Make the Most of 0.5 Percent Increase in Medicare Physician Fee Schedule

Noncompliance with EHR and PQRS to affect the non participating providers.

Get ready for the most important update of the year: the Medicare Physician Fee Schedule amounts increased by 0.5% effective January 1, 2016. What’s more, the Medicare Part B deductible for year 2016 is $166, according to Medicare contractor NGS, which covers the Wisconsin region.

“Yes, there is an increase,” affirms Doreen Boivin, CPC, CCA, with Chiro Practice, Inc., in Saco, Maine. “They can enjoy it for a short-lived time if they didn’t participate correctly in PQRS and EHR.”

Here’s a lowdown on the money involved as reimbursement for the most common procedure codes in chiropractic manual therapy.

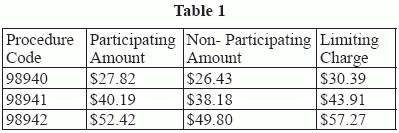

Know How Much the CMT Codes Pay in 2016

The most common CPT® codes are covered by Medicare are 98940 (Chiropractic manipulative treatment [CMT]; spinal, 1-2 regions), 98941 (... 3-4 regions), and 98942 (… 5 regions). When it comes to money, participating and non-participating providers are entitled to different payments.

“I believe the majority did well,” says Boivin. According to the law, limiting charges apply to Medicare non-participating providers who did not accept assignment on a claim. Providers meeting this criteria who successfully participated in both the EHR and PQRS programs can use the limiting charge listed in Table 1.

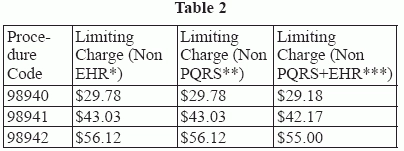

Fall in Line With the Payment Adjusted Limiting Charge

Providers who did not implement EHR or failed to comply with PQRS in the determination of year 2014 will have to use the rates below.

*Non EHR: The non-par providers not accepting assignment who could not successfully participate in EHR to select this limiting charge

**Non PQRS: The non-par providers not accepting assignment who could not successfully participate in PQRS to select this limiting charge

*** (Non PQRS+EHR): The non-par providers not accepting assignment who could not successfully participate in both EHR and PQRS to select this limiting charge

A million questions: Is noncompliance going to result in a big loss or a moderate bearable decrease in the payment for the non performed DCs? Is this limiting charge worrisome? Is there anything they can do about this now?

Boivin answers: “The limiting charge has always been part of the program. Providers just need to pay attention to their reimbursements. Noncompliance will result in a moderate loss over time.”

Although NGS Medicare had initially released the fee schedule amounts for Wisconsin in late October 2015, they pulled this information off their website in the last week of December in order to correct “technical errors.” In fact, there was a 14-day hold on claims submitted for 2016 services, until Jan. 15, 2016, when the 2016 fee schedule amounts and limiting charges were made available on the NGS website.

Even then there were inconsistencies with the reduced limiting charge amounts, which only apply to non-par providers who do not accept assignment on claims and did not successfully participate in the PQRS and/or E.H.R. programs in 2014. This was because the reduced limiting charge amounts were not updated initially so as to reflect the increased penalties which now apply in 2016 (a 2 percent reduction to covered services for not doing either PQRS or EHR, and a 4 percent reduction for not doing both programs).

To download the 2016 Fee Schedule grid, go to www.wichiro.org/wpwca/wp-content/uploads/2016/01/2016_FEE_SCHEDULE_1.25.16.pdf

You can also use the fee schedule lookup tool located online at NGSMedicare.com

Impact to you: “Use your tools at hand,” advises Boivin. “This is your best defense to stay on top of things.”