Use Musculoskeletal Codes for Deep Abscess I&D

When billing for abscess procedures, coders need to look beyond the integumentary (skin) section of the CPT® manual and use musculoskeletal codes when appropriate because these procedures reimburse at a higher rate than integumentary abscess codes. Sometimes, careful examination of the operative report may indicate that the surgeon went below the fascia into the muscle tissue and perhaps as far as the bone.

Many coders overlook the musculoskeletal section because so much of their work is focused in the integumentary section of the manual (10000 series codes) or because the documentation provided by the surgeon does not clearly indicate the location of the abscess. But when you’re coding for incision and drainage (I&D) procedures for superficial or deep abscesses, your physician must document the location of the abscess to aid in coding. Read on for expert advice on how to file valid claims for I&D.

Find the Right Code

Like wound repair and lesion excisions, abscess codes are found both in the integumentary and musculoskeletal section of the CPT® manual. There is a common misconception among inexperienced coders that these procedures begin and end with the integumentary section, so many procedures are billed under the integumentary umbrella without anyone looking at other coding options available to surgeons, says Kathy Mueller, RN, CPC, CCS-P, an independent coding consultant with experience in both clinical and physician office settings.

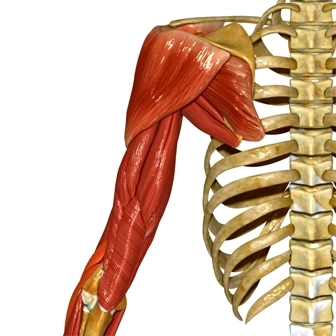

The integumentary system consists of two layers: cutaneous tissue (epidermis and dermis) and subcutaneous tissue. Below the subcutaneous tissue is a layer of fibrous tissue called the fascia that marks the beginning of the musculoskeletal system. This means that the code for an incision that goes through the fascia is not found in the integumentary section of the CPT® manual.

The I&D of abscesses in cutaneous and subcutaneous tissue is coded 10060 (Incision and drainage of abscess [e.g., carbuncle, suppurative hidradenitis, cutaneous or subcutaneous abscess, cyst, furuncle, or paronychia]; simple or single). Complicated or multiple abscesses are coded 10061 (Incision and drainage of abscess [e.g., carbuncle, suppurative hidradenitis, cutaneous or subcutaneous abscess, cyst, furuncle, or paronychia]; complicated or multiple).

These two codes apply to abscesses found on any body region. In other words, a subcutaneous abscess of the arm is coded the same as an abscess of the surface of the foot.

Caveat: This is not the case, however, if the incision penetrates the fascia. Within the musculoskeletal section itself, there are codes that are specific to the following areas: neck, shoulder, upper arm and elbow, forearm and wrist, hand and fingers, pelvis and hip joint, femur and knee joint, leg and ankle joint, and foot and toes.

In addition, within the musculoskeletal section, the abscess may be located in the muscle or in the bone with separate codes describing such I&D procedures. For example, when an I&D of a non-integumentary abscess in the foot is performed, the following codes may apply:

Musculoskeletal abscess I&D codes reimburse at a significantly higher rate than their integumentary counterparts. Code 28002, for example, is assigned 12.72 RVUs (Non Facility, National) for 2015, whereas 10060 is only 3.31 RVUs (Non Facility, National). Code 10061, for multiple or complicated integumentary abscesses, has 5.85 RVUs (Non Facility, National). Even the lowest-paying musculoskeletal foot abscess code, 28001, reimburses at more than double the rate (8.07 RVUs) of 10060.

Incising an abscess in the bone of the foot boosts payment even more. Code 28005 has 16.68 RVUs (Non Facility, National). Because it is a more significant and complex procedure, though, the CMS surgical package also includes a 90-day global period. The other two musculoskeletal codes, as well as the integumentary codes, all have 10-day global periods.

Correctly Document the Procedure

Choosing the right CPT® section depends on how the procedure is described in the surgeon’s procedure notes. Surgeons often describe deep abscesses, but even if, for example, I&D for deep abscess is listed at the top of the operative report, coders should check the procedure notes to determine exactly how deep the incision was and whether it went below the fascia.

Some operative reports may not contain a clear description of the service performed even in the procedure notes. Sometimes, the operative note may say as little as I&D, foot, and that just isn’t enough for a coder to work with, says Arlene Morrow, CPC, a general surgery coding and reimbursement specialist in Tampa, Fla.

Morrow recommends that surgeons look the code up in the CPT® manual as they write or dictate their operative notes. All the coder has is the operative note, so he or she wants the procedure described in it to be as close to what’s in the CPT® manual as possible, Morrow says.

In addition, CMS no longer tolerates unjustifiable reimbursement claims for services such as abscess I&D and wound care. Therefore, says Morrow, the fact that local anesthetic was provided to the patient should be documented, as well as the results from the pathology lab because these items may indicate the medical necessity of the procedure.

Without supporting documentation, Medicare may take the position that the service wasn’t provided, Morrow says. She recommends asking the doctor to order a pathology report or a specimen from the lab (to prove something was removed) and include the results in the patient’s chart.

If the documentation does not support the fact that I&D was performed, the provider may be able to bill for a visit (and even then, only with supporting documentation).

Here’s how: Any history and physical visit performed before the procedure may be billable separately if there is supporting documentation that shows that the visit was significant and led to the decision to perform the I&D of the abscess. In that case, modifier -25 (Significant, separately identifiable evaluation and management service by the same physician or other qualified health care professional on the same day of the procedure or other service) should be attached to the appropriate level evaluation and management (E/M) code when performed the same day as 10060, 10061, 28001, and 28002. Modifier -57 (Decision for surgery) should be used for 28005 because this procedure has a 90-day global period. Medicare, as well as most private carriers, will pay for E/M performed the same day as surgery with a 90-day global period only if modifier -57 is attached.

If the procedure is elective and the surgeon only performs a routine pre-op exam before performing the procedure, no separate E/M should be charged.