What Is Outpatient Facility Coding and Reimbursement?

Outpatient facility coding is the assignment of ICD-10-CM, CPT®, and HCPCS Level II codes to outpatient facility procedures or services for billing and tracking purposes. Examples of outpatient settings include outpatient hospital clinics, emergency departments (EDs), ambulatory surgery centers (ASCs), and outpatient diagnostic and testing departments (such as laboratory, radiology, and cardiology).

Outpatient facility reimbursement is the money the hospital or other facility receives for supplying the resources needed to perform procedures or services in their facility. The resources typically include the room, nursing staff, supplies, medications, and other items and staffing the facility bears the cost for. The facility captures the charges and codes, typically on the UB-04 claim form, and sends the claim to the payer for reimbursement.

Coding Systems Used in the Outpatient Facility Setting

The three main coding systems used in the outpatient facility setting are ICD-10-CM, CPT®, and HCPCS Level II. These are often referred to as code sets.

ICD-10-CM in the Outpatient Facility Setting

The ICD-10-CM code set is used in all clinical settings (including outpatient facilities, inpatient facilities, and physician offices) to capture diagnoses and the reason for the visit. For example, a diagnosis of chest pain would be coded as R07.9 Chest pain, unspecified.

The role of diagnosis codes in the outpatient reimbursement process is to support the medical necessity of the services provided. Consequently, complete and accurate assignment of ICD-10-CM codes is essential to the outpatient reimbursement process. The ICD-10-CM code set is updated annually in October by the Centers for Disease Control and Prevention (CDC) National Center for Health Statistics (NCHS). In rare cases, ICD-10-CM codes are implemented on dates other than Oct. 1.

CPT® in the Outpatient Facility Setting

The CPT® code set, developed and maintained by the American Medical Association (AMA), is used to capture medical services and procedures performed in the outpatient hospital setting or to capture pro-fee services, meaning the work of the physician or other qualified healthcare provider. CPT® codes represent medical services and procedures such as evaluation and management (E/M), surgery, radiology, laboratory, pathology, anesthesia, and medicine. The main CPT® code set update occurs on Jan. 1, but the AMA updates certain CPT® sections throughout the year, as well.

HCPCS Level II in the Outpatient Facility Setting

The HCPCS Level II code set, originally developed for use with Medicare claims, primarily captures products, supplies, and services not included in CPT® codes such as medications, durable medical equipment (DME), ambulance transport services, prosthetics, and orthotics. The HCPCS Level II code set is maintained by the Centers for Medicare & Medicaid Services (CMS). Medicare updates the HCPCS Level II code set quarterly, with a major update Jan. 1 featuring codes and extra content such as the index.

The HCPCS Level II code set includes a section specific to outpatient hospital reporting. Medicare created C codes for use by Outpatient Prospective Payment System (OPPS) hospitals. OPPS hospitals are not limited to reporting C codes, but they use these codes to report drugs, biologicals, devices, and new technology procedures that do not have other specific HCPCS Level II codes that apply. Note that Medicare has identified certain other facilities, such as critical access hospitals, that may use C codes at their discretion.

Official Coding Guidelines for Outpatient Facility Coding

To assign medical codes accurately, the outpatient facility coder must have a good understanding of official coding guidelines, such as the ICD-10-CM Official Guidelines for Coding and Reporting, AMA CPT® guidelines for medical services and procedures, and the National Correct Coding Initiative (NCCI) edits and policy manual. It is imperative that facility coders stay abreast of official coding guidelines across all code sets (ICD-10-CM, CPT®, and HCPCS Level II) and review the published updates and changes as they occur.

Official coding guidelines provide detailed instructions on how to code correctly; however, it is important for facility coders to understand that guidelines may differ based on who is billing (inpatient facility, outpatient facility, or physician office). The ICD-10-CM Official Guidelines are a good resource, with sections that apply to all healthcare settings, such as Section I.A, Conventions for the ICD-10-CM, and Section I.B, General Coding Guidelines, as well as sections that apply only to specific settings. For instance, Section IV, Diagnostic Coding and Reporting Guidelines for Outpatient Services, is relevant to coding and reporting hospital-based outpatient services and provider-based office visits. Guidelines in this section do not apply to inpatient hospital services.

