and changes. Sometimes, even in the risk adjustment environment, there can be different rules regarding whether diagnosis codes can be captured for commercial risk adjustment versus Medicare Advantage risk adjustment.

Example of How HCC Coding Rules Can Differ Between HHS and CMS: Telehealth

Commercial risk adjustment (administered by HHS) allows diagnoses to be captured for RAF calculation from an audio-only visit with an approved provider. Medicare Advantage (administered by CMS) requires the telehealth visit to be both audio and video for HCC diagnoses to be captured for risk adjustment.

Difference Between HCC and Fee-for-Service Coding

HCC coding differs from other coding processes. For instance, fee-for-service (FFS) coding, also known as pro-fee coding, is the process of a medical coder billing an insurance company for medical services rendered by a healthcare provider to the insurance company’s members. The provider performing the service bills it as a CPT® or HCPCS Level II code. The service must be medically necessary to adequately treat the patient’s conditions. Medical necessity is proven by the diagnoses listed on the claim using ICD-10-CM codes.

In contrast, HCC coding does not include CPT® or HCPCS Level II codes, but rather involves the health plan submitting only ICD-10-CM codes to CMS or HHS for risk adjustment. CMS or HHS then uses that information to calculate the payment sent to the health plan. For instance, CMS pays Medicare Advantage Organizations a per-member per-month (PMPM) payment based on predicted risk scores. The PMPM is a capitation payment, meaning a fixed, pre-arranged monthly payment. Most ICD-10-CM codes used for risk score calculation are collected from claims submitted to the health plan by a provider; however, additional diagnosis codes may be submitted on a supplemental file, as well. These supplemental diagnosis codes are the direct result of the HCC coding process.

You should not get the impression that HCC coding is easier than FFS coding because risk adjustment uses only ICD-10-CM; what might be “good enough” to establish medical necessity on the FFS claim may not be specific enough for accurate risk score calculation. Because FFS coding focuses more on the service code, sometimes claims are submitted to a payer with the minimum number of diagnosis codes needed to support the service instead of including all conditions that are being treated and that affect medical decision making. It may not be the intention of the provider to limit codes on a claim; it may be the result of how the electronic medical record (EMR) is set up to pull diagnoses from the assessment or a clearinghouse’s policy to increase production. That is one reason why HCC coding requires coders specially trained in conducting chart reviews to code relevant diagnoses in accordance with each risk adjustment program’s specific rules.

How Is HCC Coding Processed?

Physician coders do not submit diagnoses directly to the government for HCC coding; the process is performed by the enrollee’s health plan. The health plan transmits diagnosis codes to the government agency overseeing the risk adjustment payment model a person is enrolled in. Transmission occurs either via the Electronic Data Submission (EDS) for Medicare Advantage or the External Data Gathering Environment (EDGE) server for Medicaid or commercial risk adjustment.

How Does HCC Coding Impact Billing?

HCC coding does not impact billing and reimbursement in the way FFS coding does. HCC impacts reimbursement — or payment — that a health plan receives from the government agency overseeing the risk adjustment program for caring for members. FFS impacts the payment a provider receives from the health plan for services rendered to their patients.

The primary way HCC coding does impact reimbursement relates to the accuracy of diagnoses submitted on a provider’s claim that the health plan will use for risk score calculation. The goal of capturing HCC diagnoses is to allow the health plan to submit the most complete and accurate health status of the patient to the government’s risk adjustment agency. For this reason, many health plans and vendors have developed provider documentation programs geared toward educating the providers in improved documentation practices to describe the diagnoses to the highest level of specificity. Many HCC coders also fill the role of documentation educators. More accurate diagnosis codes and documentation supporting medical necessity for services result in more accurate reimbursement for practices and facilities.

Why Does HCC Coding Exist?

HCC coding is a necessary process to ensure that all diagnoses submitted for risk score calculation are correct, current, specific, and supported. Most of the conditions that HCCs represent are chronic, but some severe acute conditions that are expected to be costly to treat also risk adjust.

Because risk adjustment is a methodology by which a health plan receives payment for caring for the health needs of its members, the health plan must accurately report diagnoses to CMS or HHS to accurately receive payment. Health plans use these payments not only to be reimbursed for the costs of the members using medical services, but also to offer additional benefits — such as lower premiums or copays — to its members. Failure to capture current conditions each calendar year (CY) results in an underpayment to the health plan. It is vital that HCC coders working on behalf of a health plan report all HCC diagnoses documented in the medical record.

Health plans and vendors employ HCC coders trained to capture all diagnoses accurately, documented not only by the primary care physician, but also from inpatient, ambulatory, and specialist records. The HCC coder must follow all requirements for place of service, provider type, and acceptable signatures as not all medical records are eligible for HCC condition capture.

Specific and complete capture of diagnoses is vital for a healthy risk adjustment program. In the HCC payment models, conditions that are expected to be ongoing and/or require significant medical costs are organized into diagnostic categories called HCCs. These categories carry various weighted values called risk adjustment factors (RAFs).

The government agency overseeing the risk adjustment program inserts the RAFs into an algorithm that results in the payment to the health plan. For instance, in the CMS-HCC model, the RAF for sepsis is higher than the RAF for lobar pneumonia, and the RAF for lobar pneumonia is higher than the RAF for chronic obstructive pulmonary disease (COPD). The severity of the illness directly corresponds to the RAF. Higher value RAFs result in higher reimbursement for the health plan because more severe illnesses typically incur more significant medical costs.

Why Are Dates of Service Important in Risk Adjustment?

