Master Your Mandibular Excision Coding With These Two Scenarios

Hint: Don’t leave $360 on the table by failure to identify extensive resection.

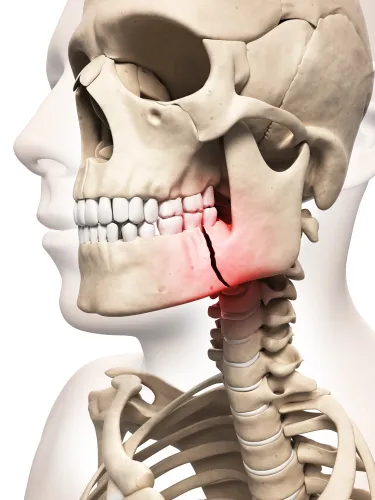

When your surgeon excises a mandibular lesion, you will have to base your coding on the type of lesion that was removed, the approach that was used and the extent of resection that was performed. You should also focus on whether or not an additional procedure such as an osteotomy or grafting was performed.

Here are two case scenarios that will help you get proficient with reporting a mandibular lesion excision procedure. Check and see if you can crack the coding.

Coding Scenario 1: The patient is a 20-year-old male patient with a six month history of a painful swelling on the right mandibular posterior region near the second molar. Upon examination, your clinician notes that the swelling is 2cmx2cms in size and has caused expansion of the alveolar ridge near the second molar tooth and was slightly tender on palpation. The mucosa over the lesion appeared to be normal. There was no evidence of any kind of lymphadenopathy.

Based on the results of investigations (radiography and histological studies), your clinician arrives at a diagnosis of odontoblastoma of the mandible. Your clinician then performs a surgical excision to remove the tumor.

Coding Scenario 2: The patient is a 33-year-old male patient with a one month history of a painful swelling in the right mandible in the posterior region near the second molar. Upon examination, your surgeon notes that the swelling is about 5cmx5cm in size and was firm, and non-tender. The mucosa appeared normal but had a shiny appearance due to the size of the lesion. There was expansion of the buccal cortical plate and the first and second molar was tender on percussion.

Based on results of investigations (radiography and histological studies), your clinician arrives at a diagnosis of osteosarcoma of the mandible. Your clinician then performs an extensive resection along with partial mandibulectomy. He places a bone graft to repair the mandible.

Choose From Five Excision Codes Based on Lesion Type

When your oral surgeon performs an excision of a lesion of the mandible, you will have to choose from one of the five codes that are available for excision. You will have to base your decision on whether the tumor was benign or malignant and on the extent of resection. You should also look at whether or not your surgeon performed an osteotomy and if so, the type of approach that he used for the procedure (intraoral or extra-oral).

The five CPT® codes that you can choose from when reporting an excision of a tumor of the mandible includes:

You choose 21040 when your clinician removes a benign tumor or a cyst through enucleation and curettage. If he also performs an osteotomy, depending on the approach used, you will have to choose either 21046 or 21047. “Watch approach used to determine the right code when osteotomy is performed,” says Barry Shipman, DMD, clinical professor, University of Florida School of Dentistry, Hialeah Dental Center. “For an intraoral approach, use 21046 and choose 21047 for an extra oral approach.”

You look at reporting either 21044 or 21045 for excision of malignant tumors. You will reserve the use of 21045 only for procedures that involve extensive resection of the mandible. “Check the quantity of mandible resected and if there is a discontinuity defect present to determine if 21045 is apt for the procedure performed,” Shipman adds.

In the first scenario described, your clinician removed the lesion through excision. He did not perform an osteotomy. Since he removed a benign lesion through surgical excision, you report 21040.

Coding tip: When your surgeon performs an extensive resection (21047), if he opts to use bone grafts to replace the resected areas, you will have to report the graft separately. You report this with 21215 (Graft, bone; mandible [includes obtaining graft]).

In the second scenario, your surgeon performed surgical excision of a malignant tumor with extensive resection and bone graft. You report 21045 for the resection of the tumor. Since he also placed a bone graft to repair the resected area, you should also report 21215.

Reimbursement: Don’t miss out on checking documentation to see if your clinician has performed an osteotomy when he performs an excision of a benign tumor. The 2015 relative value units (RVUs) for 21040 are 15.11, while 21046 and 21047 carry 32.44 RVUs and 38.26 RVUs respectively. This translates to a Medicare reimbursement of $540.25 for 21040 while 21046 and 21047 pay out $1,159.88 and $1,367.97 respectively. As the difference in reimbursement between 21040 and procedures involving excision with osteotomy is very high, you risk a lot of deserved reimbursement if you fail to identify the osteotomy procedure that your clinician performed.

Again, when reporting malignant lesion excisions, you will have to check documentation for extent of resection. 2015 relative value units (RVUs) for 21044 are 25.41, while 21045 carries 35.41 RVUs. This translates to a Medicare reimbursement of $908.53 for 21044 and $1,266.07 for 21045. The difference in reimbursement is approximately $360 between the two codes, so look at documentation properly to avoid reporting errors.

If you are in doubt, check with your surgeon to zero in on the exact procedure that was performed.

Check For Scenarios Where You Can Report an Additional E/M Code

Your oral surgeon will perform a preoperative evaluation of the patient prior to performing the excision procedure. You cannot report a separate E/M code for the preoperative management of the patient prior to the procedure. Also, CCI edits are in place that prohibits you from using an E/M code for evaluation of the patient prior to the procedure.

However, the modifier indicator for the bundling of E/M codes with the excision codes carry the modifier indicator ‘1,’ which indicates that you can unbundle and report both the codes if a suitable modifier is used. Since the E/M codes form the column 2 codes in the edits with excision codes, you will have to append the modifier to it. The appropriate modifier that you will have to use with the E/M code is 25 (Significant, separately identifiable evaluation and management service by the same physician or other qualified health care professional on the same day of the procedure or other service).

So, if there is a scenario like the patient is suffering from hypertension or diabetes and your clinician performs additional investigation about the condition. Your clinician will want to know if there are going to be any adverse effects from the systemic condition. You can consider reporting an E/M code for the additional investigation your clinician performed.

Global days: Most of these procedures carry a 90-day global period. So, any post-operative follow up that your clinician performs in this period will get included within the payment allocated for the particular CPT® code and cannot be claimed for separately with any other CPT® code or an E/M code.