Save thyself from 3 lethal errors in documentation.

Are you too busy with patients, and leave documentation work for others? If so, it’s time to change the habit and take charge to ensure impeccable documentation that reflects your patient care.

The Office of the Inspector General targeted one of the most prestigious practices in California, ending with a bleak review in July named “Alleviate Wellness Center received unallowable Medicare Payments for Chiropractic Services.” The OIG asked for a whopping 97 percent refund of Medicare payments from calendar year 2012-13. Read on to know why this happened and lessons to take home from this.

In calendar years (CYs) 2012 and 2013, Medicare allowed payment of approximately $1.4 billion for chiropractic services provided to Medicare beneficiaries nationwide. Unfortunately, we as chiropractic do not fare well on the previous year reports of OIG as well. In 2006, Medicare inappropriately paid an estimated $178 million for chiropractic services that were medically unnecessary, incorrectly coded, or undocumented.

Apparently, chiropractors do not do as well with documentation as they do with patient care, for “lack of education on Medicare documentation requirements,” says Doreen Boivin, CPC, CCA, with Chiro Practice, Inc., in Saco, Maine. “Buying a manual is great as a resource, but providers should have access to training for a nominal fee. Doctors just want to be able to treat patients, not be overwhelmed with paperwork.”

Given this background, the OIG picked Alleviate Wellness Center in Southern California because of its status as one of the top three revenue generating practices in the region owned by a licensed chiropractor.

Check What OIG Found

The OIG picked 100 random cases for review. The Center was able to provide records for 81 cases, but the rest of the records were not retrievable. To start with, OIG noticed unusual and eccentric trends such as:

The money matters: On the basis of the review, OIG estimated that at least $482,867 of the $498,764 paid to the Center for chiropractic services was paid inappropriately. Although 100 percent of the chiropractic services in the sample were unallowable, OIG’s policy is to recommend recovery of overpayments at the lower limit, which is approximately 97 percent of the total amount.

Learn From Their Mistakes

Root cause analysis: The Center did not have appropriate policies and procedures in place to ensure basic compliance to guidelines.

1) No written policies of the organization were available to show the auditors. Instead, they referred to some online handbook. “There should be written policies in the office,” says Boivin. “Having the Medicare documentation manual as a reference would be suggested.”

2) The biller did not review the medical records for anything else other than the beneficiary’s name, address, and Medicare number.

3) There was no practice of reviewing medical records to ensure services were adequately documented.

Nail the Fatal Flaws

It might be easy to think that you would catch those type of mistakes in your own practice because they are obvious. But here is a list of OIG pointers for lack of compliance, to help ensure you won’t become a target.

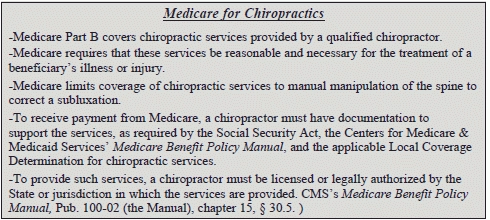

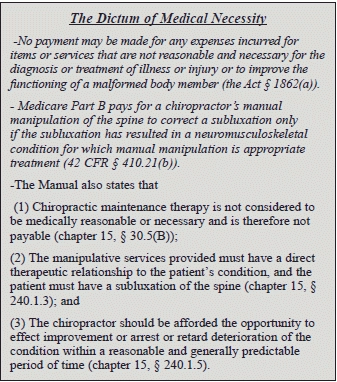

1) Want of medical necessity: Remember to comply with these amongst other requirements when you claim medical necessity next time:

Example: In this case, the Center received a total of $2,250 for 85 chiropractic visits from a 56-year-old gentleman, for whom the Center could not justify medical necessity, and according to the medical review contractor, “… the patient did not have evidence of a spinal subluxation…. The care therefore does not meet Medicare criteria.”

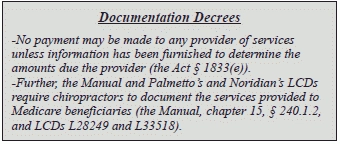

2) Insufficient documentation: Of the 100 sampled chiropractic services, 23 were insufficiently documented for subsequent chiropractic visits. There was a log with the date of subsequent visits and patient signatures without any mention of specific services provided on those visits. “There are no clinical findings available for review for the date of service,” said the medical review contractor.

Remember: The Manual and Palmetto’s and Noridian’s LCDs require that the initial visit and all subsequent visits to the chiropractor meet specific documentation requirements. The following must be documented for subsequent visits:

(1) Patient history, including documentation of changes in patient’s complaints, if any, and systems review as required.

(2) Physical examination of the area of the spine affected, documentation of change in patient’s condition, and an evaluation of treatment effectiveness;

(3) The specific treatment given (the Manual, chapter 15, § 240.1.2(B), and LCDs L28249 and L33518).

3) Missing documentation or records: This is the last thing you would want to handle in an audit. So, take a little time to alert your staff regarding maintaining inventories, and keep periodic checks on efficient recordkeeping. A well-treated patient would earn you a good reputation, but a good record can save the day. Imagine having to cut a sorry finger and say that 19 medical records were lost! This could be the harbinger of a bigger HIPAA breach demon!

Final takeaway: Read twice to be doubly sure you eradicate any of these possibilities in your practice and stay safe. “Stay on top of your resources,” stresses Boivin. “Utilize them as often as you need to. Do online webinars, buy coding books and ask questions of your community.”

For further information, refer http://oig.hhs.gov/oas/reports/region9/91402027.pdf