Key Difference Between Inpatient and Outpatient Coding Guidelines for Uncertain Diagnosis

Let's review a major difference between inpatient and outpatient coding guidelines specific to coding an uncertain diagnosis:

Outpatient: ICD-10-CM Official Guidelines, Section IV.H, Uncertain Diagnosis, is specific to outpatient coding: “Do not code diagnoses documented as ‘probable,’ ‘suspected,’ ‘questionable,’ ‘rule out,’ ‘compatible with,’ ‘consistent with,’ ‘working diagnosis,' or other similar terms indicating uncertainty. Rather, code the condition(s) to the highest degree of certainty for that encounter/visit, such as symptoms, signs, abnormal test results, or other reason for the visit.”

Inpatient: ICD-10-CM Official Guidelines, Section II.H, Uncertain Diagnosis, is specific to inpatient facility coding: “If the diagnosis documented at the time of discharge is qualified as ‘probable,’ ‘suspected,’ ‘likely,’ ‘questionable,’ ‘possible,’ or ‘still to be ruled out,’ ‘compatible with,’ ‘consistent with,’ or other similar terms indicating uncertainty, code the condition as if it existed or was established.”

These guidelines are essentially opposite of each other. For example, suppose a patient presents to the outpatient clinic with a complaint of chest pain and shortness of breath (SOB). After a full assessment and work-up, a final diagnosis of rule-out acute myocardial infarction (AMI) is documented. According to outpatient-focused Section IV.H, the encounter should be coded based on the signs or symptoms, which in this case are chest pain and SOB. Because the AMI is an unconfirmed diagnosis, it cannot be coded for an outpatient encounter. Conversely, if this same scenario were related to an inpatient admission, Section II.H would allow the inpatient facility to code the rule-out AMI as an AMI.

To avoid incorrect coding and reduce the likelihood of denied or rejected claims and inaccurate reimbursement, the best practice is to refer only to the guideline sections (including general sections) that apply to the healthcare setting where the encounter is being coded.

Physician Coding in a Facility Setting

The focus is on outpatient facility coding and reimbursement, but facility coders and pro-fee coders need to be aware that the facility is not the only entity that can submit claims for services performed in facilities. Physicians and other providers also report the services they perform in facilities to be reimbursed for their work.

For instance, suppose a specialist, such as a cardiologist or gastroenterologist, provides a consultation for a patient in the ED of a hospital. The specialist then bills the professional fee using the appropriate outpatient consultation CPT® code (99242-99245) or other appropriate E/M code based on payer guidelines. (Medicare, for instance, no longer accepts the consultation codes, and providers and coders should check with their individual payers to determine the appropriate codes for billing consultations.)

It’s worth noting that this outpatient scenario is similar to how the physician would bill for a service they performed in an inpatient setting. Although physician services are often provided in an outpatient setting (such as a physician office, ED, ASC, or diagnostic department), physicians aren’t limited to billing from these settings to capture their professional work. Many private practice physicians have admitting privileges with hospitals and can admit their patients for more acute care when warranted. During the hospital stay, the admitting physician typically makes frequent visits to the hospital and performs an inpatient E/M service at each visit. This is a billable service for the physician; therefore, each E/M service performed is coded using the appropriate CPT® code(s) to capture the professional work (pro-fee).

The outpatient and inpatient scenarios above discuss capturing the professional work of the physician. However, the facility coders also would submit claims to bring in reimbursement for the facility resources used (such as the room cost, nursing personnel, drugs, supplies, etc.), which is separate from the professional fee.

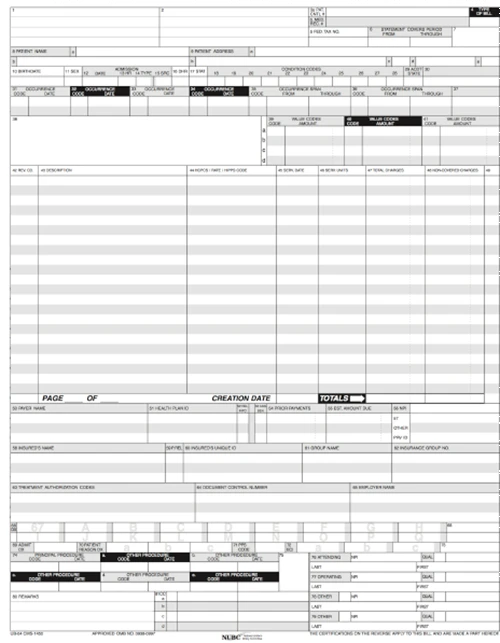

The inpatient and outpatient hospital facilities bill using the UB-04 institutional claim form (also called the CMS-1450), shown in Figure 1. The electronic version of this form is called the 837I (Institutional), the ANSI ASC X12N 837I, or the American National Standards Institute Accredited Standards Committee X12N 837I (Institutional) Version 5010A2.

