Urology Coding Alert

Compliance:

Assess CERT Findings to Identify Your Risk Areas

Published on Thu Apr 13, 2023

You’ve reached your limit of free articles. Already a subscriber? Log in.

Not a subscriber? Subscribe today to continue reading this article. Plus, you’ll get:

- Simple explanations of current healthcare regulations and payer programs

- Real-world reporting scenarios solved by our expert coders

- Industry news, such as MAC and RAC activities, the OIG Work Plan, and CERT reports

- Instant access to every article ever published in Revenue Cycle Insider

- 6 annual AAPC-approved CEUs

- The latest updates for CPT®, ICD-10-CM, HCPCS Level II, NCCI edits, modifiers, compliance, technology, practice management, and more

Related Articles

Other Articles in this issue of

Urology Coding Alert

- ICD-10-CM:

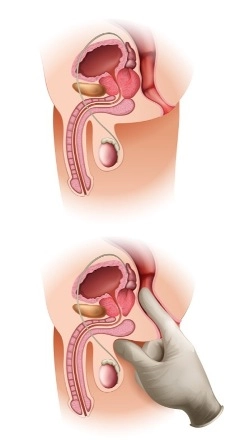

Master a Few Anatomic Terms to Ace Incontinence Coding

Master a Few Anatomic Terms to Ace Incontinence Coding Hint: Stress incontinence and overactive bladder [...] - Compliance:

Assess CERT Findings to Identify Your Risk Areas

Documentation improvement remains a key area on which you should focus. Knowing where to focus [...] - Artificial Intelligence:

Let AMA’s AI Classifications Guide Your Learning

Not all AI is created equal, and knowing the nuances will affect your code categorization. [...] - You Be the Coder:

Test Your Biopsy Imaging Know-How

Question: How would I report the procedure described in this operative report? There is also an [...] - Reader Questions:

CMS Isn’t Fooling You With These April 1 ICD-10 Updates

Question: Have new codes been recently added to ICD-10-CM? I thought new codes only came into [...] - Reader Questions:

Don’t Automatically Use NCCI to Override a Bundle

Question: I have a physician who keeps wanting to bill 52356 and 52352 together on the [...]

View All