mayra.zambrano

Contributor

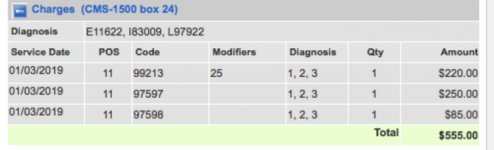

I work at a wound care clinic where lot's of our patients are covered by Medicare. They come in at least 1 time a week for our provider to fill out orders for home health wound care. I have noticed that the claims are initially processed with no issues. E/M code and wound care are paid for. Months down the line, I receive letters recouping the amount paid on the E/M code. The message sent on the refund request letter states that the "patient was in a home health episode". Does anyone know why this is happening?