Hint: Making sure the beneficiary or representative understands the notice is key.

When a facility believes that fee-for-service Medicare may not cover services a resident may want, you can deliver an advanced beneficiary notice (ABN) of noncoverage that covers all the bases. Make sure you know which components are required, from necessary letterhead info to the timing of delivery, and understand which circumstances require a skilled nursing facility ABN (SNFABN) versus other forms of notice, like the Notice of Medicare Noncoverage (NOMNC).

Remember: The SNFABN serves as a notice to Medicare Part A beneficiaries that services or care that Medicare usually covers may not be covered in this particular instance due to the care being not medically reasonable or necessary or care that is considered custodial, says the Centers for Medicare & Medicaid Services (CMS) in instructions for completing form CMS-10055.

However, the SNFABN is only required in certain instances. If the resident stays in the SNF via another payer source besides Medicare, the form is required, but if the resident leaves the SNF immediately after skilled care ends, then a SNFABN probably is not required, though a NONMC may be, says Kris Mastrangelo, president and CEO of Harmony Healthcare International in Topsfield, Massachusetts.

The SNFABN details the financial liability, Mastrangelo emphasizes.

“The SNFABN provides information to the beneficiary so that s/he can decide whether or not to get the care that may not be paid for by Medicare and assume financial responsibility. SNFs must use the SNFABN when applicable for SNF Prospective Payment System services (Medicare Part A),” CMS says.

Know These SNFABN Basics

Even though CMS-10055 form looks easy to navigate, make sure you include the components required by CMS. Otherwise, you risk your facility being held liable for paying for some aspects of the resident’s care.

“The SNFABN is a CMS-approved model notice and should be replicated as closely as possible when used as a mandatory notice. Failure to use this notice or significant alterations of the SNFABN could result in the notice being invalidated and/or the SNF being held liable for the care in question,” CMS says.

The SNFABN should include the following sections: header, body, option boxes, additional information, and signature and date. It should be either legibly handwritten or typed; CMS recommends 12-point font for typed versions but know that you may need to make the font size larger for an individual resident.

Keep This Pertinent Info in Header

There’s a section in the header on your SNFABN labeled “Skilled Nursing Facility,” and you need to include your facility’s name, address, and phone number, at the very least. You should also add a TTY (text telephone) number, when appropriate. You can include your facility’s email address, additional contact information, and/or the corporate logo, CMS says.

Fill in the resident’s first and last name in the space labeled “Beneficiary’s Name.” Include the resident’s middle initial if it’s on their Medicare Beneficiary Identifier (MBI) card. However, a misspelling or missing initial won’t invalidate the SNFABN, as long as the beneficiary or their representative recognizes the name on the SNFABN, CMS says.

Don’t worry too much about the identification number, because the SNFABN will still be valid if the space is left blank; the number is optional or can even be an internal filing number, CMS.

Important: Do not include the resident’s MBI or Social Security number on the SNFABN.

Include This Info in the Body

Make sure you specify the date that Medicare is expected to stop providing payment for care and include the type of care in question. CMS provides the example “Inpatient Skilled Nursing Facility Stay.” When describing the reasoning behind the belief that Medicare will stop paying, aim for plain language; CMS’ examples use “you” to describe the beneficiary.

“The SNF must give the applicable Medicare coverage guideline(s) and a brief explanation of why the beneficiary’s medical needs or condition do not meet Medicare coverage guidelines. The reason must be sufficient and specific enough to enable the beneficiary to understand why Medicare may deny payment,” CMS says.

You need to provide an estimated cost for the care in question; the numbers can reflect a daily cost, an estimated total service cost, or a per-item estimate. If you do not provide a cost estimate entry on the SNFABN or the amount you provide is different than the actual cost the facility charges the beneficiary, the SNFABN is not invalidated, CMS assures.

“If for some reason the SNF is unable to provide a good faith estimate of projected costs of care at the time of SNFABN delivery, the SNF should indicate in the cost estimate area that no cost estimate is available. This should not be a routine or frequent practice but allows timely issuance of the SNFABN during rare instances when a cost estimate is not available,” CMS says. Look to your Medicare Administrative Contractor (MAC) or regional office if you experience issues with cost estimate consistency.

Don’t Select an Option Unless Beneficiary Physically Cannot

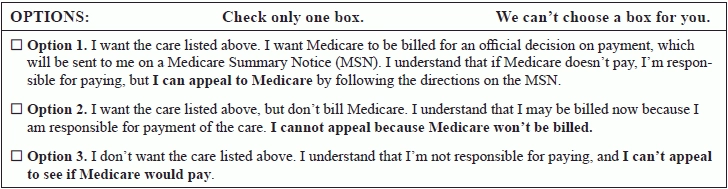

There are three options listed on the SNFABN; the corresponding check boxes are for the beneficiary receiving the ABN. Facilities cannot preselect a box for the beneficiary.

However, if the beneficiary cannot physically mark their selection, the facility can enter the beneficiary’s request but must indicate on the form that the facility physically made the selection per the beneficiary’s wishes and on their behalf. “Otherwise, SNFs are not permitted to select or pre-select an option for the beneficiary as this invalidates the notice,” CMS says.

Find more information about the Medicare requirements for submitting no-pay bills in Chapter 6 of the Medicare Claims Processing Manual.

Be Careful with Dates

Any information included in the “additional information” section of the SNFABN is assumed to have been added at the same time as the rest of the information on the SNFABN. If, for example, you need space to include an additional dated witness signature — and the date is different — make sure you include the specific dates.

The beneficiary or their authorized representative must sign their respective name in the signature box and write the date of signature to acknowledge that they have received and understand the SNFABN letter.

If the beneficiary in question refuses to select an option or sign, your facility should “annotate the original copy of the SNFABN indicating the refusal to sign and may list a witness to the refusal,” CMS says. CMS recommends that, in such a situation, the SNF consider “not furnishing care.”