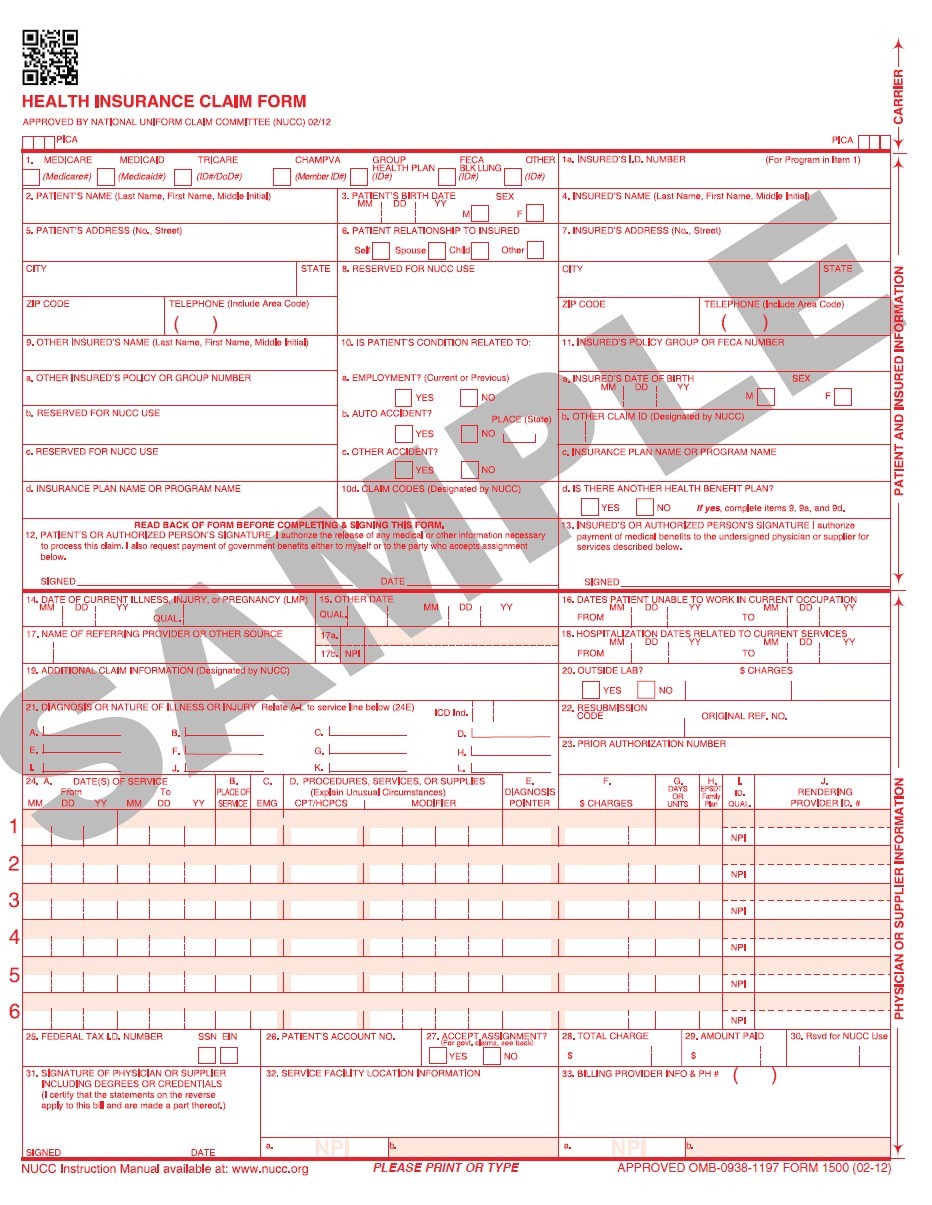

The professional fee services are billed on the CMS-1500 professional claim form, shown in Figure 2. The electronic version of the CMS-1500 is called the 837P (Professional), the ANSI ASC X12N 837P, or the American National Standards Institute Accredited Standards Committee X12N 837P (Professional) Version 5010A1.

