Worried Your MIPS Invite Got Lost in the Mail? Check Online and Verify Your Status

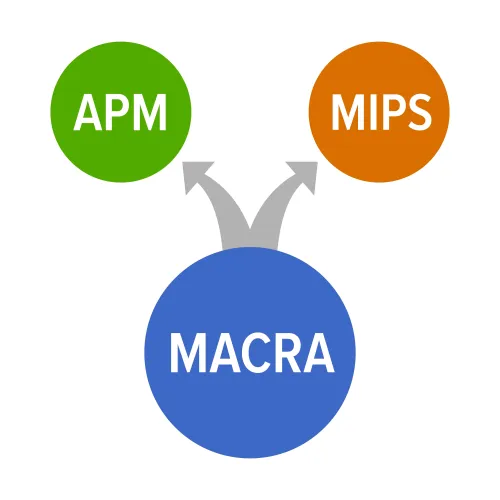

New CMS tool lets anxious Part B providers see if they are required to report for 2017. Stop waiting by the mailbox for your Merit-Based Incentive Payment System (MIPS) letter. CMS is now offering some relief to worried providers unsure about reporting under MACRA for 2017. A new link allows Medicare Part B clinicians the option to punch in their National Provider Identification numbers and access their MIPS eligibility online. Most Medicare Part B providers now fall under MIPS, the lower-level entry into MACRA’s Quality Payment Program (QPP). Letters are being sent out in batches through May and provide details outlining clinician status. Many have voiced frustration over the lack of information regarding their MIPS status and reporting requirements, but with the new link and guidance, discovering if you qualify in 2017 should be easy. Look at the MIPS-Entry Qualifiers “If you’re included in MIPS in 2017, you will need to decide whether to report as an individual or with a group,” the QPP fact sheet advises. Those practitioners included under MACRA in 2017 include physicians defined as “doctors of medicine, doctors of osteopathy, osteopathic practitioners, doctors of dental surgery, doctors of dental medicine, doctors of podiatric medicine, doctors of optometry,” the MIPS guidance states, as well as chiropractors, physician assistants, clinical nurse specialists, certified registered nurse anesthetists, and any group practices that support these clinicians. Reminder: You may already have an idea whether or not you qualify for MIPS measures’ reporting. Remember for this first performance year, if you bill Medicare Part B more than $30,000 in payments a year and see more than 100 Medicare Part B-enrolled patients annually, then you will be part of the QPP. Spoiler alert: “Even if clinicians are not MIPS eligible in the first year, they could wind up being eligible in following years,” warns attorney Sarah Warden, Esq., of Greenspoon Marder in Ft. Lauderdale, Fla. “So clinicians that are right on the line of eligibility should consider taking steps to become MIPS ready.” Exclusions: It’s important to verify your status to avoid a 4 percent penalty in 2019 for the data you submit for CY 2017. Due to the reduced measures that came out in the final rule last fall, many providers will be exempt for this first year of MACRA. Here is a go-to checklist of MIPS exemptions from the QPP fact sheet: What-if scenario: Most practices know if they fall within the requirements to report under MIPS. So, what if your books suggest you’re in the program, but the letter never comes and the link suggests otherwise, too? “Contacting your MAC is a good idea for those clinicians that do not get a letter and are concerned that they may be over the low volume threshold,” Warden suggests. Follow-up: The old adage “lost in the mail” may apply here if your contact details are outdated with Medicare. “Physicians should also make sure that their Medicare enrollment information is up-to-date so that the letter is sent to the correct address,” advises Warden. Resource: For more information about the MIPS link and eligibility, visit https://qpp.cms.gov/learn/eligibility.