2.2% Reimbursement Cut To Hammer HHAs Next Year

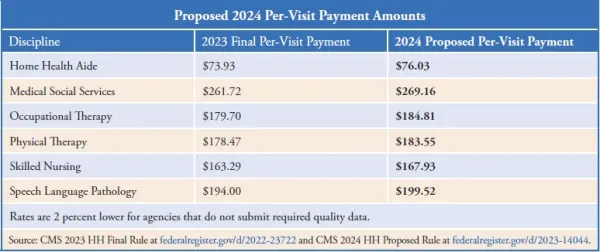

Medicare officials are slicing deep this time. Medicare is putting beneficiaries’ access to home health at grave risk with its latest payment proposal. On June 30, the Centers for Medicare & Medicaid Services released a 392-page proposed rule that floats cutting home health agency payment rates by 2.2 percent in 2024. “The home health payment update percentage is a proposed 2.7 percent increase (approximately $460 million). Accounting for an estimated 5.1 percent decrease, as required by statute, that reflects the effects of the proposed prospective, permanent behavior assumption adjustment ($870 million decrease), and an estimated 0.2 percent increase that reflects the effects of a proposed update to the fixed-dollar loss ratio (FDL) used in determining outlier payments ($35 million increase), CMS estimates that Medicare payments to HHAs in CY 2024 would decrease in the aggregate by 2.2 percent,” CMS explains in a fact sheet about the rule. That would strip $375 million out of home health payments next year. Where did that 5.1 percent reduction come from, given that in 2023 rulemaking CMS said the so-called behavioral adjustment was -7.85 percent, and implemented half of it (-3.925 percent)? “Using updated CY 2022 claims … CMS determined that Medicare paid more under the new system than it would have under the old system,” the agency details. “CMS is proposing an additional permanent adjustment percentage of -5.653 percent in CY 2024 to address the differences in the aggregate expenditures. The proposed permanent adjustment of -5.653 percent includes the remaining -3.925 percent (to account for CYs 2020 and 2021) not applied to the CY 2023 payment rate and accounts for actual behavior changes in CY 2022.” Industry experts aren’t exactly surprised by the proposal in the rule scheduled for publication in the July 10 Federal Register. “The 2.2 percent pay reduction is extremely unfortunate, but not completely unexpected,” observes consultant Angela Huff with FORVIS in Springfield, Mo. In its March 29 webinar required by law to review behavioral adjustment details, CMS made it pretty clear it was going to stick to its guns on its calculations. This was despite many dire warnings that the dwindling pay rates are ramping up access problems (see HHHW by AAPC, Vol. XXXII, No. 12). This is also despite the multiple comments Medicare Payment Advisory Commission commissioners have shared that their hospitals are having increasing difficulty finding agencies to take their referrals (see HHHW by AAPC, Vol. XXXI, No. 2; Vol. XXXI, No. 45; and Vol. XXXII, No. 10). While the cut may not be coming out of nowhere, industry representatives still are aghast at the proposal. “In the midst of ongoing inflation and increasing pressure on wages, the fact that CMS can act like a 2.2 percent cut has any connection with reality is pretty shocking,” says attorney Robert Markette Jr. with Hall Render in Indianapolis. “The ongoing cuts are not sustainable, and CMS has to know that,” Markette tells AAPC. “There seems to be a blindness from CMS to the approach they have taken to budget neutrality that they persist in following,” Huff laments. “The proposed payment rate inflation update of 2.7 percent is very out of touch with actual inflation rates,” judges FORVIS’ M. Aaron Little. “The decline in rates during a period of high inflation is going to put a lot of pressure on providers who have been cutting costs left and right for years,” Markette maintains. “It is hard to see where additional cuts will come from, especially as market pressure on wages is increasing labor costs,” he says. Try this: “The proposed reduction in spending will require agencies to take a close look at operations to determine where, if possible, they can improve efficiency and cost management,” Little says. “This also makes it more important than ever that agencies closely evaluate volume and mix of Medicare Advantage and commercial payers and make certain their contracts with those payers are financially sustainable,” he urges. Meanwhile, industry representatives are railing against the cuts. “We continue to strenuously disagree with the budget neutrality methodology that CMS employed to arrive at the rate adjustments,” National Association for Home Care & Hospice President William Dombi says in a statement. “Overall spending on Medicare home health is down, fewer patients are receiving care, patient referrals are being rejected because providers cannot afford to provide the care needed within the payment rates, and providers have closed their doors or restricted service territory to reduce care costs,” Dombi points out. “If the rate was truly budget neutral, we would not see these actions occurring,” he stresses. “Despite several years of significant Medicare home health payment cuts — and evidence demonstrating reduced access to home health services as a result — CMS has proposed further cuts in 2024 and beyond,” the Partnership for Quality Home Healthcare criticizes in a release. “CMS estimates the overall impact of the rule to be a $375 million (-2.2 percent) decrease in estimated payments for home health for CY 2024,” the