3 Examples Guide You to Unlisted Coding Bliss

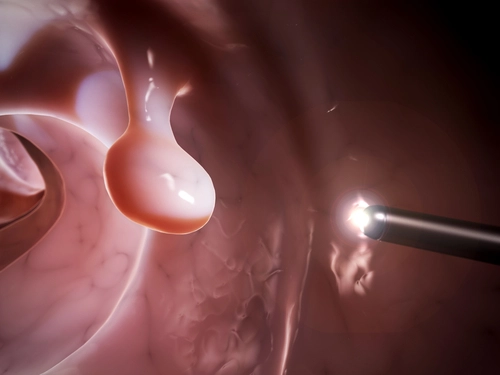

Hint: Never rely on “coding close” to a procedure code. If you’ve ever searched the CPT® code book for a code and come up empty-handed, you understand the importance of unlisted codes. But you probably also know that a tremendous amount of effort is involved in getting paid when you use these codes, and that your team has to do the majority of the legwork to collect. To ensure that your otolaryngologist gets reimbursed for procedures without specific codes, check these quick tips, along with ENT-specific examples, and readjust your coding to boost your payment odds for unlisted services. Don’t “Code Close” For providers, there’s often a disincentive to use unlisted codes for the primary reason that they are lacking a proper fee schedule. When providers are compensated based on relative value units (RVUs) — and these unlisted procedures lack RVUs — the notion of submitting a “blank” code to document a complex, time-consuming procedure can leave a provider feeling understandably uncomfortable. And the process of getting properly compensated from third-party payers is equally arduous, causing providers, coders, and billers to sometimes shy away from using unlisted codes. However, you should avoid finding a code that’s “close” to the procedure that the ENT physician performed. If your provider asks you to submit a code with an established fee schedule rather than an unlisted code — even if the code they’re recommending doesn’t match what was performed — then this should trigger an immediate red flag. Not only is there risk of committing fraud, but improper documentation of a procedure can affect patients from the perspective of both insurance payments and electronic health records (EHRs). Factoring in the notorious difficulty providers face when attempting to get payment for unlisted codes, it seems that neither option is ideal. There are also long-term ramifications in attempting to fit new technologies and procedures without an accurate CPT® procedural description into an existing CPT® code. Those ramifications come when the specialty ultimately does acquire a new CPT® code for the service. If the service has been submitted previously under an existing CPT® code, RVUs from the prior code will be removed and reallocated to the new code’s fee schedule. However, if the procedure has previously been submitted using an unlisted code, new RVUs will be allocated to the fee schedule, creating a new fee for the new CPT® code without the redistribution of RVUs from other CPT® codes, says Barbara J. Cobuzzi, MBA, CPC, COC, CPC-P, CPC-I, CENTC, CPCO, CMCS, of CRN Healthcare in Tinton Falls, New Jersey. Determining the value of future codes not only impacts the specialty, but other procedures of a comparable nature as well. This emphasizes the importance of using unlisted codes in cases where there is no code available that accurately describes the services performed. Unlisted Example 1: Maxillary Sinus Aspiration Suppose the provider aspirates fluid from the maxillary sinus without guidance for a patient with sinusitis. Although some practices might look to 30000 (Drainage abscess or hematoma, nasal, internal approach), that code refers to a nasal procedure and not one based in the sinus. Instead, your best bet here is 31299 (Unlisted procedure, accessory sinuses). As with any unlisted code, you’ll want to find a code that’s similar to let the provider know the amount you’re hoping to get as your reimbursement and guide the third-party payer in setting a value for the service that does not have an established CPT® code, Cobuzzi says. Talk to the surgeon to determine what they find most similar, and let the insurer know by putting the close or equivalent code for valuation in Box 19 of the claim form or its electronic format. For instance, in this situation, the otolaryngologist might suggest 31256 (Nasal/sinus endoscopy, surgical, with maxillary antrostomy) as a comparable code for reimbursement purposes. Unlisted Example 2: Endoscopic Resection of Sinonasal/Skull Base Tumor Here’s another scenario in which physicians and coders alike might opt for an incorrect code (for less reimbursement) in order to avoid the hassles of submitting an unlisted code. Rather than risking a denial for an unlisted code, a physician or coder might prefer the idea of coding for endoscopic resections of sinonasal/skull base tumors with one of the following: If the documentation supports the removal of a tumor, then all of these procedure codes are incorrect. The removal of tissue in the sinus is not equivalent to that of a tumor in the skull base; and, from a coding standpoint, the use of the above codes to document tumor removal could put a practice at risk in case of an audit. That leaves you out of options when considering which endoscopic CPT® code fits best for these procedures. For endoscopic resections of sinonasal and skull base tumors, you’ll want to apply the unlisted accessory sinus code 31299. “Endoscopic resections of skull base tumors are often performed with a neurosurgeon, and the codes that would be used for valuation depends on where the tumor(s) are located,” Cobuzzi notes Unlisted Example 3: Sialendoscopy Let’s say that the ENT performs sialendoscopy, which reveals a lodged stone in the left submandibular gland. The physician removes the stone using sialendoscope. If the documentation supports dilation and cannulation or catheterization in order to introduce the sialendoscope, you’ll want to begin by incorporating the appropriate CPT® codes for that preliminary portion of the surgery. The subsequent removal of the stone using a sialendoscope warrants the reporting of unlisted code 42699 (Unlisted procedure, salivary glands or ducts). Again, it’s up to the discretion of your provider as to whether you choose to use comparison code 42335 (Sialolithotomy; submandibular (submaxillary), complicated, intraoral) or 42330 (Sialolithotomy; submandibular (submaxillary), sublingual or parotid, uncomplicated, intraoral) to give the payer an idea of the reimbursement amount you’re seeking. If the operative report details an inherently simple procedure, then 42330 may be a more suitable comparative option.