Figure 1. Example of UB-04 (CMS-1450) institutional claim form

Figure 2. Example of CMS-1500 professional claim form

How Facilities Report Codes for Outpatient Services

In the outpatient hospital setting, charges for resources used, medical services, and procedures that do not require the skill set of a coding professional typically are hard-coded directly from the hospital’s charge description master (CDM or chargemaster) and captured on the hospital’s UB-04 claim form. Typically, the more complex medical services and procedures are soft-coded. This means a coding professional manually codes the medical service or procedure.

To ensure complete and accurate coding of services, outpatient hospital facility coders must understand and reference outpatient hospital coding guidelines and payer-specific guidelines. There are many outpatient hospital departments that have specific guidelines on how to code and bill for certain services, such as intravenous (IV) injection and infusion, chemotherapy, and radiation therapy, all of which require in-depth knowledge usually obtained by a certified coder.

The facility coder, unlike the pro-fee coder, also must understand relevant payment methodologies, such as the OPPS, and be aware of how government and payer rules and policies may affect facility reporting. For instance, outpatient facility coders need to understand how coding and reimbursement for observation care services differ between physicians and outpatient hospitals, staying aware of issues like Medicare’s two-midnight rule and relevant updates.

The type of code to use for a specific service is another area that sometimes differentiates professional fee coding from facility coding. For example, Medicare has guidelines on how to code outpatient hospital clinic visits for Medicare beneficiaries. When a Medicare patient is evaluated in the outpatient hospital clinic, the clinic visit is coded using HCPCS Level II code G0463 Hospital outpatient clinic visits for assessment and management of a patient instead of the standard E/M CPT® code (99202-99215) a pro-fee coder uses when reporting professional fee services.

Outpatient facility coding doesn’t differ only from pro-fee coding. There also are major differences between inpatient and outpatient facility coding. One big difference is that the main procedure coding system used for inpatient claims is the ICD-10-PCS code set rather than CPT®. Outpatient coders should not use ICD-10-PCS codes.

Navigating the healthcare coding and reimbursement sector can be complex as there are varying rules and guidelines that are not always transparent. The examples above demonstrate how the guidelines can differ depending on the payer-specific rules and the healthcare setting.

Typical Outpatient Hospital Departments

Outpatient hospital departments or services found within a hospital setting typically include:

Hospital ED

Outpatient hospital clinic

Outpatient radiology department

Outpatient therapy department

Dialysis services

Outpatient cancer center

Hospital ASC (outpatient facility), which can be owned by the hospital or function as an independent freestanding ASC, with no financial ties to the hospital

How services and procedures are reimbursed when performed in the outpatient hospital departments is determined by the payer-specific payment methodologies or the OPPS, explained below under OPPS Outpatient Reimbursement Method.

Billing Process for Outpatient Facilities

The medical billing process for outpatient facilities begins when a patient is registered either by the admitting office or the outpatient facility department, and the patient encounter is created. The patient encounter process then flows through the typical outpatient facility channels before a claim is generated and processed for payment by the business office.

The business office is a separate department in the hospital that is commonly referred to as patient financial services. They are responsible for ensuring that a clean claim is submitted to the payer for appropriate reimbursement. The billing form used to bill for outpatient hospital procedures and services is the UB-04 claim form, shown above in Figure 1, which is maintained by the National Uniform Billing Committee (NUBC).

Typical Steps of Outpatient Hospital Flow

1. Patient is registered by the admitting office, clinic, or hospital outpatient department. This includes validating the patient’s demographic and insurance information, type of service, and any preauthorization for procedures required by the insurance company, if not already completed prior to the visit.

2. The clinical assessment and documentation of services provided, order of relevant diagnostic and laboratory tests, and documentation of the final diagnosis for that visit is completed.

3. Charges are entered into the hospital’s computer system for items, drugs, supplies used, and procedures or services provided during the visit. Charges that are entered into the system are assigned a revenue code associated to the hospital’s chargemaster and captured on the UB-04 claim form.

