Your Top 5 Outpatient Coding Problems...Solved!

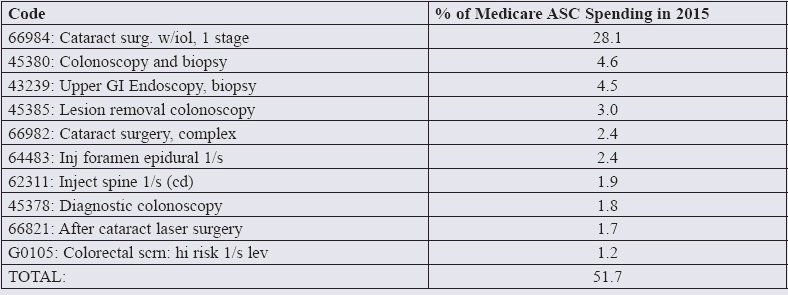

Safeguard your reimbursement with these fast fixes Like most ASCs, chances are that a small number of procedures account for a big chunk of your case volume—and your revenues. “Even a seemingly innocuous coding error can cost you significantly over time if the error is repeated over your largest volume procedures,” says Sarah L. Goodman, MBA, CHCAF, COC, CCP, FCS, president of the consulting firm SLG, Inc., in Raleigh, N.C. Only ten procedures accounted for approximately 51.7 percent of total Medicare ASC spending, according to VMG Health’s Multi-Specialty ASC Intellimarker 2016 study. If you’re looking to boost your revenue—and who isn’t—make sure you’re not making one of these common errors. Anything look familiar? 66984 (Extracapsular cataract removal with insertion of intraocular lens prostheses [1 stage procedure], manual or mechanical technique [e.g. irrigation and aspiration or phacoemulsification]) Neglecting to document medical necessity results in denials because the mere presence of a cataract doesn’t medically necessitate surgery. “A diagnosis isn’t the same as medical necessity,” says Rhonda Buckholtz, CPC, CPCI, CPMA, CDEO, CRC, CHPSE, COPC, CENTC, CPEDC, CGSC, vice president of strategic development at Eye Care Leaders. Be sure that both test results and activities of daily living are correctly documented in the patient’s file. Don’t forget—you must document medical necessity for each eye. If a patient has their second eye done at a later date, medical necessity documentation for the first eye won’t support payers’ guidelines for the second surgery. Beware: Patients often have their cataract consultation conducted in a physician’s office, while the actual procedure is performed in a surgery center. Be certain the correct documentation is on file at both locations. 45380: (Colonoscopy, flexible; with biopsy, single or multiple) When screening procedures turn unexpectedly diagnostic, pay careful attention to the order of diagnosis codes. They affect how your payers process your claims, and can also determine the patient’s out of pocket expense for the procedure. Screening colonoscopies are conducted on patients not reporting signs or symptoms. Insurers pay the full cost of screening colonoscopies and those patients aren’t responsible for a co-pay or deductible. A diagnostic colonoscopy would be conducted when a patient presents with symptoms such as blood in the stool, diarrhea, or abdominal pain. There would likely be an out-of-pocket payment due from the patient. Tip: For Medicare patients, don’t forget to append modifier 33 (Preventative service) to the procedure code. 66982: (Extracapsular cataract removal with insertion of intraocular lens prostheses [1 stage procedure], manual or mechanical technique [e.g. irrigation and aspiration or phacoemulsification], complex, requiring devices or techniques not generally used in routine cataract surgery [e.g. iris expansion device, suture support for intraocular lens, or primary capsulorrhexis] or performed on patients in the amblyogenic developmental stage) First things first: Make sure the cataract really is complex, and then document it sufficiently. These kinds of surgeries are more likely to be ‘complex,’ according to the American Academy of Ophthalmology’s expert coders Jennifer Edgar, OCS, and Sue Vicchrilli, COT, OCS: Your surgeon’s operative report should clearly state the reasons why the surgery qualifies as complex, but the best way to indicate complexity on your claim is to use the appropriate ICD-10 code(s). Medicare LCDs list a variety of diagnosis codes that justify 66982, so check with your local MAC for the most up-to-date specifics. Note that some payers will require two or more ICD-10 codes. Resource: For a complete list of diagnosis codes that support the use of 66982, go to www.aao.org/eyenet/article/icd-10-codes-cataract-family Beware: Don’t code every cataract surgery where dye was used to stain the capsule as “complex.” The use of dye doesn’t always meet 66982’s requirements—sometimes it’s just an additional surgical step. 45378: (Colonoscopy, flexible; diagnostic, including collection of specimen[s] by brushing or washing, when performed [separate procedure]) If you’re not coding the moderate sedation involved in this procedure correctly, you’re losing out on revenue. In 2017, this code was revised to no longer include moderate/conscious sedation as an inherent part of the procedure. Report it separately: 66821: (Discission of secondary membranous cataract [opacified posterior lens capsule and/or anterior hyaloids]; laser surgery [e.g. YAG laser] [1 or more stages]) To obtain proper reimbursement for post-surgical complications (such as a secondary cataract), you’ll want to pay close attention to any global periods that might apply, as well as correct usage of modifiers 78 and 79. Example: A patient undergoes a YAG capsulotomy nine weeks after cataract surgery in the right eye. Since the patient is still in the global period, you’d code the procedure 66821-78, -RT. A month later, the patient is scheduled for cataract surgery in the left eye. Some providers make the mistake of coding the second eye as 66982-79-LT because the patient is still in the global period for the YAG—forgetting that the YAG wasn’t the original procedure. The global period for the original cataract surgery has expired, so there’s no need to append modifier 79 to the surgery on the left eye. Red Flag: When you’re billing a service with modifier 79, make sure you’re not using the same diagnoses codes from the original surgery, warns Buckholtz. And multiple sessions with the YAG don’t mean multiple payments. The definition of 66821 includes the language “one or more stages,” so you may only report 66821 on the same eye once during the 90-day global period. Top Ten CPT® Codes Billed by ASCs