Master Subsequent Care Coding with 3 Expert Tips

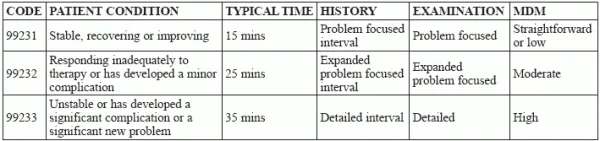

Hint: Avoid consultation codes for Medicare. If subsequent hospital care coding has you stumped, you are not alone. These common inpatient E/M service codes perennially bump up the improper payment rate on the Comprehensive Error Rate Testing (CERT) report and continue to be a hot topic for the Medicare Administrative Contractors (MACs) Targeted Probe and Educate (TPE) program. Keep your claims clean with this advice on how to properly code subsequent care. Here’s an overview of the E/M codes causing all the trouble: Tip 1: Break Down the Codes Like other E/M codes, 99231-99233 describe increasingly severe medical conditions and an increasing amount of work on the provider’s part to treat them. Each also describes an increasing amount of typical time spent at the bedside and on the patient’s hospital floor or unit. On the patient side, the conditions range from the lowest level, where the patient is stable, recovering, or improving, to the highest, where the patient is unstable and getting worse because he has developed a significant complication or a significant new problem. While on the provider side, the codes reflect reviews of the condition’s history, an examination of the patient, and level of medical decision making (MDM) appropriate for treating the patient. Components: From the provider’s perspective, the codes follow similar guidelines to many of the other E/M codes. Two of the three key components — history, exam, and MDM — need to be present in the documentation to support the level of service if coding on that basis. However, if MDM is one of those components, two of three MDM components (number of diagnoses/management options; amount or complexity of data to be reviewed; or risk of complications and/or morbidity or mortality) need to be present to determine the level of MDM complexity. The following table summarizes both sides of this E/M equation: Distinction: Notice that 99231-99233 describe an “interval” history, which is a history of the patient’s condition since the last time the patient was seen. That means you don’t need to record information about the PFSH obtained during an earlier encounter. Tip 2: Beware Admission Date Services The provider who admits the patient to the hospital should report an initial hospital care code for that date (99221-99223, Initial hospital care, per day…). An admitting physician should not additionally report a code from the range 99231-99233 on the admission date. “Instead, the admitting physician must combine multiple visit notes for the day into a final, single E/M hospital admission code,” explains Terri Brame Joy, MBA, CPC, COC, CGSC, CPC-I, director of operations with Encounter Telehealth in Omaha, Nebraska. For each subsequent day that physicians provides E/M services, they can bill the appropriate subsequent hospital care code. Exception: If a provider is not the admitting physician, but provides an E/M service for a Medicare patient on the admission date, you can report a subsequent hospital care code. That’s because Medicare does not accept the consultation codes, which you would ordinarily use to report a provider’s consultation with a hospital inpatient under another physician’s primary care. Example: A surgeon sees a patient with Crohn’s disease in the office for a surgical evaluation, but chooses to admit the patient for acute gastroenteritis and dehydration that requires intravenous (IV) hydration. The next day, the patient is stable but refusing oral intake. The surgeon conducts a brief interval history of the present illness and a limited exam of the gastrointestinal system; reviews a minimal amount of data; and orders more IV fluids without additives. Analysis: The service meets all the criteria for 99231. The refusal of oral intake would be considered a minor problem, and the scenario requires a problem-focused history and exam and straightforward decision making, according to Chelle Johnson, CPMA, CPC, CPCO, CPPM, CEMC, AAPC Fellow, billing/credentialing/auditing/coding coordinator at County of Stanislaus Health Services Agency in Modesto, California. In addition, the IV order “reflects a low-risk management option in the table of risk pertinent to MDM,” according to Kent Moore, senior strategist for physician payment at the American Academy of Family Physicians. Tip 3: Don’t Double Dip for Discharge If the surgeon is the attending physician of record and you’re billing a hospital discharge code (99238-99239, Hospital discharge day management …), you shouldn’t additionally report any subsequent hospital care codes on the same date of service. Remember, too, these E/M services involve face-to-face care “between the attending physician and the patient,” according to the Medicare Claims Processing Manual, Chapter 12, Section 30.6.9.2. Key: “Only the attending physician of record reports the discharge day management service [CPT® code 99238 or 99239],” reminds the CMS guidance. However, if the surgeon is one of several physicians involved in the patient’s care, you can report a subsequent hospital care code (99231-99233) for a final visit with the patient, even if the attending is reporting a discharge code on the same date. Bottom line: “You should bill only one E/M code per day, regardless of the number of times your surgeon sees the patient on that date,” Joy says. “Each physician who sees the patient on that date should combine his multiple notes into one final E/M code, including the attending physician and each specialty seeing the patient. Resource: Review the Medicare’s guidelines at www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/clm104c12.pdf.