Pulmonology Coding Alert

Back Up Your Level of E/M Services With Medical Necessity

If you are reporting high level E/M codes because your provider says that the patient was very ill or the case was highly complex, but you don’t have the documentation to back it up, your claim could cost your practice time and money. Medical necessity is the key to successful coding and reimbursement, and if you can’t support your code choice with documented medical necessity, your payer will toss the claim back on your desk without appropriate reimbursement.

Review these expert tips to ensure you understand what medical necessity really is and can explain to your providers why complicated cases don’t mean high codes every time.

Get to Know the Definition

The first key to supporting your coding, is understanding what medical necessity really is.

Why it matters: On the back of the CMS-1500 or the electronic equivalent, your provider is attesting that “I certify that the services shown on this form were medically indicated and necessary for the health of the patient.” If your coding doesn’t reflect this, your provider could wind up in trouble with Medicare and perhaps your other payers, too.

“Remember [your provider] has signed on the front of that form that he agrees with these statements,” explains Kim Garner-Huey, MJ, CHC, CPC, CCS-P, PCS, CPCO, an independent coding and reimbursement consultant from Birmingham, Ala. in her audio conference “Medical Necessity: Defining and Documenting to Support Billing,” sponsored by The Coding Institute affiliate AudioEducator.com.

Official wording: According to the American Medical Association’s (AMA’s) 2011 report to the Institute of Medicine’s Committee on Determination of Essential Health Benefits, the AMA defines medical necessity as “Health care services or products that a prudent physician would provide to a patient for the purpose of preventing, diagnosing or treating an illness, injury, disease or its symptoms in a manner that is: (a) in accordance with generally accepted standards of medical practice; (b) clinically appropriate in terms of type, frequency, extent, site, and duration; and (c) not primarily for the economic benefit of the health plans and purchasers or for the convenience of the patient, treating physician, or other health care provider.”

Medicare defines medical necessity in the Social Security Act (Title XVIII of the Social Security Act, Section 1862 [a] [1] [a]) as follows: “No payment may be made under Part A or Part B for expenses incurred for items or services which are not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member.”

Check Your Payers’ Policies

Your payers and providers may not always agree upon what is medically necessary. If a provider performs a service, he is doing it out of his judgment that it is medically necessary to treat the patient. The patient may get an explanation of benefits for her insurance company stating the service provided was not medically necessary, however. “If we all understand, at least on the physician and provider side ... the basis of it to begin with, we can head off some of those issues, as well as get paid appropriately for the services we’re providing and make sure our documentation supports that,” Huey says

There are two possibilities when you receive a denial based on medical necessity:

1. Covered, but not medically necessary in this case — Your provider may perform an E/M (or other) service, that the payer normally covers, but for some reason the payer does not feel the encounter is medically necessary for the claim you are submitting. These are the denials you should appeal, using your provider’s documentation.

2. Not covered, regardless of provider’s determination of medical necessity — There are some services your payer may never reimburse you for, regardless of your physician’s determination that the encounter was medically necessary for that patient at that time.

Example: If your pulmonologist performs an E/M service with a CPAP (94660, Continuous positive airway pressure ventilation [CPAP], initiation and management), Medicare will not reimburse you for that encounter’s work, regardless of the medical necessity your physician documents. If you append modifier 25 (Significant, separately identifiable evaluation and management service by the same physician or other qualified health care professional on the same day of the procedure or other service), the E/M documentation will need to clearly prove the visit was not related to the procedure.

Focus on the E/M Impact

With electronic medical records (EMRs) becoming more commonplace, you may see that your provider’s documentation is more detailed and his levels of history and examination seem higher than in the past. That means you need to be careful coding services, such as established patient visits, that only require two out of three key components for a code level.

Your payer can easily determine if your physician rendered an E/M service when you bill for it, but determining whether medical necessity supports the level of service you coded is the next step. A payer can make the medical necessity judgment and either deny or adjust your E/M levels based on their medical necessity determination. “For example, they could decide that yes, indeed, you performed a 99214 (Office or other outpatient visit for the evaluation and management of an established patient, which requires at least 2 of these 3 key components: a detailed history; a detailed examination; medical decision making of moderate complexity …) ... you had that detailed history; you had the detailed exam; you had that moderate complexity medical decision making [MDM], but, you did it too often, or it really wasn’t medically necessary today to meet that patient’s needs,” Huey explains.

Medicare rules: In the Internet-Only Manual, Publication 100-04, Medicare Claims Processing Manual, Chapter 30, Section 6.1 (Selection of Level of Evaluation and Management Service), Medicare states: “Medical necessity of a service is the overarching criterion for payment in addition to the individual requirements of a CPT® code. It would not be medically necessary or appropriate to bill a higher level of evaluation and management service when a lower level of service is warranted. The volume of documentation should not be the primary influence upon which a specific level of service is billed. Documentation should support the level of service reported.”

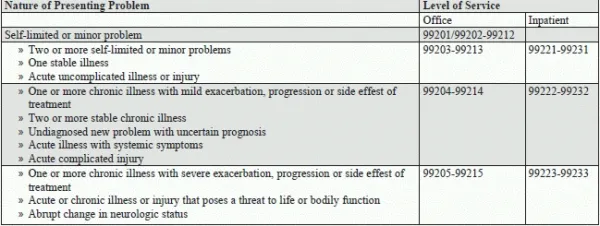

Best bet: If you look at the table of risk Medicare publishes in the E/M guidelines, you can look at the nature of the presenting problem (NPP) to help guide you whether the NPP and thus the medical necessity supports the level of service you want to report. See the table on page xx. This is not a proven or formalized method, but may assist in a better understanding.

Critical: “Medical necessity and medical decision making are not the same thing,” Huey stresses. “That is where we get a lot of confusion.” You can have moderate, or even low, medical decision making, but completing a comprehensive history and comprehensive exam to decide that the patient is doing well was relevant and medically necessary.

“The best example is this,” Huey says. “A hospital that operates a heart failure and heart transplant clinic manages patients that either had a heart transplant or they’re in heart failure; otherwise, they wouldn’t be in the clinic. The clinic had a high number of 99214s and 99215s.” Even though the patients may have been doing well clinically, resulting in low or moderate MDM, performing higher levels of history and exam, thus billing higher level codes, was justified, she explains.

Pulmonology Coding Alert

- Sleep Studies:

Distinguish the Difference Between Sleep Studies and Polysomnography With These 3 Tips

Focus on 3 factors to reach the best coding option. Increased levels of scrutiny [...] - News You Can Use:

OIG Report May Lead to More Sleep Study Refunds to MACs

Clear documentation of the patient’s progress may keep you in the clear. Your may be [...] - E/M Corner:

Back Up Your Level of E/M Services With Medical Necessity

Key: MDM and medical necessity are not the same. If you are reporting high level [...] - Readers Question:

Don't Miss Instructional ICD-10 Notes

Question: My doctor saw a male Medicare patient with a 3-day history of cough, wheezing and [...] - Reader Question:

Look at Type of Test Before Reporting Perfusion Imaging

Question: Our pulmonologist was called in to perform a perfusion imaging with aerosol ventilation and lung [...] - You Be the Coder:

Asthma Education May Qualify for Prolonged Services

Question: A new patient visited our office with breathing problems. The physician took a comprehensive history [...]