lobbying group emphasizes. “CMS’ own data shows that recent annual updates to Medicare’s payment rates for 2021 and 2022 have significantly underestimated inflation, including labor costs, by more than 5 percent resulting in significant underfunding of the resources necessary to provide patient care,” PQHH says. “CMS’s market basket projections are not keeping up with the real-world costs to home healthcare providers, and home health agencies cannot absorb compounding cuts in this environment,” PQHH CEO Joanne Cunningham blasts in the release. “It is disappointing that the agency appears to have again disregarded the thoughtful and data-driven technical and policy recommendations the provider community has discussed with CMS,” Cunningham adds. “Our mission-driven, nonprofit members are navigating continued, substantial challenges: workforce shortages and inflation-fueled price hikes that increase operating costs,” says LeadingAge CEO Katie Smith Sloan. CMS “calculate[d] a market basket rate update using cost report data from 2021 — and in doing so failed to capture the impact of the past 24 months’ increases in labor, transportation and other business-related costs,” Smith Sloan condemns in a release. “Providers’ operating environment is tough,” Smith Sloan continues. “A 2.2 percent cut will hurt. Reduced payment will limit members’ ability to recruit, hire, and retain staff in a very tight labor market — and without staff, there is no care.” Cut Threatens Access In A Big Way CMS’ short-sightedness and underfunding is going to lead to a big access problem, industry veterans insist. “The fatally flawed budget neutrality methodology that CMS continues to insist on applying will have a direct and permanent effect on access to care,” Dombi argues. “When you add in the impact of shortchanging home health agencies on an accurate cost inflation update of 5.2 percent over the last two years, the loss of care access is natural and foreseeable,” he warns. The cut “will undermine the delivery of high-quality home healthcare services to millions of older Americans,” PQHH predicts. “The home health provider community is gravely concerned that CMS’s proposed actions for 2024 will only continue to degrade beneficiary access to home healthcare services,” Cunningham says. “Home health leaders have seen an increasing rate of referral rejections by agencies that simply do not have the capacity to accept new patients,” PQHH reports. “An additional 5.653 percent payment cut as proposed for 2024 would exacerbate these challenges,” it forecasts. “This reduction in conjunction with other market trends, like Medicare Advantage growth across the country, is creating a difficult economic climate for providers that is leading some to exit the market which in turn reduces access to care,” Huff tells AAPC. “This proposed rule contradicts the Biden Administration’s oft-stated commitment to ensuring access to home and community-based care and threatens to harm those who most need home health: older adults and families,” Smith Sloan stresses. Even the American Hospital Association notes that it “has previously expressed concern about the scale of the proposed PDGM behavioral offsets, and is disappointed CMS continues to seek their implementation,” according to a release. Watch out: This isn’t the end of cuts either, experts point out. In addition to the permanent behavioral adjustments finalized last year and proposed this year, CMS also calculates a $3.44 billion “temporary” adjustment to make PDGM budget-neutral for 2020, 2021, and 2022. “We recognize that implementing both the permanent and temporary adjustments may adversely affect HHAs,” CMS acknowledges in the new proposed rule. “Given that the magnitude of both the temporary and permanent adjustments for CY 2024 rate setting may result in a significant reduction of the payment rate, we are not proposing to take the temporary adjustment in CY 2024,” CMS confirms. But “we will propose a temporary adjustment factor to the national, standardized base payment rate when we propose this temporary payment adjustment in future rulemaking,” the rule says. In other words, more big cuts are waiting in the wings. Legislative solution: Since CMS is signaling a continued intransigence on this topic, home health providers now must appeal to lawmakers for help. “We now turn to Congress to correct what CMS has done and prevent the impending harm to the millions of highly vulnerable home health patients that depend and will depend in the future on this essential Medicare benefit,” Dombi says, referring to S. 2137 to eliminate the rate cuts. Sens. Debbie Stabenow (D-MI) and Susan Collins (R-ME) introduced the bill (see HHHW by AAPC, Vol. XXXII, No. 23). The Preserving Access to Home Health Act of 2023 would “safeguard access to essential home-based, clinically advanced healthcare services by preventing CMS from implementing the permanent cuts of negative 9.36 percent, as well as the additional $3.44 billion in temporary cuts to the Medicare Home Health Program,” PQHH notes. Speak up: Interested parties have until Aug. 29 to submit comments. See the rule, including instructions for commenting, at https://public-inspection.federalregister.gov/2023-14044.pdf.