Podiatry Coding & Billing Alert

Diabetic Shoes:

Follow 3 Tips to Ace Diabetic Shoe Claims

Published on Thu Aug 18, 2022

You’ve reached your limit of free articles. Already a subscriber? Log in.

Not a subscriber? Subscribe today to continue reading this article. Plus, you’ll get:

- Simple explanations of current healthcare regulations and payer programs

- Real-world reporting scenarios solved by our expert coders

- Industry news, such as MAC and RAC activities, the OIG Work Plan, and CERT reports

- Instant access to every article ever published in Revenue Cycle Insider

- 6 annual AAPC-approved CEUs

- The latest updates for CPT®, ICD-10-CM, HCPCS Level II, NCCI edits, modifiers, compliance, technology, practice management, and more

Related Articles

Other Articles in this issue of

Podiatry Coding & Billing Alert

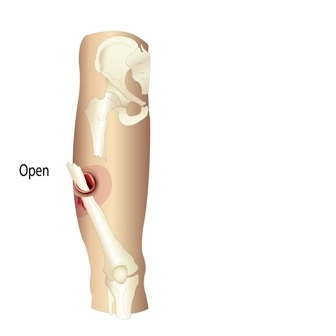

- Wound repair, Part 1:

Target Length of Wound and Complexity for Successful Laceration Repair

Wound repair using only adhesive strips should be reported with an E/M code. In the [...] - Diabetic Shoes:

Follow 3 Tips to Ace Diabetic Shoe Claims

Certifying physician must be MD or DO. When you bill for diabetic shoes in your [...] - E/M 2023:

Get Ready: Office/Outpatient Consultation CPT® Guidelines Will Change in 2023

Hint: Don’t forget to append modifier 32. Now is the time to review the changes [...] - You Be the Coder:

Puzzle Out This Arthrodesis Scenario

Question: The patient came in for right tarsometatarsal (TMT) joint fusion, which I thought would be [...] - Reader Questions:

See How to Submit Heel Spur Excision

Question: According to the documentation, my podiatrist performed a calcaneal spur resection with plantar fascial release [...] - Reader Questions:

Stay Compliant With HIPAA

Question: We’ve been experiencing an increase in phishing and are aware of reports of ransomware events. [...] - Reader Questions:

Understand Billing Date for Custom Inserts

Question: What would be the correct date of service to bill for custom inserts? The day [...]

View All