Put Your Finger on These Trigger Point Injection Codes

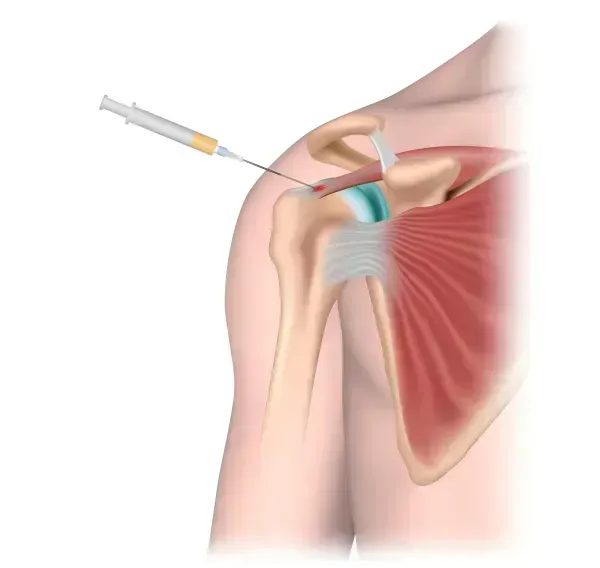

Do this, but don't do that, for straightforward TPI reporting. Trigger point injections (TPIs) may be a common procedure in your practice, but they can be problematic when you document them. Do you count injections or sites? Can you bill for all TPI procedures? And can you bill for medications your provider uses in the process? We asked our experts, who answered with these dos and don'ts to help you avoid the most common issues involved in TPI coding. Do Count Muscle Groups; Don't Group These Codes Consider the following scenario: a provider administers two TPIs into two separate muscle groups and three additional TPIs into three different muscle groups for a total of five injections in five muscle groups. You turn to CPT® and, after reading the descriptors, you decide to code 20552 (Injection[s]; single or multiple trigger point[s], 1 or 2 muscle[s]) for the first set of injections and 20553 (Injection[s]; single or multiple trigger point[s], 3 or more muscle[s]) for the second. Later, you receive a denial from your payer for reporting the two codes together. Why? According to Mary I. Falbo, MBA, CPC CEO of Millennium Healthcare Consulting Inc., in Lansdale, Pennsylvania, "only one code from 20552 or 20553 should be reported for a given patient on any particular day, no matter how many sites or regions are injected." Marcella Bucknam, CPC, CCS-P, COC, CCS, CPC-P, CPC-I, CCC, COBGC, manager of clinical compliance with PeaceHealth in Vancouver, Washington, agrees with Falbo, and reminds you to use "20553 for more than two muscles, including injections into a muscle on a different part of the body, including another extremity." Bucknam also cautions coders "not to use modifier 50 [Bilateral procedure] even if the muscles are in another extremity." These positions are confirmed by the Correct Coding Initiative (CCI) edits, which state that you should never report 20552 and 20553 on the same date for the same patient. CCI does not permit a modifier to override this edit. In other words, the two services cannot be unbundled regardless of the number or locations of muscle groups receiving the injections. As tempting as it may be to view 20553 as an add-on code to 20552, it is important to remember that both are standalone codes, and that you would code TPIs involving one or two muscles with 20552 and three or more with 20553. So, the only procedure code you could use in this scenario is 20553, as the provider injected more than two muscle groups. It's also important to remember that you only need to count the number of muscles involved, not the number of injections or trigger points. Both codes cover one or more injections involving one or more trigger points. What distinguishes 20553 from 20552 is the number of muscles the provider injects. Do Use Different Codes; Don't Confuse Similar Procedures Most TPIs involve administering steroids or anesthesia directly into the muscle to relieve the pain. However, if your physician performs a procedure known as dry-needling, in which the needle alone is inserted into the muscle group without any steroid or anesthesia being used, then you cannot report 20552 or 20553. Instead, you would report 20999 (Unlisted procedure, musculoskeletal system, general) to document the procedure. Falbo, however, voices a note of caution, calling policies on reporting 20999 "payer- specific. As there is insufficient evidence of dry-needle TPIs having therapeutic value, most payers consider dry-needle TPIs as not medically necessary," explains Falbo. Bucknam concurs, adding that "if you're going to bill an unlisted code, verify whether the payer will cover the service, and tell the patient up front that they may have to pay at the time of the service." Do Bill for Steroids; Don't Bill for Anesthesia Assuming your physician did not perform a dry-needle TPI, the next step is to determine if you can bill for the medication your physician uses in the procedure. As a rule, Falbo points out, Medicare regards local anesthetics such as lidocaine part of the practice expense for the procedure. So, "typically they are bundled into the primary service." This is true for 20552 and 20553, since the practice expense inputs for both codes under the Medicare physician fee schedule include an anesthetic. Be careful: If your payer does allow you to bill for the anesthetic, you will have to report J3490 (Unclassified drugs), as there are no J codes for these medications in the quantity of an injectable form your provider will typically administer with a TPI. If you do report J3490, be sure to specify the drug and amount in your documentation. Steroids, however, are separately billable, and you can report such codes as J1020 (Injection, methylprednisolone acetate, 20 mg), J1030 (. . . 40 mg), J1040 (. . . 80 mg) or J3301 (Injection, triamcinolone acetonide, not otherwise specified, 10 mg), depending on the drug and quantity your provider uses. Just heed Bucknam's advice to keep your documentation "as clear as possible, as unclear documentation of the amount of drug or the number of injections can not only result in lost revenue, but also in inadequate reimbursement for the supplies you used."