MDS Alert

Follow 5 Steps to Code K0300

Don’t let some dietary regimens fool you into incorrect coding.

Coding K0300 — Weight Loss probably forces you to regularly brush up on some of your math skills. But aside from the mathematical calculations involved with K0300, you also need to avoid a few pitfalls, such as using the wrong “current weight” in your comparison.

For item K0300, you’ll compare the resident’s weight in the current observation period with his weight at a point closest to 30 and 180 days ago, explained Barbara Wheeler with the Indiana State Department of Health Divisions of Health Care Education & Quality and Long Term Care’s MDS/RAI Clinical Help Desk, in a recent presentation for the state’s providers.

If the resident is a new admission, you need to ask the resident or his family if he’s had weight loss in the past 30 and 180 days, Wheeler said. But for subsequent assessments, you’ll calculate the weight comparisons from the resident’s medical record. Here are the steps you need to take for coding K0300 accurately:

1. Determine the ‘Current’ Weight

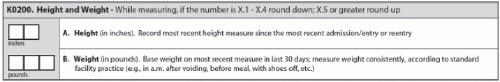

To calculate weight loss for K0300, you will use the resident’s current weight reported in K0200B. If you haven’t yet completed K0200 — Height and Weight, you will report the resident’s weight in this item as his most recent weight in the last 30 days, wrote MDS expert and consultant Judy Wilhide-Brandt, RN, BA, RAC-MT, C-NE, in a March 4 analysis for Washington, D.C. - based Leading Age. And this is the 30 days prior to the assessment reference date (ARD).

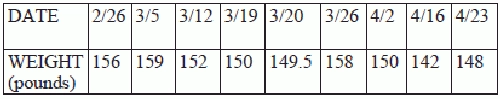

Example: Brandt provides a scenario to illustrate this. Staff weighed Mr. Smith on the following dates and recorded his weight as follows:

The ARD is April 22, so the current weight that you would report in K0200B would be 142 pounds, which staff recorded for April 16. Although April 23 is closest to the ARD, you cannot record the weight taken on that date because it’s after the April 22 ARD.

You have a 30-day look-back period to obtain the current weight, and when there is more than one weight in the look-back period, you must use the one closest to the ARD without going past the ARD, Brandt explained.

Therefore, the most recent weight in the last 30 days prior to the ARD is the one recorded on April 16.

2. Find the 30-Day Comparison Weight

Now that you have the resident’s current weight, you then need to determine his weight 30 days prior to the date of the current weight (not the ARD). In the example above, you would use the weight taken on March 19 — 150 pounds — “because this is the weight closest to a point 30 days preceding the current weight,” Brandt instructed.

3. Calculate the Weight Loss

The next step is to calculate the 5 percent weight loss in the past 30 days. To do this, start with the resident’s weight 30 days ago, then multiply it by 0.95 (95 percent), Wheeler advised. The resulting answer gives you a 5 percent loss in weight from 30 days ago.

In the example, you would take the weight of 150 pounds and multiply it by 0.95, which gives you 142.5 pounds (150 x 0.95 = 142.5). So 142.5 pounds would represent a 5 percent weight loss in the 30-day period.

Then, compare this weight with the resident’s current weight reported in K0200B. If the K0200B weight is less than the one you just calculated, you would report this as a weight loss in K0300. In the example, the current weight of 142 pounds is less than 142.5 pounds, so you would code this as a weight loss in K0300, Brandt said.

4. Repeat Steps for 6-Month Weight Loss

The procedures for calculating a 10 percent weight loss for 180 days are identical to those you use for 30 days, so you can follow the same steps, Brandt noted.

You will start with the resident’s weight closest to 180 days ago and multiply that number by 0.90 (90 percent), Wheeler said. “The resulting answer will be a 10 percent weight loss from the weight 180 days ago.”

Example: Assume that the resident’s current weight is 110 pounds. His weight 180 days ago was 126 pounds. Multiply 126 pounds by 0.90, and this will give you 113 pounds (126 x 0.90 = 113), Wheeler instructed. So because the resident’s current weight of 110 pounds is less than the resulting answer of 113 pounds, this constitutes a weight loss that you would report in K0300.

5. Check the Medical Record

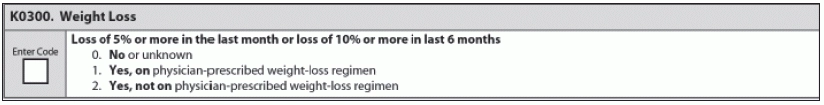

From your calculations, you will know if no weight loss occurred. In this case, you would code K0300 as 0 — No or unknown. But if the resident did experience sufficient weight loss, you have two separate choices in K0300:

1 — Yes, on physician-prescribed weight-loss regimen, or

2 — Yes, not on physician-prescribed weight-loss regimen.

So how do you choose which answer to code here? “Review the chart to determine if the weight loss was planned and pursuant to a physician’s order,” Brandt said.

Beware: Keep in mind that even if the resident’s medical record appears to indicate that he’s on some kind of dietary regimen, that doesn’t mean you can code 1 — Yes, on physician-prescribed weight-loss regimen. The diet must specifically intend for weight loss. “If a resident is placed on a diabetic or calorie-restricted diet and the intent is not to induce weight loss, then it would not be considered a physician-ordered weight-loss regimen,” Wheeler reminded.

So if the resident experienced weight loss but not due to an intentional, physician-prescribed diet, you would code 2 — Yes, not on physician-prescribed weight-loss regimen.

MDS Alert

- Section K:

Still Confused About K0710 Rules? Here's How To Do The Math

Heed expert advice on how to calculate for column 3. Since the October 2013 RAI [...] - Follow 5 Steps to Code K0300

Don’t let some dietary regimens fool you into incorrect coding. Coding K0300 — Weight Loss [...] - Section O:

Get The Answers To Your Burning Questions About Section O

Clear up your confusion over reporting minutes & days in O0400D. Good news: If you’ve [...] - Solve This Helpful O0500 Scenario

Don’t confuse O0500 with O0400 coding for therapist’s time. You have a lot of criteria [...] - Tool:

Need QAPI Help? Check Out This Treasure Trove Of Tools

Collaborative effort yields helpful resource for implementing QAPI. If you’re struggling with your Quality Assurance [...] - Section A:

Improve Your A0410 Coding In 3 Steps

Warning: Don’t submit MDS records to CMS when A0410=1. What criteria should you use to [...] - Industry News to Use:

Improve Dementia Care With These New Tools

Plus: Your Five Star Preview Report is now available. Improving dementia care has become a [...]