Don’t stop at base rate when gauging proposed cut’s effect on your pay.

The base payment rate is just one factor in Medicare’s complicated payment update methodology for home health agencies. Make sure you’re looking at your entire reimbursement picture for next year.

In its 2025 home health proposed rule released on June 26, the Centers for Medicare & Medicaid Services calls for a 1.7 percent payment reduction for HHAs (see story, p. 170).

History: That compares to a 0.8 percent increase for 2024, 0.7 percent increase for 2023, 3.2 percent increase for 2022, 1.9 percent increase for 2021, 1.3 percent increase for 2020, 2.1 percent increase for 2019, and then cuts in the previous eight years: 0.4 percent for 2018; 0.7 percent for 2017; 1.4 percent for 2016; 0.3 percent for 2015; 1.05 percent for 2014; 0.01 percent for 2013; 2.3 percent for 2012; and a whopping 5 percent for 2011. Before 2020, the last Medicare payment rate increase was 1.75 percent in 2010. Some years were affected by the 2 percent sequestration reduction.

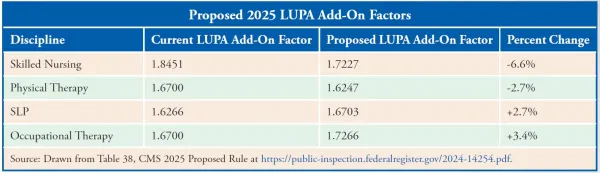

But these proposed changes will also impact your Medicare pay next year:

And as with every year, “for 2025, the wage index changes include … modifications in wage index values,” the National Association for Home Care & Hospice points out in its rule analysis. “NAHC cautions HHAs to consider the wage index impact as it can exceed the impact of the inflation update and any of the other rate adjustments,” the trade group stresses.

“Remember the potential impact of the wage-index adjustment. There are a lot of proposed changes to the wage-index adjustments and those changes could be significant to some providers,” cautions reimbursement expert M. Aaron Little with Forvis Mazars in Springfield, Mo.

In the past, CMS has phased in wage index changes. But with its new permanent rule of capping wage index drops at 5 percent per year, no phase-in is necessary, the rule says.

Reminder: CMS aims to have 2.5 percent of home health prospective payment system payments consist of outliers. And it now uses 15-minute unit rates to calculate the estimated cost of an episode to determine whether the claim will receive an outlier payment and the amount of payment for an episode of care, the agency says in the rule scheduled for publication in the July 3 Federal Register.

How it works: “A high FDL ratio reduces the number of periods that can receive outlier payments but makes it possible to select a higher loss-sharing ratio, and therefore, increase outlier payments for qualifying outlier periods,” CMS explains in the rule. “Alternatively, a lower FDL ratio means that more periods can qualify for outlier payments, but outlier payments per period must be lower.”

CMS always keeps the outlier loss-sharing ratio at 0.80, which means Medicare pays 80 percent of the additional estimated costs that exceed the outlier threshold amount, the rule explains. The agency moves the FDL around to try to hit the 2.5 percent target.

The FDL has been a bit all over the place under PDGM. CMS set it at 0.56 for 2020 and 2021, then 0.40 for 2022, 0.35 for 2023, and 0.27 for 2024. Now, the figure will go back up to 0.38, CMS proposes in the rule.

Bottom line: “This proposal would decrease the number of episodes qualifying for outlier payment,” NAHC says. The change will cost HHAs $100 million next year, CMS says.

The proposed OASIS points are in Table 20 of the rule and the functional level thresholds are in Table 21.

“We propose to update the comorbidity subgroups to include 22 low comorbidity adjustment subgroups … and 90 high comorbidity adjustment interaction subgroups.” See the proposed changes in Tables 22 and 23 of the rule.

Note: The 183-page OMB wage index bulletin is at www.whitehouse.gov/wp-content/uploads/2023/07/OMB-Bulletin-23-01.pdf. Links to wage index, case mix, and LUPA change documents are at www.cms.gov/medicare/payment/prospective-payment-systems/home-health/home-health-prospective-payment-system/cms-1803-p.