Eli's Hospice Insider

Hospice Pay Will Increase Starting Oct. 1 — But Not As Much As Proposed

Tip: Don’t let revised labor share’s impact sneak up on you.

A relatively quiet final rule for 2022 could still lead to reimbursement turmoil for some hospice agencies.

Back in April, the Centers for Medicare & Medicaid Services proposed a 2.3 percent increase to hospice payment rates (see Hospice Insider, Vol. 14, No. 6). Now CMS has nudged that down to a straight 2.0 percent increase.

The 2.0 percent figure, which equals an estimated $480 million, “is a result of the 2.7 percent market basket percentage increase reduced by a 0.7 percentage point productivity adjustment,” CMS explains in a fact sheet about the rule. Plus “hospices that fail to meet quality reporting requirements receive a 2 percentage point reduction,” the agency adds.

“It does happen most years,” notes reimbursement expert Melinda Gaboury, referring to the tweaked update amount. Often “there is a slight difference” between the proposed and final figures, says Gaboury with Healthcare Provider Solutions in Nashville, Tennessee. For example, last year CMS lowered the update from a proposed 2.6 percent in the proposed rule to a smaller 2.4 percent in the final rule for 2021.

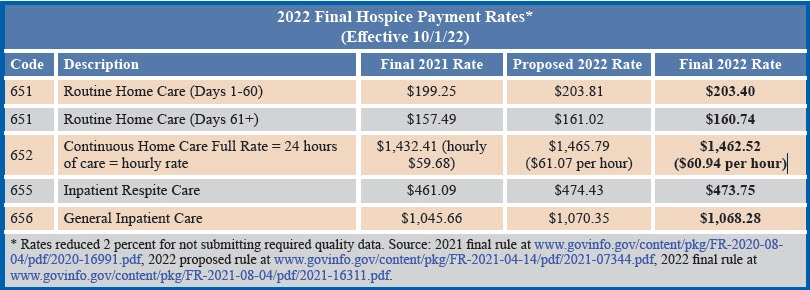

Rates are updated by 2 percent (see chart, p. 2), as is the per-beneficiary cap. The cap will be “$31,297.61, which is equal to the FY 2021 cap amount ($30,683.93) updated by … 2.0 percent,” CMS says in the final rule published in the Aug. 4 Federal Register.

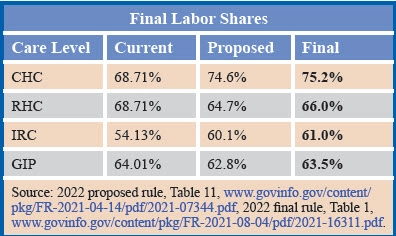

Something that does not happen every year is the rebasing of the labor share portion of hospice payment rates. Back in April, CMS suggested significant changes to the labor share figures (see Hospice Insider, Vol. 14, No. 6).

CMS received multiple comments on the topic. For example, “one commenter strongly encouraged CMS not to revise the labor share using the 2018 [Medicare cost report] for freestanding hospices,” the rule notes. “One commenter opposed the proposed labor shares, stating that the data in the cost report do not provide adequate or appropriate measures of labor expenses.”

Cost report data is valid, CMS maintains in the rule. “When submitting the MCR data [providers] must certify [in] the cost report that ‘to the best of [their] knowledge and belief, [the] report and statement are true, correct, complete and prepared from the books and records of the provider in accordance with applicable instructions, except as noted,’” the agency points out.

Multiple commenters also “expressed concern regarding the impact of COVID-19 on labor costs,” CMS relates. “Commenters stated that while they do not yet know the full extent of the impact on labor costs, they expect it to be significant. They stated that the PHE could considerably change the labor share in the next several years of cost report data, as the use of cost reports has a 2-year delay in data.”

CMS says it “understand[s] the challenges created by the PHE.” But “we believe using updated labor shares based on 2018 data is a technical improvement over the current labor shares as they reflect recent cost data for freestanding hospice providers.”

