Otolaryngology Coding Alert

Compliance:

Discover 4 Ways to Shore Up Your Time-Based Coding

Published on Tue Dec 13, 2022

You’ve reached your limit of free articles. Already a subscriber? Log in.

Not a subscriber? Subscribe today to continue reading this article. Plus, you’ll get:

- Simple explanations of current healthcare regulations and payer programs

- Real-world reporting scenarios solved by our expert coders

- Industry news, such as MAC and RAC activities, the OIG Work Plan, and CERT reports

- Instant access to every article ever published in Revenue Cycle Insider

- 6 annual AAPC-approved CEUs

- The latest updates for CPT®, ICD-10-CM, HCPCS Level II, NCCI edits, modifiers, compliance, technology, practice management, and more

Related Articles

Other Articles in this issue of

Otolaryngology Coding Alert

- Medicare Physician Fee Schedule:

Examine 2023 MPFS Final Rule Pros and Cons

Conversion factor goes down $1.55, some PHE flexibilities continue. Absent congressional action, all physician practices [...] - E/M Coding:

Ready Yourself to Successfully Implement E/M Changes

Taking the time to revise forms/templates pays dividends in the long run. The time has [...] - Compliance:

Discover 4 Ways to Shore Up Your Time-Based Coding

Steer clear of these four auditor red flags when coding time. A surefire way to [...] - You Be the Coder:

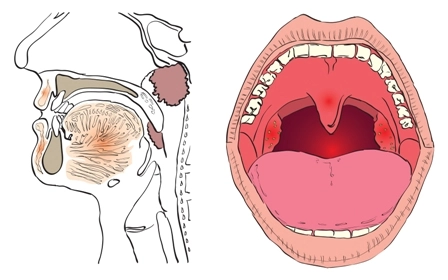

Pinpoint Proper Coding of This E/M Service

Question: Our otolaryngologist saw a new patient with a chief complaint of postnasal drip and difficulty [...] - Reader Question:

Keep Your Total Time Counts Compliant

Question: If the physician does work in preparation for an office visit the day before, or [...] - Reader Question:

Gain Insight Into Handling PHI Restriction Requests

Question: When a patient asks our office to limit or restrict disclosures of their protected health [...] - Reader Question:

Dig Deep for Details Before Using Unspecified Codes

Question: A colleague said to try not to use unspecified ICD-10 codes. However, numerous patients lately [...]

View All