4. Procedures or services that require the manual coding of ICD-10-CM, CPT®, or HCPCS Level II codes are done by the department’s coding staff.

5. A claim is then generated and processed through the business office.

6. A clean claim is electronically submitted to the payer for claims adjudication and reimbursement.

The business office plays a vital role in this process by ensuring that a clean claim is submitted to the payer. Any inaccuracies with the billing or coding should be remedied prior to claim submission. A rejected or denied claim can create a bottleneck in the reimbursement process (because of the additional work required for correction or resubmission) and have an adverse effect on the hospital’s reimbursement (because of delayed, reduced, or denied payment).

Collaboration between the business office, the health information management (HIM) department, and department-specific coders is essential to ensuring accuracy of claims. Billers typically work in the business office and may not be knowledgeable about coding-specific guidelines or revenue codes, bill types, condition codes, and value codes to validate, so billers often defer to HIM for guidance.

It is not only imperative that facility coders understand outpatient coding guidelines, but also that they have a clear understanding of the UB-04 claim form and data needed to support a clean claim. They also may need to be able to use the CMS-1500 form, depending on their specific job responsibilities.

OPPS Outpatient Reimbursement Method

Reimbursement methods for services provided to patients receiving care or treatment in an outpatient facility setting can differ depending on the payer type (government or commercial) or the type of service (such as ambulance). However, the primary outpatient hospital reimbursement method used is the OPPS.

The OPPS is a Medicare reimbursement methodology used to determine fees for Part B outpatient services. Also called Hospital OPPS (HOPPS), the OPPS was mandated as part of the Balanced Budget Act of 1997 to ensure appropriate payment of services and delivery of quality medical care to patients. Many commercial payers have also adopted the OPPS methodology.

On Aug. 1, 2000, CMS implemented OPPS. Additional changes have been made since then. Under OPPS, hospitals and community mental health centers are paid a set amount (payment rate) to provide outpatient services to Medicare beneficiaries. Many of the services are packaged and paid based on the Ambulatory Payment Classification (APC) system. CMS sets OPPS payment rates using APCs. To account for geographic differences, CMS adjusts the labor portion of the conversion factor (a number used in the calculation) based on the hospital wage index, which is essentially the personnel/staff earnings.

The APC payment methodology for outpatient services is analogous to Diagnosis-Related Groups (DRGs) under the Inpatient Prospective Payment System (IPPS) that Medicare uses to reimburse facilities for inpatient hospital medical services and procedures. Under the IPPS, each case is categorized into a DRG, which has a payment weight assigned to it, based on the average resources used to treat Medicare patients in that DRG. The labor-related share of the base payment rate is adjusted by the wage index applicable to the area where the hospital is located.

APCs do not apply to the professional component (or pro-fee) of ambulatory care, which is reimbursed under the resource-based relative value scale (RBRVS) methodology. Under the RBRVS methodology, providers are reimbursed based on CMS’ Medicare Physician Fee Schedule (MPFS), which is a complete list of procedures and fees with indicators that determine how the procedure may be reimbursed.

When a surgical procedure is performed in an outpatient hospital setting, both the surgeon and outpatient hospital facility submit a claim for reimbursement. But there is a difference between physician and hospital outpatient reporting and reimbursement methods. As an example, suppose a patient with Medicare presents for a same-day surgery in an outpatient hospital setting. Coding for outpatient services affects reimbursement because the facility bills CPT® code(s) for the surgery on the UB-04 claim form to be reimbursed for the resources (room cost, nursing staff, etc.) based on the APCs under the OPPS system. The surgeon that performed the surgery will bill the same CPT® code(s) and any applicable modifiers for the professional work (pro-fee) on the CMS-1500 claim form. The pro-fee reimbursement for that claim is based on the relative value units (RVUs) on the MPFS. The final payment is calculated by multiplying the RVUs by the associated conversion factor, with a slight adjustment based on the geographic location.

Each APC group is composed of items or services that are similar clinically and use similar resources. Medicare assigns an APC status indicator (SI) to each code to identify how the service is priced for payment. This is similar to the method used to calculate reimbursement under the MPFS. The payments for APCs are calculated by multiplying the APC’s relative weight by the OPPS conversion factor, with a slight adjustment based on the geographic location. The APC for each procedure or service is associated with an OPPS SI, which will determine how the procedure or service is paid.