CMS adds, “We plan on reviewing the 2020 hospice MCR data when complete information is available that will allow us to consider whether the hospice labor shares based on 2018 data are still appropriate.”

In all, “many comments were submitted … relating to the change in the determination of the labor component and the computation of the labor component,” observes The Health Group in Morgantown, West Virginia. But “CMS made little change as a result of the comments,” the consulting group notes in its electronic newsletter. “However, they did make modification for Contracted Physician Administrative and Nursing Administration services,” the Health Group allows.

In response to comments from the National Association for Home Care & Hospice and others, “CMS revised its calculations to incorporate both contracted medical director costs and contracted nursing administration costs,” NAHC explains in its rule summary. “This revision to the labor share methodology results in upward revisions to the proposed labor shares for each of the levels of care (between 0.6 percentage point and 1.1 percentage point),” the trade group says.

The labor share change will have a significant impact, says Judi Lund Person with the National Hospice and Palliative Care Organization. The adjustment is based on hospice cost reports, Lund Person points out. “We are pleased that CMS is using a wage component percentage that uses hospice-specific data,” she tells AAPC. “However, this also means that hospices will need to be vigilant about accuracy in the cost report, since hospice cost reports are now being used to calculate rates.”

Do this: Hospices should “ensure that the data for the hospice cost report is collected during the reporting period and that the cost report submitted is accurate, as the data is now being used for rate calculations,” Lund Person recommends.

On the wage index front, CMS finalizes that it will adopt the Office of Management and Budget’s latest area delineations. Last year, CMS adopted new delineations for 2021 “with a 5 percent cap on wage index decreases,” the final rule notes. This year, the new delineations will go fully into effect in 2022 with no cap.

Multiple commenters suggested ways to make the wage index system more fair, such as providing for reclassification and imposing caps on drastic wage index swings. As usual, CMS brushes those suggestions off. “The OMB delineations for Metropolitan and Micropolitan Statistical Areas are appropriate for use in accounting for wage area differences and … the values computed under the delineations result in more appropriate payments to providers by more accurately accounting for and reflecting the differences in area wage levels,” CMS maintains in the final rule.

Note: Links to the 79-page rule and the updated wage index are at www.cms.gov/medicaremedicare-fee-service-paymenthospicehospice-regulations-and-notices/cms-1754-f.

Eli's Hospice Insider

- Reimbursement:

Hospice Pay Will Increase Starting Oct. 1 — But Not As Much As Proposed

Tip: Don’t let revised labor share’s impact sneak up on you. A relatively quiet final [...] - Regulations:

Medicare Takes Baby Steps Toward Improving Hospice Addendum

CMS says ‘no thanks’ to many industry suggestions addressing addendum problems. Hospices should be thankful [...] - Compliance:

Aide CoP Changes Should Make Hospices’ Lives A Little Easier

Medicare is making these COVID waivers permanent. If you’ve enjoyed the added flexibility around aide [...] - Audits:

Number Of OIG Audit Reports On Hospices Hits Double-Digits

Reviewers are overriding physicians’ judgment, audit targets charge. The two nonprofit hospices in the OIG’s [...] - Hospice News:

State Examines Cost Of Services Hospices Should Have Paid For

More than $620 million should have come out of hospices’ pockets, audit claims. It’s not [...] - Hospice News:

Check Out New Medicare Data Resource

Check Out New Medicare Data Resource You can get concrete data about how COVID-19 affected [...] - Hospice News:

Hospice Pays Half-Million For Missing Recerts

Hospice Pays Half-Million For Missing Recerts An Alabama hospice is paying the piper after confessing [...] - Hospice News:

New CERT Program Website Launches

If you have CERT questions, a new online resource may help answer them. The CERT [...] - Hospice News:

Beware This Important Deadline For PPP Loans

If you miss the due date for a crucial Paycheck Protection Program requirement, you could [...] - Hospice News:

Hospice Owner Pleads Guilty To Kickbacks

A California home health and hospice agency owner has pleaded guilty to fraud and kickback [...]