2 Surgeons, 1 Procedure Calls For 1 Modifier 62

Calculate your fees to know what is at risk.

Multiple surgeons may be necessary because of the complexity of the procedure or because of the patient’s condition. When you are coding this type of situation, you need to work with the other surgeon’s staff to make sure that both surgeons use modifier 62 (Two surgeons) on the one procedure.

When you use modifier 62, both surgeons will bill at a reduced rate and some payers may reimburse at 125 percent of the regular fee schedule amount. Make sure you capture your surgeon’s portion of the reimbursement by absorbing the following tips.

Report Modifier 62 on the Same Procedure

The trick with modifier 62 is that both surgeons (usually from different specialties) need to attach modifier 62 to the same procedure code.

Example: Your surgeon’s female patient was diagnosed with a gynecologic malignancy and needs a total hysterectomy with the removal of her ovaries, bladder, and ureteral transplantations. The gynecologist decides that she needs the help of a urologist during the surgery. Both surgeons perform the surgery to fulfill the procedures’ needed expertise and neither surgeon is assisting the other.

Each surgeon will report 58240 (Pelvic exenteration for gynecologic malignancy, with total abdominal hysterectomy or cervicectomy, with or without removal of tube[s], with or without removal of ovary[s], with removal of bladder and ureteral transplantations, and/or abdominoperineal resection of rectum and colon and colostomy, or any combination thereof) with modifier 62 attached.

If they don’t, it will cause a lot of confusion having two surgeons, from different practices, filing claims for the same procedure. That confusion will likely result in a denial for one or both of the providers. If claims are filed incorrectly, the surgeon that gets his claim in first may be the only one that gets paid.

Warning: If two surgeons are working on performing two distinct procedures during the same surgical session, you can’t use modifier 62 and call the surgery a co-surgery because the physicians won’t be reporting the same code. In this case, each physician should report the code for the service she provided, without a modifier.

Upside: If two surgeons are reporting two separate codes using their own identification number (NPI), each surgeon should receive the full fee for the service. Both surgeons also must document their separate procedures and they are responsible for the postoperative care for the surgery they performed.

Construct Specific Notes When There’s Multiple Surgeons

The two surgeons need to write their own personal operative notes describing the distinct part of the procedure they each performed. Both surgeons need to document their role in the procedure, and also mention each other in their notes, both as primary surgeons or co-surgeons.

Example: Surgeon A might write notes for the approach and mention Surgeon B as the other surgeon and Surgeon B might begin his operative notes with how the patient was positioned and then mention that the approach was performed by Surgeon A.

Best bet: You need to work with the other surgeon’s office to make sure that both practices are getting paid fairly for the services rendered. Making a call to the other surgeon’s practice to make sure his report mentions your surgeon and that information is mirrored can be beneficial.

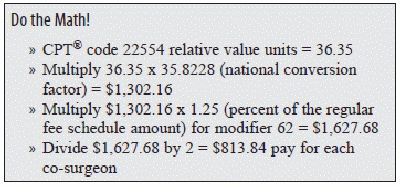

Calculate the Pay for Each Surgeon

Both surgeons will bill the CPT® code with modifier 62 at a reduced rate. Medicare and some other payers reimburse procedures coded with modifier 62 at 125 percent of the regular fee schedule amount. The payer divides this between the two surgeons reporting the procedure, so each surgeon receives 62.5 percent of the standard fee.

Example: A general surgeon and an orthopedic surgeon work together reporting 22554 (Arthrodesis, anterior interbody technique, including minimal discectomy to prepare interspace [other than for decompression]; cervical below C2) with the proper documentation.

The Medicare Physician Fee Schedule assigns a total relative value unit (RVU) of 36.35 to code 22554. When you multiply the RVUs by the national conversion factor of 35.8228, you get the national allowable fee: $1,302.16.

Once you have the fee, you can multiply by 1.25 to get the total modifier 62 reimbursement: $1,627.68. Divide that dollar amount by two for the pay for each surgeon: $813.84.

Caution: Some surgical sessions may consist of a primary surgeon and an assistant surgeon and could be confused with a co-surgery. If an assistant surgeon, or an assistant at surgery is needed, you will not use modifier 62. Instead you may use modifiers 80 (Assistant surgeon), 81 (Minimum assistant surgeon), or 82 (Assistant surgeon [when qualified resident surgeon not available]). Stay tuned for an article on these modifiers in an upcoming issue of Modifier Coding Alert.