For example, status indicator “N” shown in Table 1 indicates the item is packaged into the APC rate, which means the payment is included in another payable service. There is no separate payment for the item. The OPPS SIs can be found in the OPPS Addendum D1 file on the CMS website.

Table 1. Excerpt of OPPS Payment Status Indicators

ADDENDUM D1.–OPPS PAYMENT STATUS INDICATORS

Status Indicator | Item/Code/Service | OPPS Payment Status |

|---|---|---|

K | 1) Nonpass-Through Drugs Biologicals 2) Therapeutic Radiopharmaceuticals 3) Brachytherapy Sources 4) Blood and Blood Products | Paid under OPPS; separate APC payment. |

L | Influenza Vaccine; Pneumococcal Pneumonia Vaccine | Not paid under OPPS. Paid at reasonable cost; not subject to deductible or coinsurance. |

M | Items and Services Not Billable to the Fiscal Intermediary/MAC | Not paid under OPPS. |

N | Items and Services Packaged into APC Rates | Paid under OPPS; payment is packaged into payment for other services, including outliers. Therefore, there is no separate APC payment. |

It is important that hospital managers and outpatient facility coders stay actively engaged with the rulemaking notices and publications for the hospital OPPS. Each year, the Office of the Federal Register (OFR) releases a Notice of Proposed Rulemaking (NPRM) to announce any planned changes to the OPPS. The NPRM allows a commenting period before final changes are implemented. After all comment considerations, the OPPS final rule, along with updates to the ASC payment system, is published.

As technology advances, new procedures may become eligible for payment in an outpatient setting, so it is important to stay up to date on rule changes for successful outpatient facility coding and reimbursement.

ASC Billing and Reimbursement

An ASC is a distinct entity that operates to provide same-day surgical care for patients who do not require inpatient hospitalization. An ASC is a type of outpatient facility that can be an extension of a hospital or an independent freestanding ASC.

It is important for medical coders and billers to understand the billing requirements for both a hospital-based ASC and an independent freestanding ASC. The claim form used for billing depends on the type of facility. Hospital-based ASCs use the UB-04 form, while freestanding ASCs typically use the CMS-1500 claim form.

Coding rules, including modifier use, also can vary by setting. The AMA CPT® code book includes a section called Modifiers Approved for Ambulatory Surgery Center (ASC) Hospital Outpatient Use. Facility coders should be sure to use the correct, approved modifiers to prevent billing issues, checking payer policies, as well. Equally important, when a radiology procedure like X-ray or fluoroscopy is performed in an ASC, the facility should append modifier TC Technical component to the radiology CPT® code to ensure appropriate reimbursement to the facility for the use of the equipment owned by the ASC. The interpreting physician bills the professional component of the same radiology procedure by appending modifier 26 Professional component. These are only a couple of examples of the types of rules outpatient facility coders need to know.

ASCs are reimbursed by Medicare using a similar payment methodology to OPPS. ASC payment rules are identified by ASC payment indicators (PI), similar to OPPS’ SIs. As mentioned above, Medicare ASC updates and code changes are included and published with the OPPS proposed and final rules.

The ASC updates include several data files that list procedures that are either covered in an ASC or excluded from Medicare payment if performed in an ASC. The files are available on Medicare’s ASC Payment Rates – Addenda page. A list of covered procedures that are eligible for reimbursement are found in the Addenda AA and BB data files. The exclusion list found in Addendum EE includes CPT® unlisted codes, surgical procedures Medicare does not recognize for payment, and those that CMS medical advisors determined pose a significant risk to beneficiary safety or expect to require an overnight stay. The Addendum EE data file is particularly advantageous for determining in advance whether the procedure is excluded from Medicare payment. Outpatient facility managers and coders should be certain they are referencing the correct, current data files when billing for an ASC.

Last reviewed on Jan. 27, 2025, by the AAPC Thought Leadership Team

Presented by

Certified Outpatient Coder (COC)®

A COC certification shows your mastery of outpatient hospital coding, knowledge of ambulatory payment classifications, payment status indicators, and Medicare severity-diagnosis-related groups.

Set yourself up for success. Get the prerequisite training you need.

Medical coding and billing takes time and practice to learn. And getting up to speed on the terminology and knowledge required can be like learning a whole new language.