Pediatric Coding Alert

Listen to the Experts on Coding Cerumen Removal

Addition of 69209 adds layer of challenge to choosing code.

Since 2016, coders have had two options for reporting their physician’s impacted cerumen removal services. This made reporting the procedure more exact, which is always a positive for practice and patient.

The rub: Now, you have two codes to choose from when the provider removes impacted cerumen. Further, if the cerumen is not impacted, you’ll have to find another way to code for your provider’s service.

Unclog your earwax removal reporting procedures by taking this expert advice on when to report one of the cerumen removal codes — and when to opt for another coding strategy.

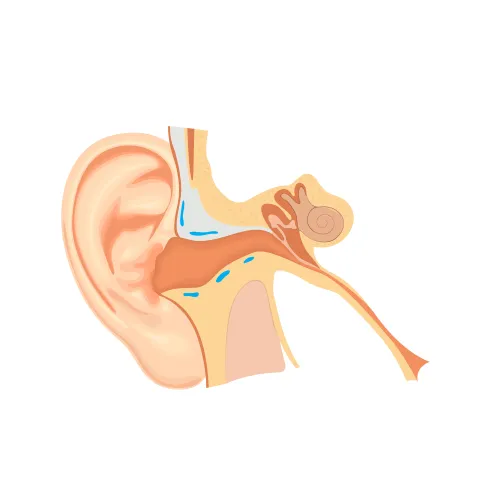

Check for Impacted Cerumen

The first element you need to look for is evidence of impacted cerumen. If cerumen is impacted, the provider could remove it using one of two methods, says Catherine Brink, BS, CMM, CPC, CMSCS, CPOM, president of Healthcare Resource Management Inc. in Spring Lake, N.J.: lavage (irrigation) or with instrumentation.

If the provider removes impacted cerumen with lavage, you’ll likely report 69209 (Removal impacted cerumen using irrigation/lavage, unilateral); if the provider needs instrumentation to remove the cerumen, you’d likely opt for 69210 (Removal impacted cerumen requiring instrumentation, unilateral).

Definition: Per the American Academy of Otolaryngology-Head and Neck Surgery (AAO-HNS), cerumen is impacted if one or more of the following conditions are present:

The AMA’s CPT® Changes 2016: An Insider’s View confirms, “Impacted cerumen is typically extremely hard and dry and accompanied by pain and itching. Impacted cerumen obstructing the external auditory canal and tympanic membrane can lead to hearing loss.”

Use of Tools Instrumental to 69210 Coding

When your provider removes impacted cerumen, you’ll need proof that he needed instrumentation to perform the removal, Falbo reminds.

The official word: Check out this guidance from CPT® Changes 2016: An Insider’s View: “Code 69210 only captures the direct method of earwax removal utilizing curettes, hooks, forceps, and suction.” If you don’t see evidence of this type of instrumentation on the encounter notes, leave 69210 off the claim.

Example: The pediatrician performs impacted cerumen removal on the right ear of an established 11-year-old patient. Notes indicate that the pediatrician used forceps, under direct visualization, to remove the cerumen. On the claim, you’d report 69210 for the procedure, with H61.21 (Impacted cerumen, right ear) appended to represent the patient’s condition.

When Water Works, Opt for 69209

If a provider removes impacted cerumen, and there isn’t evidence to support a 69210 service, you might be able to choose 69209 instead.

Again, from CPT® Changes 2016: An Insider’s View: “Another less invasive method uses a continuous low pressure flow of liquid (e.g., saline water) to gently loosen impacted cerumen and flush it out … Code 69209 enables the irrigation or lavage method of impacted cerumen removal to be separately reported.”

Example: The provider removes impacted cerumen from a 9-year-old established patient’s left ear. Encounter notes indicate that the provider used saline solution to flush the cerumen out. On this claim, you’d likely report 69209 with H61.22 (Impacted cerumen, left ear) appended to represent the patient’s condition.

Know Who Can Code 69209

Remember, the 69209 code does not have physician work relative value units (RVUs). This is because clinical staff, not the physician performs cerumen removal with lavage/irrigation. This is also why the reimbursement for the 69209 is significantly less than it is for 69210.

You’ll need to check your state’s scope of practice to determine which types of clinical staff, if any, can perform 69209 in an office setting.

Takeaway: “As long as it is within the scope of practice in your state for an MA [medical assistant], RN [registered nurse], LPN [licensed practical nurse], etc., to perform an ear lavage, then it is OK to bill [69209] under the physician, given that the physician ordered the services and is on site” during the service, Falbo explains.

Use E/M Code for Non-Impacted Cerumen Removal

There are still instances where you’ll choose the appropriate evaluation and management (E/M) code when a provider removes cerumen. According to Brink “some providers do not bill for 69209 and include it in the medical decision making [MDM] for the E/M procedure.” Other providers always bill for 69209 if the encounter notes prove that the provider removed impacted cerumen; and when the cerumen’s not impacted, they choose an E/M.

Per CPT®, “For cerumen removal that is not impacted, see E/M service code.” According to Falbo, this means that you’ll choose the appropriate E/M code depending on the specifics of the encounter; new or established office patient (99201-99215); subsequent hospital care (99231-99233); etc.

Related Articles

Pediatric Coding Alert

- Procedure Coding:

Listen to the Experts on Coding Cerumen Removal

Addition of 69209 adds layer of challenge to choosing code. Since 2016, coders have had [...] - Modifiers:

Check Global to Nail 25/57 Encounters

Reserve modifier 57 for “major” surgeries. To get the most out of every patient/provider encounter, [...] - E/M Coding:

Code Prolonged Service After Discovering the Provider

Different staff has different CPT® codes to report. If your provider performs a prolonged, in-office [...] - You Be the Coder:

Modifiers and Multiple Fracture Care Coding

Question: Encounter notes indicate that the physician performed a level-four evaluation and management (E/M) service for [...] - Reader Question:

Stay Alert on Self-Audit Frequency

Question: As the lead in our coding department, the practice manager recently placed me in charge [...] - Reader Question:

Often, Only Admitting Physician Can Code 99221-99223

Question: Can you use inpatient initial care codes 99221-99223 more than once in the same day [...]