Diagnosis risk scores are calculated using the ICD-10-CM codes collected from dates of service January 1 to December 31 each year. Diagnosis codes reported for a patient in one CY do not automatically carry over to the next; each January 1 the diagnosis is erased, and the health plan must submit the ICD-10-CM code again in the current CY. That is the only way the program administrator will consider the diagnosis for risk score calculation. Even if a patient has had a chronic condition for years, if the health plan does not resubmit the diagnosis code for a condition like COPD each CY, the health plan will not receive payment for managing this disease.

An HCC coder thoroughly reviews the medical records to ensure that all current conditions affecting the care and management of the patient are submitted each CY. The emphasis is on ALL conditions: HCC models are additive, which means that if a patient has sepsis, lobar pneumonia, and COPD in the same CY, the program administrator adds all three RAF values together to determine the patient’s risk score.

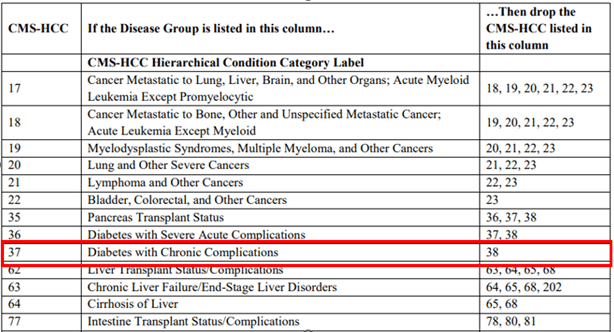

There are some exceptions in which some category RAFs will not be used in risk score calculation for the CY. This occurs when similar diagnosis categories have their own hierarchy.

As an example, Table 1 shows an excerpt of disease hierarchies for CMS-HCCs in the Medicare Advantage program. Suppose a Medicare Advantage member has diabetes without complication (HCC 38) reported on a claim on March 31 but has diabetes with a chronic complication (HCC 37) reported on a claim on December 12 of the same CY. Because of severity hierarchy, only the RAF for the more severe diabetes with a chronic complication (HCC 37) will be used for risk score calculation. CMS will drop the RAF for the diabetes without complication (HCC 38).

Table 1: CMS-HCC Hierarchy List Showing Which Disease Groups Drop When Multiple HCCs Apply to a Patient

While some ICD-10-CM codes that have been submitted by health plans to HHS or CMS may “drop off” from risk score calculation, it is imperative that HCC coders report all HCC-relevant conditions supported in the documentation during a chart review process. It is not at the discretion of the HCC coder to determine which codes to report based on hierarchy.

Common HCCs in Risk Adjustment

The most common risk adjustment payment model discussed in the coding environment is Medicare Advantage (MA). CMS estimates that as of March 2023, almost 32 million people were enrolled in an MA plan, which is about 48 percent of all Medicare beneficiaries.

HHS and CMS release versions of the HCC mapping list as ICD-10-CM codes change and based on the entities’ discretion regarding which codes should map to which category. HCC versions could be used for various calendar years, or they could be updated more often. Employers of HCC coders supply the version the coder needs to use.

Out of more than 74,000 ICD-10-CM codes, less than 8,000 are included in the 115 HCCs of the 2024 CMS-HCC version 28 mapping list. Most categories identify chronic conditions, but severe nonchronic conditions are included, as well. A chronic condition is one that is not normally expected to resolve and is expected to be recaptured each calendar year. CMS outlines its methodology in determining chronicity in its Report to Congress.

An HCC coder is not expected to memorize all the diagnosis codes that map to the HCCs. However, there are common categories of HCCs seen in any of the risk adjustment models.

ABCs of HCCs: Diagnoses to Watch For

Arrythmias

Amputation

Breast, prostate, and other cancers

Body mass index/morbid obesity

Congestive heart failure

Chronic obstructive pulmonary disease

Diabetes mellitus with or without complications

Depressive disorder, major (single episode or recurrent/moderate or severe)

Staying informed about HCC-relevant conditions under scrutiny is equal in importance to being familiar with chronic conditions. For instance, the Office of Inspector General (OIG), as part of its Work Plan, investigates MA organizations on behalf of CMS. In December 2023, the OIG released a toolkit to help Medicare Advantage plans decrease improper payments through the identification of the following high-risk-for-error diagnosis codes:

Acute stroke

Acute heart attack

Embolism

Lung cancer

Breast cancer

Colon cancer

Prostate cancer

How HCC Coding Can Be Applied

It is the responsibility of a medical coding specialist to apply professional judgment to every code reported for risk adjustment, referencing the authoritative guidance of the ICD-10-CM Official Guidelines for Coding and Reporting, AHA Coding Clinic® for ICD-10-CM and ICD-10-PCS, and the rules regulated by federal risk adjustment programs.

Expert HCC coders and clinical documentation improvement (CDI) specialists are needed by health plans, large provider groups, vendors, and government agencies administering risk adjustment programs.

Last reviewed on Jan. 20, 2024, by the AAPC Thought Leadership Team

Presented by

Certified Documentation Expert Outpatient (CDEO)®

This credential validates expertise in reviewing outpatient documentation for accuracy to support coding, quality measures, and clinical requirements.

Certified Risk Adjustment Coder (CRC)®

CRCs play a critical role in establishing accurate risk scores for patients, which promotes optimal patient care and ethical payer reimbursement for providers and health plans.

Set yourself up for success. Get the prerequisite training you need.

Medical coding and billing takes time and practice to learn. And getting up to speed on the terminology and knowledge required can be like learning a whole new language.

Ask the Experts: Let's Talk Risk Adjustment

In this workshop, we’ll cover key topics in risk adjustment, including insights on ICD-10-CM coding, common HCC challenges, and CDI best practices in the HCC landscape.