Question: When I submit a PPS assessment record to the QIES ASAP system, I’m receiving edit “-3571” — what does this mean?

Answer: If you’re trying to complete a PPS assessment for a Medicare Advantage (MA) Plan and not for a Medicare Part A stay, you will fail the new edit -3571, according to the Louisiana Department of Health & Hospitals (LADHH). This is because you should not submit assessments completed for third-party billing to the QIES ASAP system.

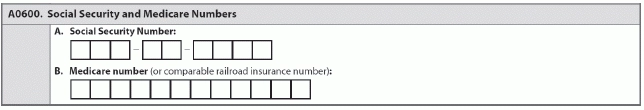

Doing so is a violation of HIPAA’s minimum necessary standard if you’re not seeking payment for a Medicare Part A stay, LADHH warns. So if you’re coding an assessment as a PPS assessment, it will fail edit -3571 if the Medicare or comparable Railroad Insurance number is not present on Item A0600B — Medicare number (or comparable railroad insurance number).

The Centers for Medicare & Medicaid Services (CMS) has put the new edit -3571 into place for A0600B, LADHH notes. “This is an issue that the facility and software vendor would need to resolve.”

Edit -3571 for Item A0600B states: “If this is a PPS assessment (A0310B= [01, 02, 03, 04, 05, 06, 07]), then the Medicare or comparable railroad insurance number (A0600B) must be present (not [^]). Thus, the submission will be rejected if this is a PPS assessment and A0600B is equal to [^].”

If the resident doesn’t have a Health Insurance Claim Number (HICN) to enter into A0600B, the new edit might cause a problem with your software in that you cannot “lock” the assessment to generate a RUG, explained Cil Bullard, RN, CPC, the Virginia RAI/OASIS Coordinator, in recent guidance for the Virginia Health Care Association’s CareConnection.

Bottom line: If you’re completing assessments for third-party billing, you must not submit them to the QIES ASAP system, Bullard stressed. “Marking assessments as a PPS assessment when it is not for a Medicare Part A stay does not follow RAI coding instructions.”

Possible solution: Your software vendor may, for example, “choose to not enforce this edit until the RUG has been granted since the assessment is for third-party insurance purposes and would not be submitted to CMS,” Bullard noted.